Question: i need the solution step by step and clear pls. Question 3 (30 Marks) A- Marcia Jones runs a small business. In the year ending

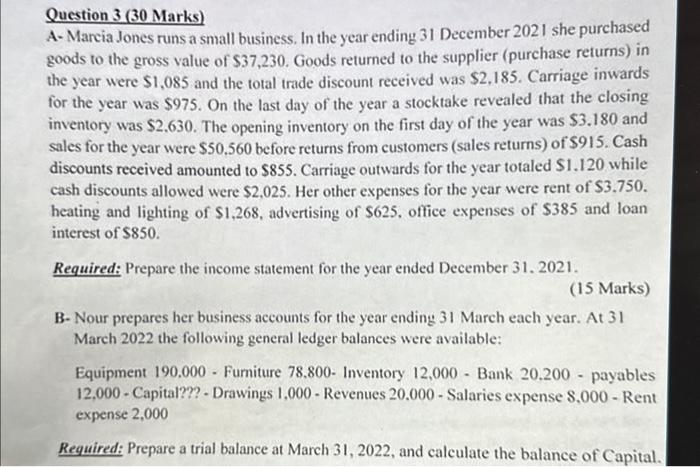

Question 3 (30 Marks) A- Marcia Jones runs a small business. In the year ending 31 December 2021 she purchased goods to the gross value of $37,230. Goods returned to the supplier (purchase returns) in the year were $1,085 and the total trade discount received was $2,185. Carriage inwards for the year was $975. On the last day of the year a stocktake revealed that the closing inventory was $2.630. The opening inventory on the first day of the year was $3.180 and sales for the year were $50.560 before returns from customers (sales returns) of $915. Cash discounts received amounted to $855. Carriage outwards for the year totaled $1.120 while cash discounts allowed were $2,025. Her other expenses for the year were rent of $3.750. heating and lighting of $1,268, advertising of $625, office expenses of $385 and loan interest of $850. Required: Prepare the income statement for the year ended December 31. 2021. (15 Marks) B- Nour prepares her business accounts for the year ending 31 March each year. At 31 March 2022 the following general ledger balances were available: Equipment 190,000 - Fumiture 78,800- Inventory 12,000 - Bank 20.200 - payables 12,000 - Capital?? - Drawings 1,000 - Revenues 20,000 - Salaries expense 8,000 - Rent expense 2,000 Required: Prepare a trial balance at March 31, 2022, and calculate the balance of Capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts