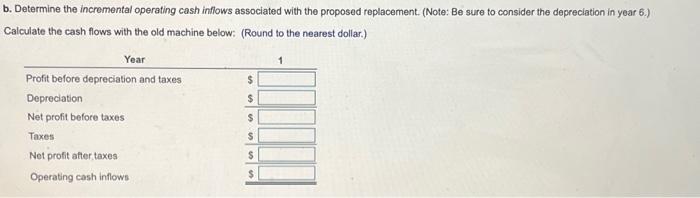

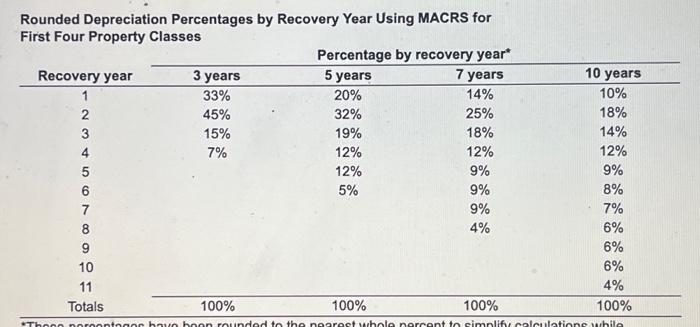

Question: I need the table for years 1-5 Determine the incremental operating cash inflows associated with the proposed replacement. (Note: Be sure to consider the depreciation

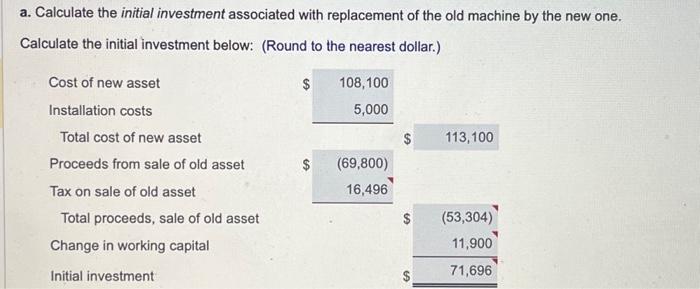

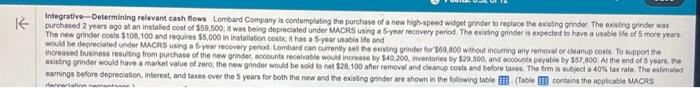

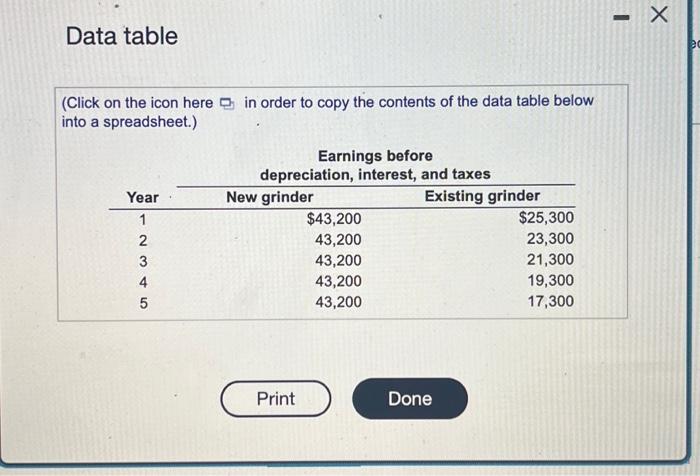

Determine the incremental operating cash inflows associated with the proposed replacement. (Note: Be sure to consider the depreciation in year 6 .) Calculate the cash flows with the old machine below: (Round to the nearest dollar.) a. Calculate the initial investment associated with replacement of the old machine by the new one. Calculate the initial investment below: (Round to the nearest dollar.) Integratlve - Oetermining relwvant cash flows Lombard Company is contemplating the purchase of a new high-speed widget grinder to reglace the ovisting grinder. The oxstng grinder was purchased 2 years ago at an instaled cost of $59,500; it was being depreciated under MMCRS ising a 5 -year recovery period. The eniaing grinder is expedind to have a usebie lile of 5 more yeas The new orinder costs $106,100 and reguices 85,000 in installation costs, it has a s-year usabio ife and earnings before deprecia5on, interest, and tanss ever the 5 years for both the new and the owisting ginder are shown in the following table darouciation repranturos i oontaina the applicabin MACFS Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Determine the incremental operating cash inflows associated with the proposed replacement. (Note: Be sure to consider the depreciation in year 6 .) Calculate the cash flows with the old machine below: (Round to the nearest dollar.) a. Calculate the initial investment associated with replacement of the old machine by the new one. Calculate the initial investment below: (Round to the nearest dollar.) Integratlve - Oetermining relwvant cash flows Lombard Company is contemplating the purchase of a new high-speed widget grinder to reglace the ovisting grinder. The oxstng grinder was purchased 2 years ago at an instaled cost of $59,500; it was being depreciated under MMCRS ising a 5 -year recovery period. The eniaing grinder is expedind to have a usebie lile of 5 more yeas The new orinder costs $106,100 and reguices 85,000 in installation costs, it has a s-year usabio ife and earnings before deprecia5on, interest, and tanss ever the 5 years for both the new and the owisting ginder are shown in the following table darouciation repranturos i oontaina the applicabin MACFS Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts