Question: I need the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you! Rita Adams

I need the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you!

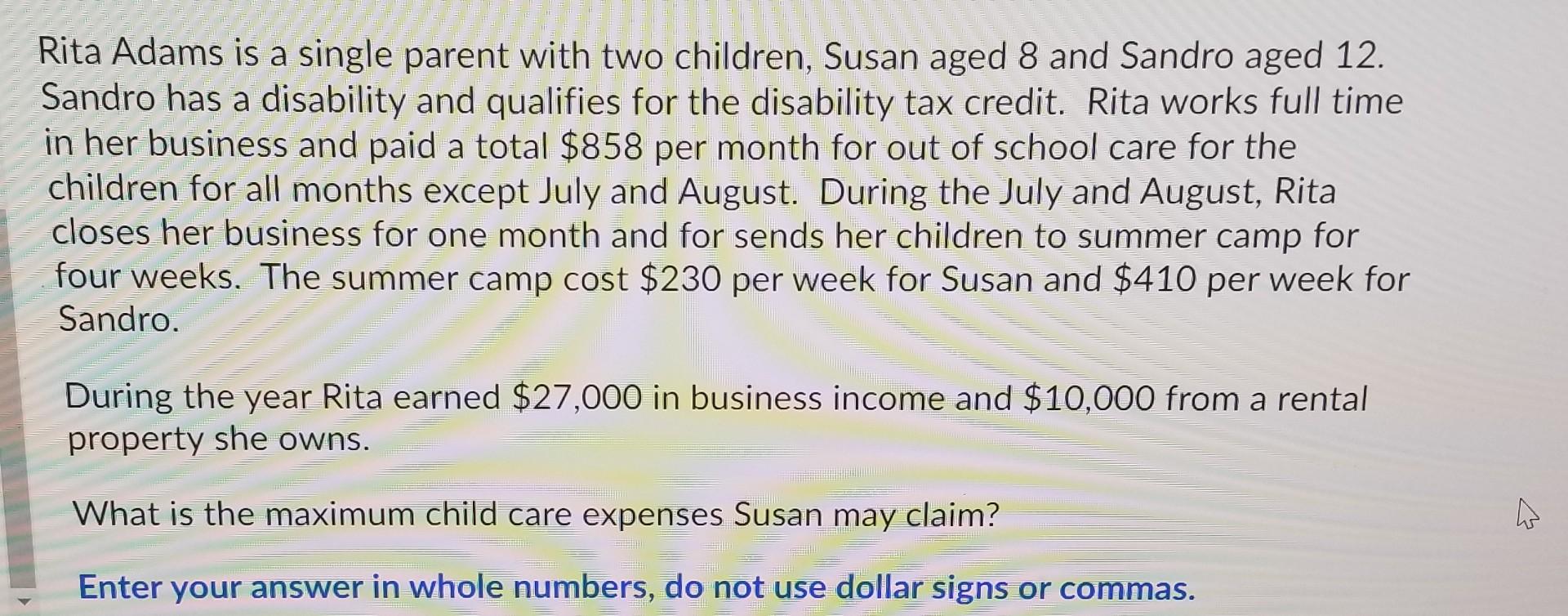

Rita Adams is a single parent with two children, Susan aged 8 and Sandro aged 12. Sandro has a disability and qualifies for the disability tax credit. Rita works full time in her business and paid a total $858 per month for out of school care for the children for all months except July and August. During the July and August, Rita closes her business for one month and for sends her children to summer camp for four weeks. The summer camp cost $230 per week for Susan and $410 per week for Sandro. During the year Rita earned $27,000 in business income and $10,000 from a rental property she owns. What is the maximum child care expenses Susan may claim? Enter your answer in whole numbers, do not use dollar signs or commas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts