Question: I need the solution to solve these problems. Question 2 Not answered Marked out of 3.00 Currently the firm has total market value of debt

I need the solution to solve these problems.

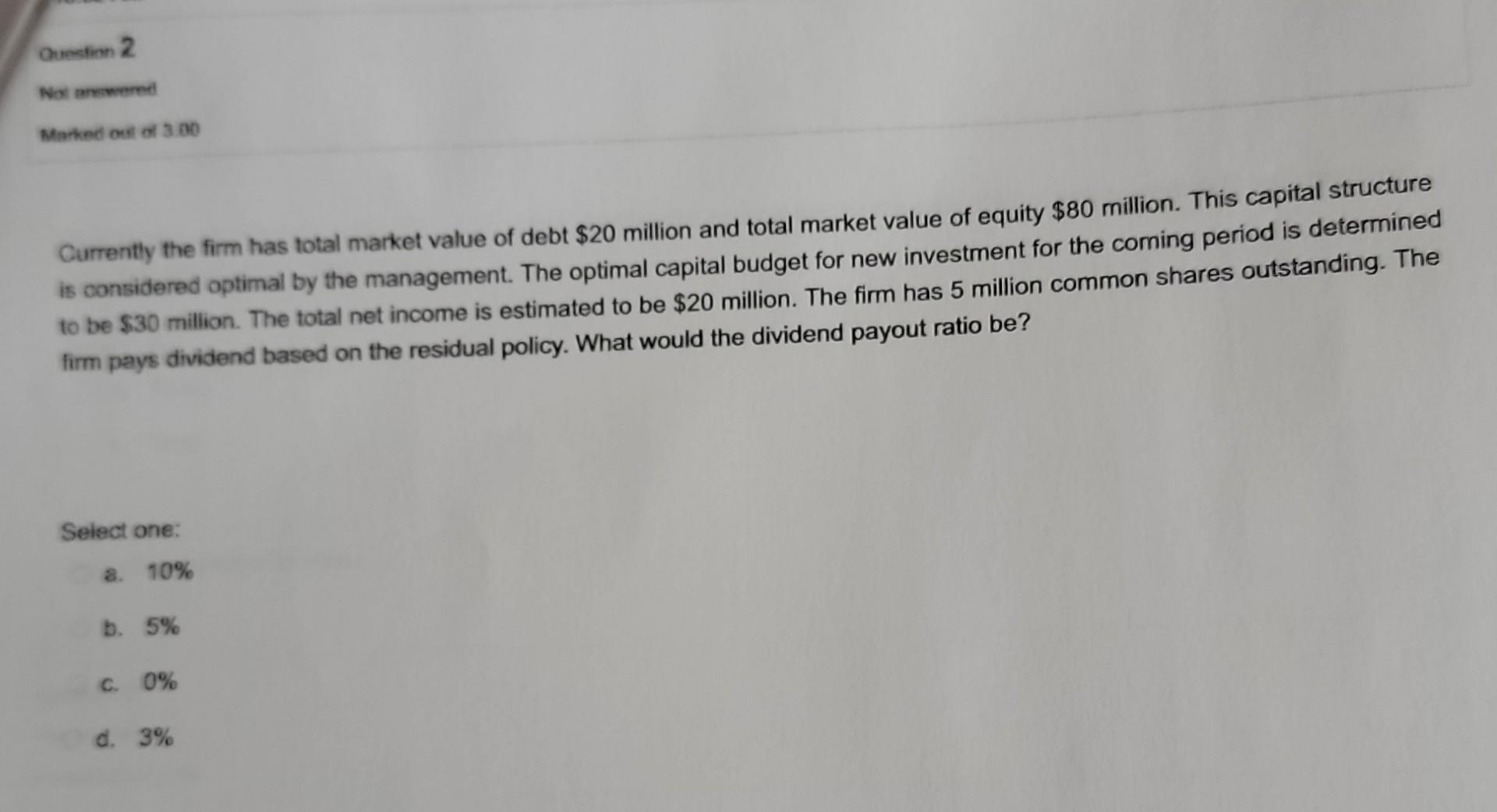

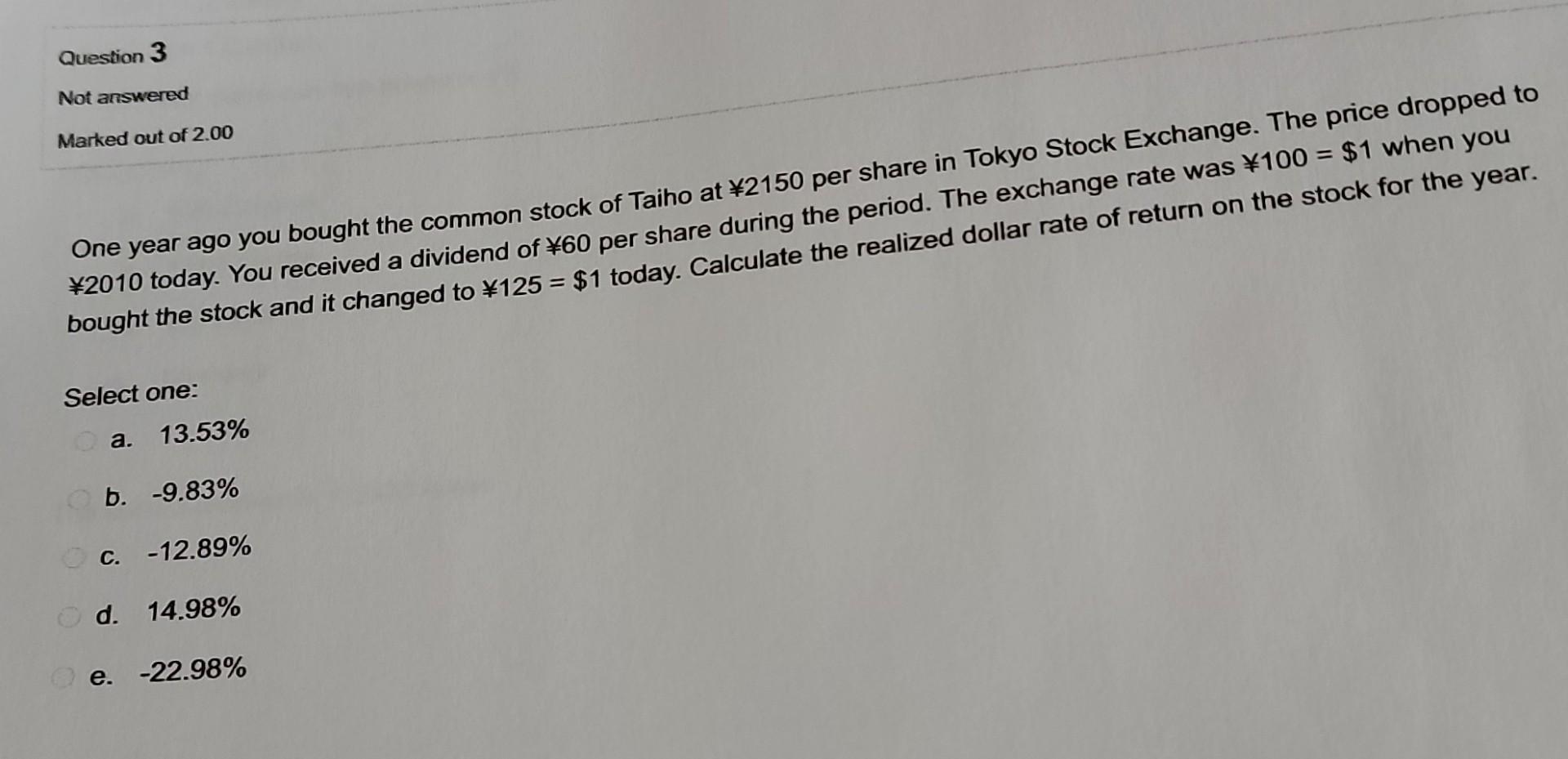

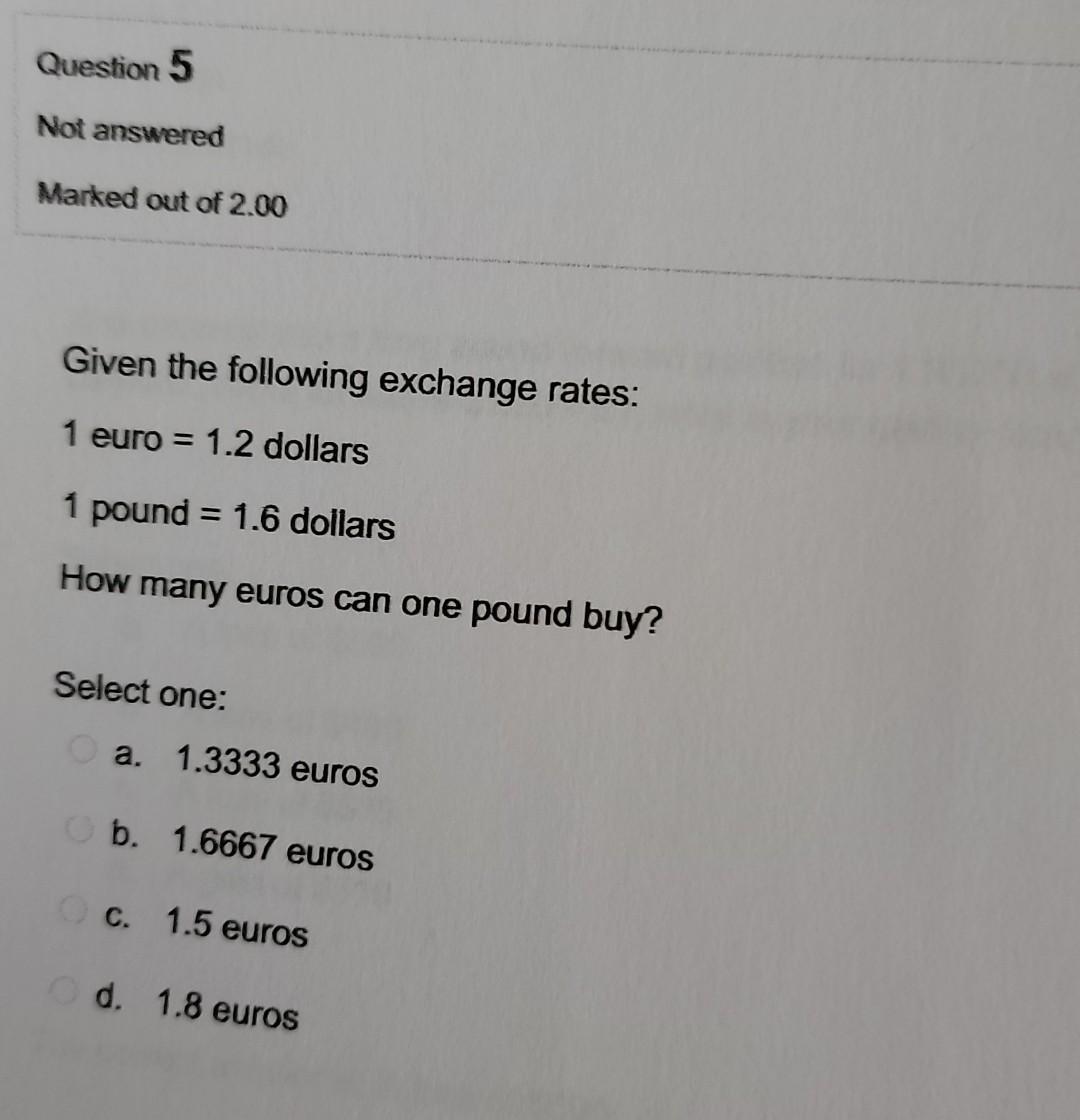

Question 2 Not answered Marked out of 3.00 Currently the firm has total market value of debt $20 million and total market value of equity $80 million. This capital structure is considered optimal by the management. The optimal capital budget for new investment for the coming period is determined to be $30 million. The total net income is estimated to be $20 million. The firm has 5 million common shares outstanding. The firm pays dividend based on the residual policy. What would the dividend payout ratio be? Select one: a. 10% b. 5% c. 0% d. 3% Question 3 Not answered Marked out of 2.00 One year ago you bought the common stock of Taiho at 2150 per share in Tokyo Stock Exchange. The price dropped to 2010 today. You received a dividend of 60 per share during the period. The exchange rate was 100 = $1 when you bought the stock and it changed to 125 = $1 today. Calculate the realized dollar rate of return on the stock for the year. Select one: a. 13.53% b. -9.83% c. -12.89% Od. 14.98% e. -22.98% Question 5 Not answered Marked out of 2.00 Given the following exchange rates: 1 euro = 1.2 dollars 1 pound = 1.6 dollars How many euros can one pound buy? Select one: a. 1.3333 euros O b. 1.6667 euros O c. 1.5 euros Od. 1.8 euros

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts