Question: Describe the methods for allocating the total joint production cost to joint products. Star company processes an ore in Dept.1, from which comes there,

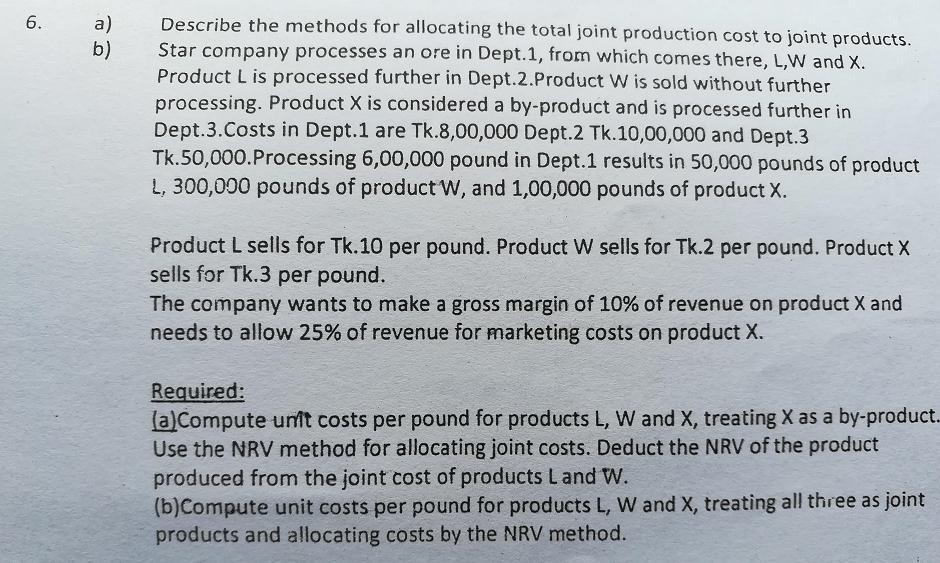

Describe the methods for allocating the total joint production cost to joint products. Star company processes an ore in Dept.1, from which comes there, L,W and X. Product L is processed further in Dept.2.Product W is sold without further processing. Product X is considered a by-product and is processed further in Dept.3.Costs in Dept.1 are Tk.8,00,000 Dept.2 Tk.10,00,000 and Dept.3 Tk.50,000.Processing 6,00,000 pound in Dept.1 results in 50,000 pounds of product L, 300,000 pounds of product W, and 1,00,000 pounds of product X. 6. a) b) Product L sells for Tk.10 per pound. Product W sells for Tk.2 per pound. Product X sells for Tk.3 per pound. The company wants to make a gross margin of 10% of revenue on product X and needs to allow 25% of revenue for marketing costs on product X. Required: (a)Compute unit costs per pound for products L, W and X, treating X as a by-product. Use the NRV method for allocating joint costs. Deduct the NRV of the product produced from the joint cost of products L and W. (b)Compute unit costs per pound for products L, W and X, treating all three as joint products and allocating costs by the NRV method.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Part a The joint cost allocation approaches include the following A Benefits Received approaches i Physical Units Methods ii Average Unit cost Method or Weighted Average Method B Market Value Approach... View full answer

Get step-by-step solutions from verified subject matter experts