Question: i need the solution for Q12 only Chapter 3 Principles of Option Pricing 95 price can go lower. How would you resolve this apparent paradox?

i need the solution for Q12 only

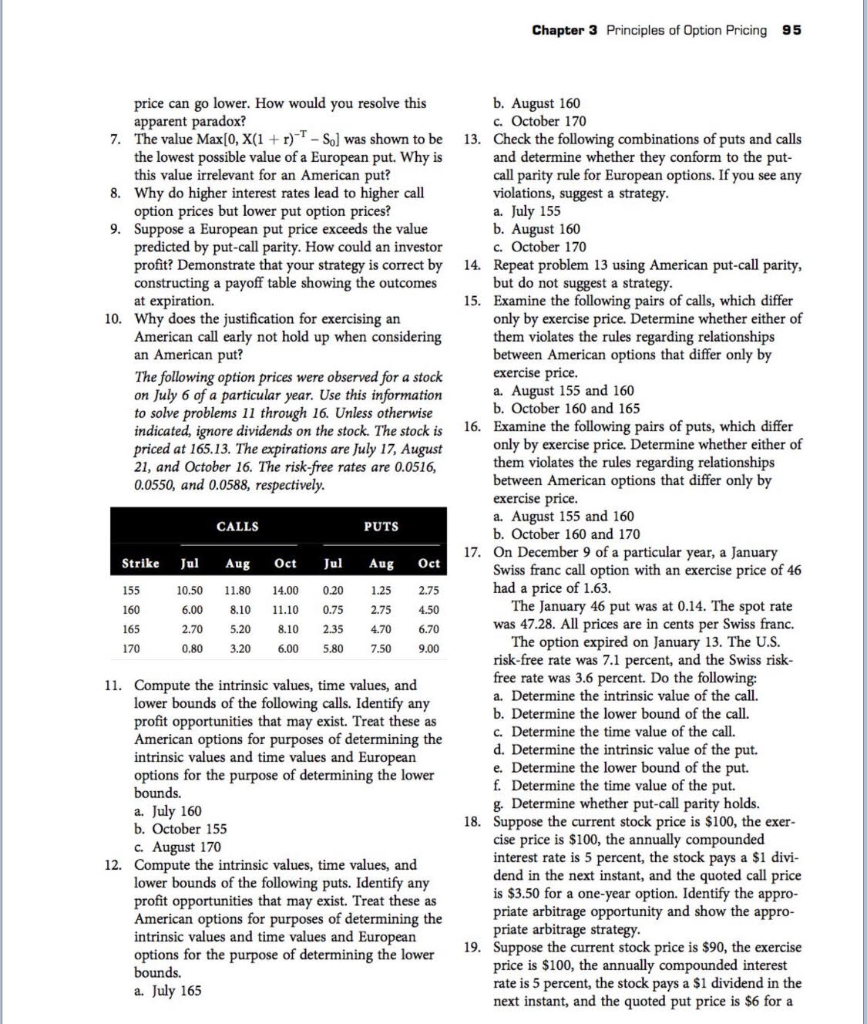

Chapter 3 Principles of Option Pricing 95 price can go lower. How would you resolve this apparent paradox? The value Max[0, X(1 the lowest possible value of a European put. Why is this value irrelevant for an American put? b. August 160 c. October 170 Check the following combinations of puts and calls and determine whether they conform to the put- call parity rule for European options. If you see any violations, suggest a strategy a. 7. r -Sol was shown to be 13. 8. Why do higher interest rates lead to higher call option prices but lower put option prices? 9. Suppose a European put price exceeds the value ugust 160 predicted by put-call parity. How could an investor profit? Demonstrate that your strategy is correct by c. October 170 Repeat problem 13 using American put-call parity, but do not suggest a strategy 14. constructing a payoff table showing the outcomes 15. Examine the following pairs of calls, which differ at expiration. Why does the justification for exercising an American call early not hold up when considering an only by exercise price. Determine whether either of them violates the rules regarding relationships between American options that differ only by exercise price. a. August 155 and 160 b. October 160 and 165 10. The following option prices were observed for a stock on July 6 of a particular year. Use this information to solve problems 11 through 16. Unless otherwise indicated, ignore dividends on the stock. The stock is 16. Examine the following pairs of puts, which differ only by exercise price. Determine whether either of them violates the rules regarding relationships between American options that differ only by exercise price a. August 155 and 160 b. October 160 and 170 priced at 165.13. The expirations are July 17, August 21, and October 16. The risk-free rates are 0.0516, 0.0550, and 0.0588, respectively. CALLS PUTS 17. On December 9 of a particular year, a January Strike Aug Oct Jul Aug Oct 10.50 1.80 14.00 0.20 1.25 2.75 6.00 8.10 11.10 0.75 2.75 4.50 2.70 5.20 8.10 2.35 4.70 6.70 0.80 3.20 6.00 5.80 7.50 9.00 Swiss franc call option with an exercise price of 46 had a price of 1.63. 155 The January 46 put was at 0.14. The spot rate was 47.28. All prices are in cents per Swiss franc. The option expired on January 13. The U.S. risk-free rate was 7.1 percent, and the Swiss risk free rate was 3.6 percent. Do the following a. Determine the intrinsic value of the call. b. Determine the lower bound of the call. c. Determine the time value of the call. d. Determine the intrinsic value of the put. e. Determine the lower bound of the put. f. Determine the time value of the put. g. Determine whether put-call parity holds. Suppose the current stock price is $100, the exer- cise price is $100, the annually compounded interest rate is 5 percent, the stock pays a $1 divi- dend in the next instant, and the quoted call price is $3.50 for a one-year option. Identify the appro- priate arbitrage opportunity and show the appro- priate arbitrage strategy. Suppose the current stock price is $90, the exercise price is $100, the annually compounded interest rate is 5 percent, the stock pays a S1 dividend in the next instant, and the quoted put price is $6 for a Compute the intrinsic values, time values, and lower bounds of the following calls. Identify any profit opportunities that may exist. Treat these as American options for purposes of determining the intrinsic values and time values and European options for the purpose of determining the lower bounds. 11. 18. b. October 155 c. August 170 Compute the intrinsic values, time values, and lower bounds of the following puts. Identify any profit opportunities that may exist. Treat these as American options for purposes of determining the intrinsic values and time values and European options for the purpose bounds. a. 12. 19. of determining the lower y 165 Chapter 3 Principles of Option Pricing 95 price can go lower. How would you resolve this apparent paradox? The value Max[0, X(1 the lowest possible value of a European put. Why is this value irrelevant for an American put? b. August 160 c. October 170 Check the following combinations of puts and calls and determine whether they conform to the put- call parity rule for European options. If you see any violations, suggest a strategy a. 7. r -Sol was shown to be 13. 8. Why do higher interest rates lead to higher call option prices but lower put option prices? 9. Suppose a European put price exceeds the value ugust 160 predicted by put-call parity. How could an investor profit? Demonstrate that your strategy is correct by c. October 170 Repeat problem 13 using American put-call parity, but do not suggest a strategy 14. constructing a payoff table showing the outcomes 15. Examine the following pairs of calls, which differ at expiration. Why does the justification for exercising an American call early not hold up when considering an only by exercise price. Determine whether either of them violates the rules regarding relationships between American options that differ only by exercise price. a. August 155 and 160 b. October 160 and 165 10. The following option prices were observed for a stock on July 6 of a particular year. Use this information to solve problems 11 through 16. Unless otherwise indicated, ignore dividends on the stock. The stock is 16. Examine the following pairs of puts, which differ only by exercise price. Determine whether either of them violates the rules regarding relationships between American options that differ only by exercise price a. August 155 and 160 b. October 160 and 170 priced at 165.13. The expirations are July 17, August 21, and October 16. The risk-free rates are 0.0516, 0.0550, and 0.0588, respectively. CALLS PUTS 17. On December 9 of a particular year, a January Strike Aug Oct Jul Aug Oct 10.50 1.80 14.00 0.20 1.25 2.75 6.00 8.10 11.10 0.75 2.75 4.50 2.70 5.20 8.10 2.35 4.70 6.70 0.80 3.20 6.00 5.80 7.50 9.00 Swiss franc call option with an exercise price of 46 had a price of 1.63. 155 The January 46 put was at 0.14. The spot rate was 47.28. All prices are in cents per Swiss franc. The option expired on January 13. The U.S. risk-free rate was 7.1 percent, and the Swiss risk free rate was 3.6 percent. Do the following a. Determine the intrinsic value of the call. b. Determine the lower bound of the call. c. Determine the time value of the call. d. Determine the intrinsic value of the put. e. Determine the lower bound of the put. f. Determine the time value of the put. g. Determine whether put-call parity holds. Suppose the current stock price is $100, the exer- cise price is $100, the annually compounded interest rate is 5 percent, the stock pays a $1 divi- dend in the next instant, and the quoted call price is $3.50 for a one-year option. Identify the appro- priate arbitrage opportunity and show the appro- priate arbitrage strategy. Suppose the current stock price is $90, the exercise price is $100, the annually compounded interest rate is 5 percent, the stock pays a S1 dividend in the next instant, and the quoted put price is $6 for a Compute the intrinsic values, time values, and lower bounds of the following calls. Identify any profit opportunities that may exist. Treat these as American options for purposes of determining the intrinsic values and time values and European options for the purpose of determining the lower bounds. 11. 18. b. October 155 c. August 170 Compute the intrinsic values, time values, and lower bounds of the following puts. Identify any profit opportunities that may exist. Treat these as American options for purposes of determining the intrinsic values and time values and European options for the purpose bounds. a. 12. 19. of determining the lower y 165

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts