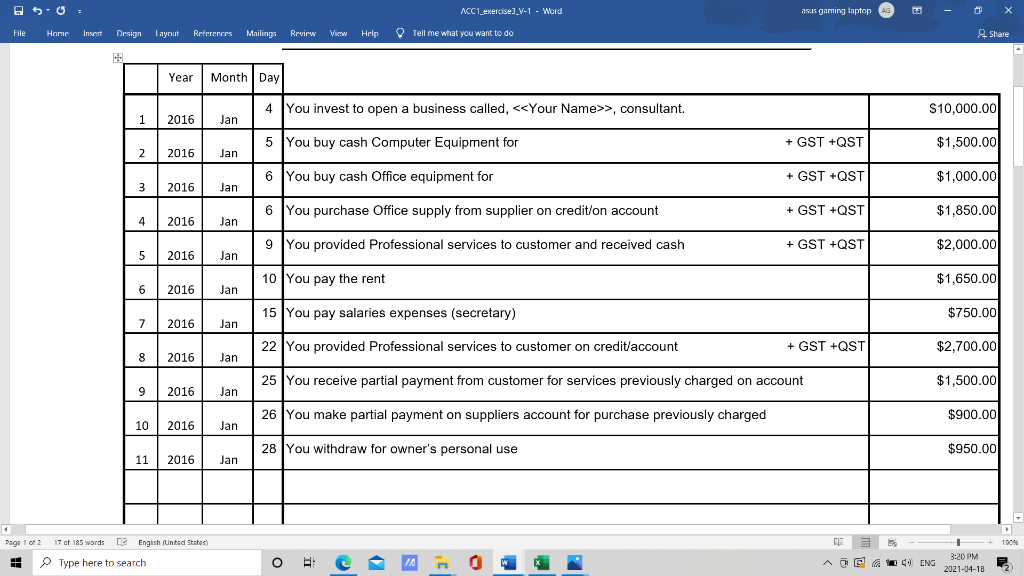

Question: I NEED THE SOLUTION AS I AM CONFUSD IN GST AND QST POSTING IN ALL 3 DOCUMENTS GST- 5% QST 9.975% Prepare the following documents

I NEED THE SOLUTION AS I AM CONFUSD IN GST AND QST POSTING IN ALL 3 DOCUMENTS

GST- 5%

QST 9.975%

Prepare the following documents

- General Journal entries

- Post entries to General Ledger

- Trail balance

ACC1_exercise)_V-1 - Word asis gaming laptop HE File Home Insert Design layout Referencrs Mailings Review View rir Tell me what you want to do Share Year Month Day 4 You invest to open a business called, >, consultant. S10,000.00 1 2016 Jan 5 You buy cash Computer Equipment for + GST +QST $1,500.00 2 2 2016 Jan 6 You buy cash Office equipment for + GST +QST $1,000.00 3 2016 Jan 6 You purchase Office supply from supplier on credit/on account + GST +QST $1,850.00 4 2016 Jan 9 You provided Professional services to customer and received cash + GST +QST $2,000.00 5 2016 Jan 10 You pay the rent $1,650.00 6 2016 Jan 15 You pay salaries expenses (secretary) $750.00 7 2016 Jan 22 You provided Professional services to customer on credit/account + GST +QST $2,700.00 8 2016 Jan 25 You receive partial payment from customer for services previously charged on account $1,500.00 9 2016 Jan 26 You make partial payment on suppliers account for purchase previously charged $900.00 10 2016 Jan 28 You withdraw for owner's personal use $950.00 11 2016 Jan 1904 Page 1 of 17 ct 185 words English (United States) Type here to search O Aue 40 ENG 3:20 PM 2021-04-18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts