Question: I need the total row completed. During the year, Wright Company sells 500 remote-control airplanes for $120 each. The company has the following inventory purchase

I need the total row completed.

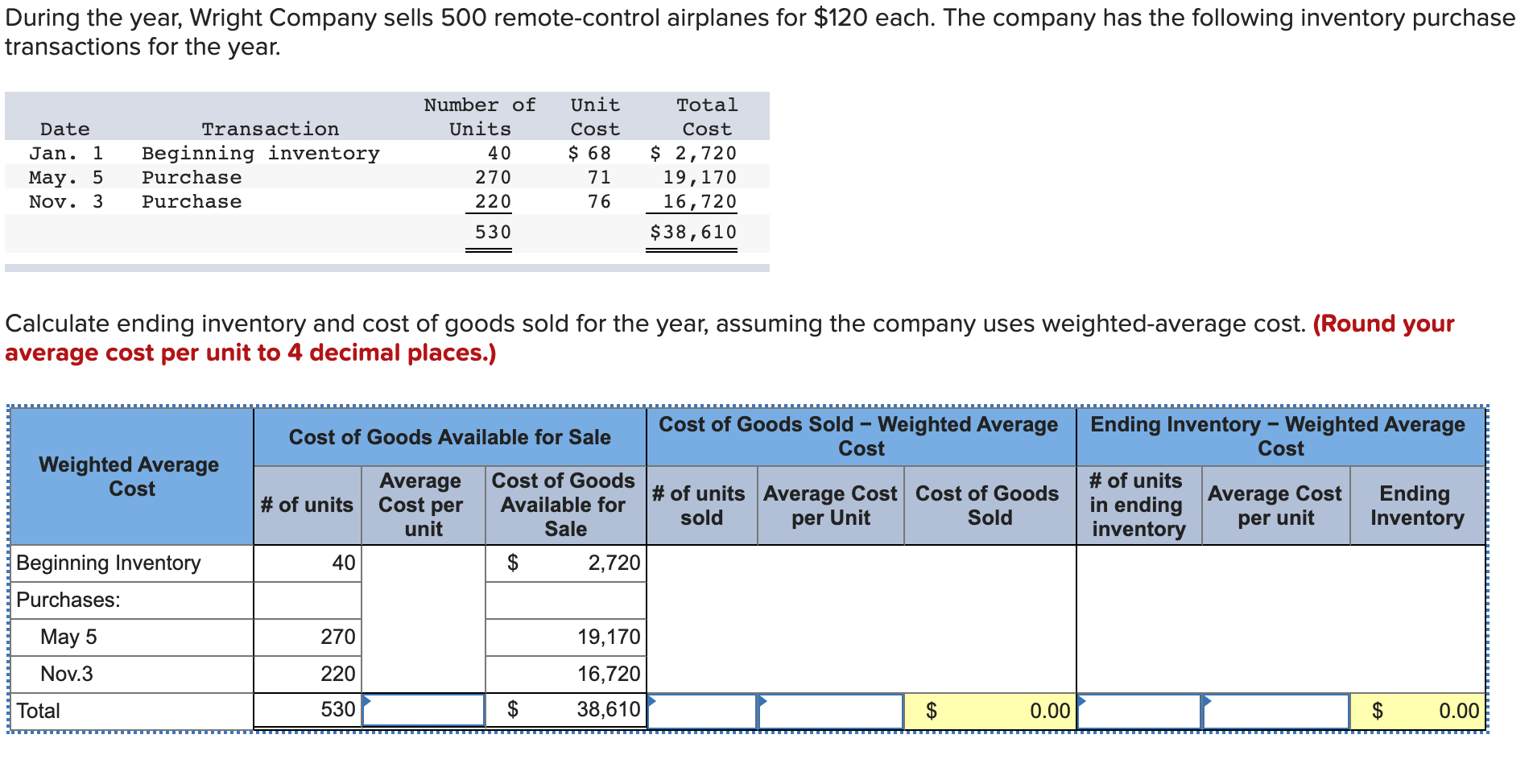

During the year, Wright Company sells 500 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Date Jan. 1 May. 5 Nov. 3 Transaction Beginning inventory Purchase Purchase Number of Units 40 270 220 Unit Cost $ 68 71 76 Total Cost $ 2,720 19,170 16,720 $38,610 530 Calculate ending inventory and cost of goods sold for the year, assuming the company uses weighted average cost. (Round your average cost per unit to 4 decimal places.) Weighted Average Cost of Goods Available for Sale Cost of Goods Sold - Weighted Average Cost Average Cost of Goods $ # of units Average Cost Cost of Goods of units Cost per Available for unit Sale sold per Unit Sold $ 2,720 Ending Inventory - Weighted Average Cost # of units Average Cost Ending in ending inventory per unit Inventory Cost Beginning Inventory Purchases: May 5 270 Nov.3 220 19,170 16,720 38,610 E Total 530 0.00 $ 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts