Question: i need these answer and to mske sure the ones i have are correct As you work on your project, be sure to save your

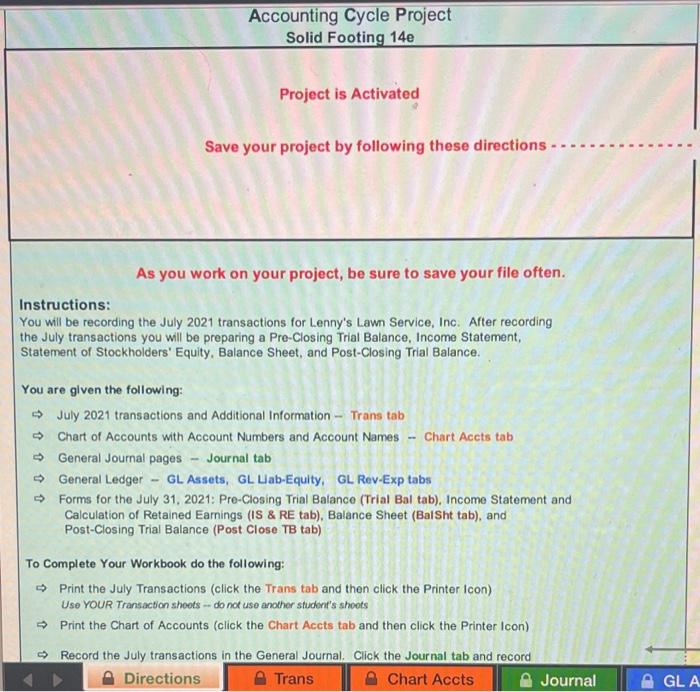

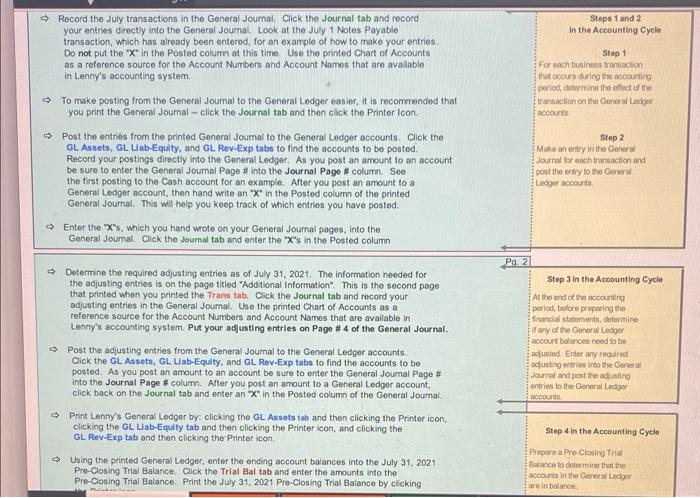

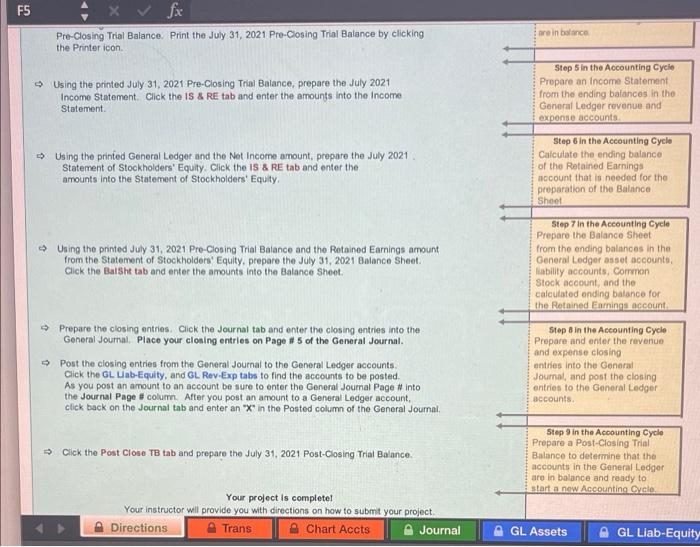

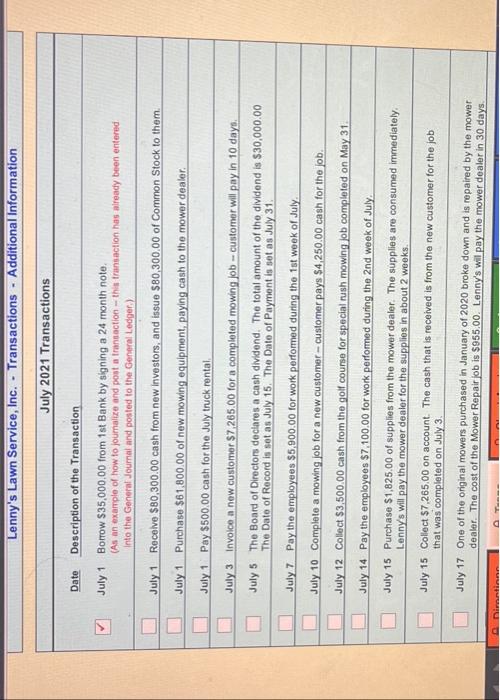

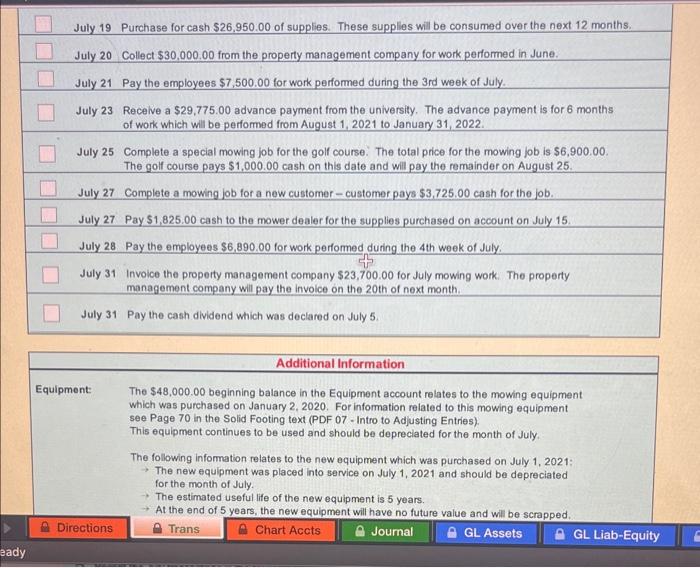

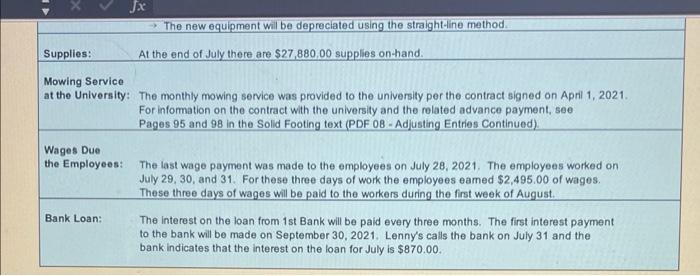

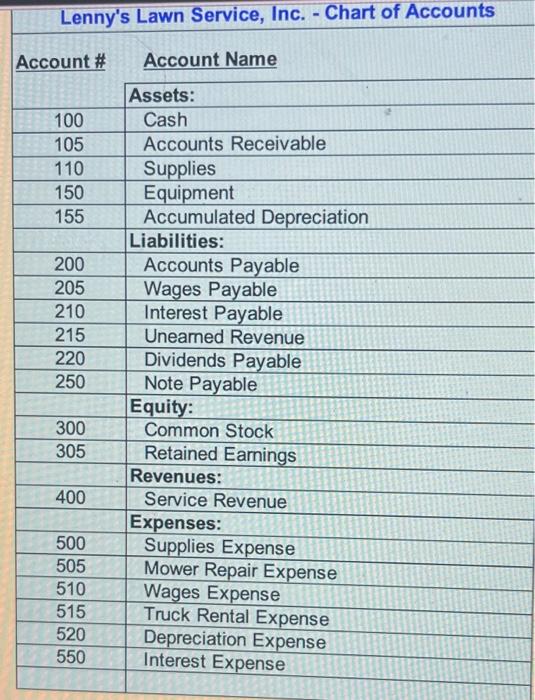

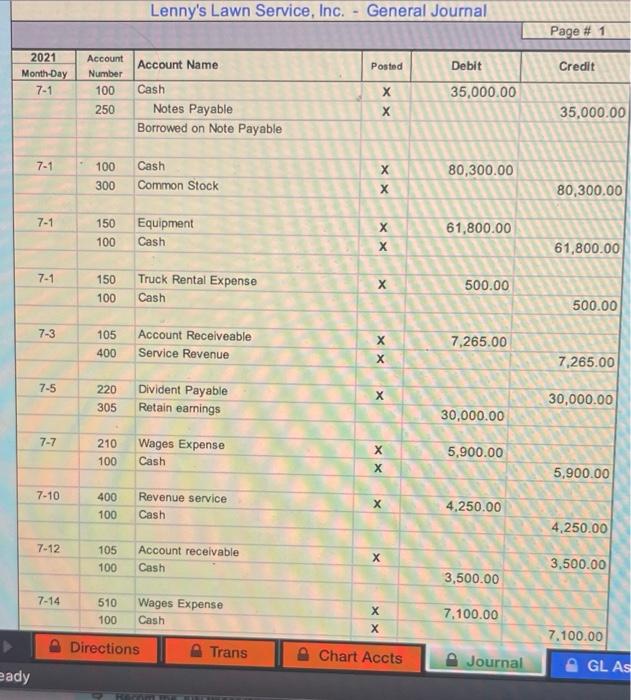

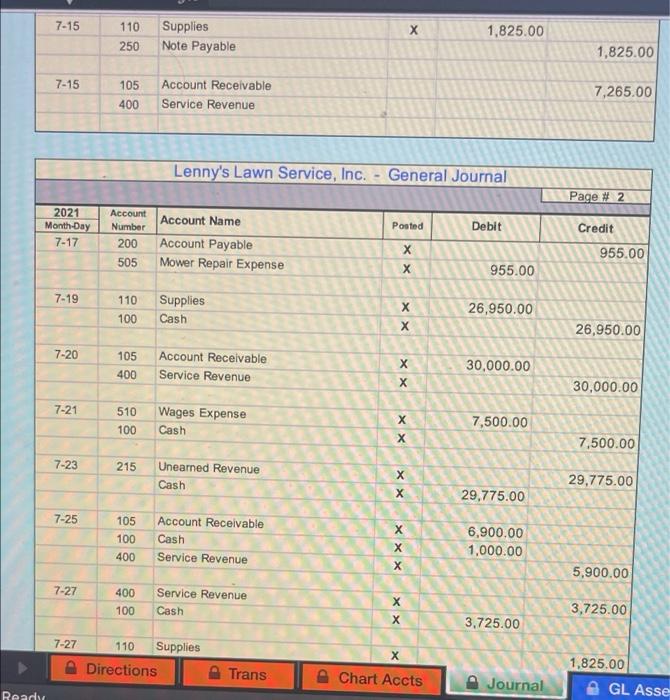

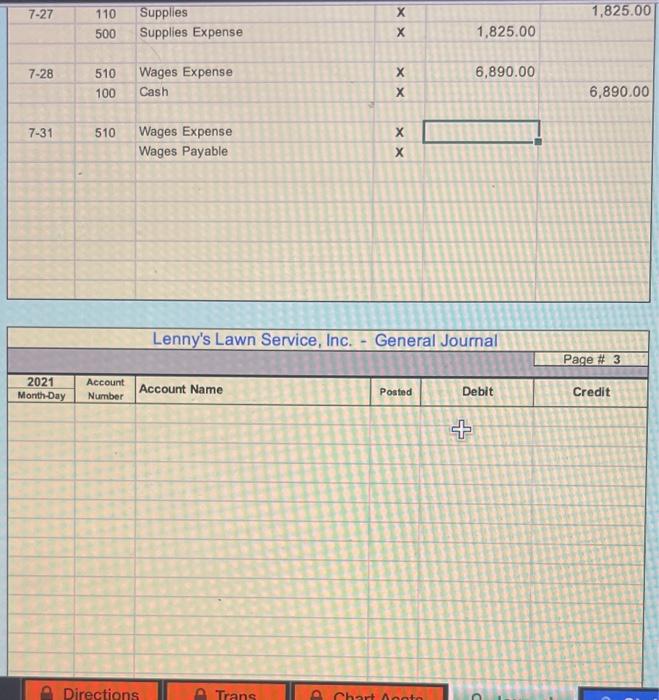

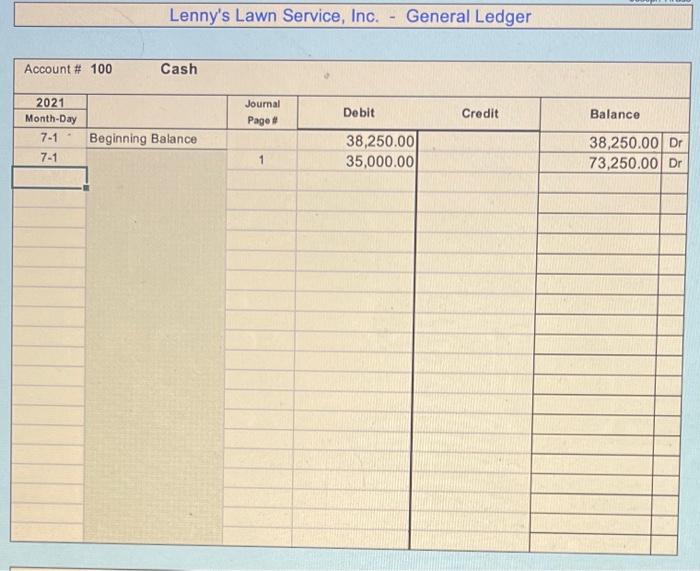

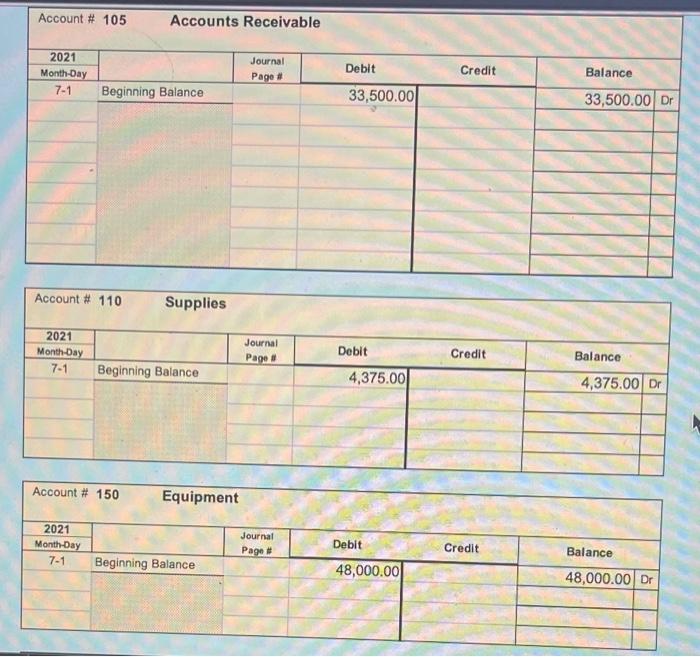

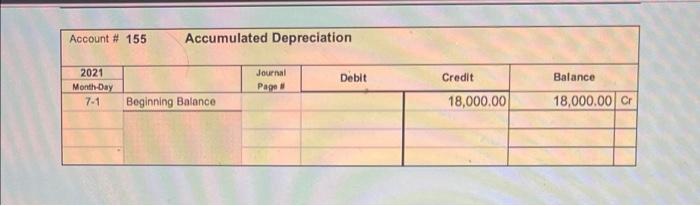

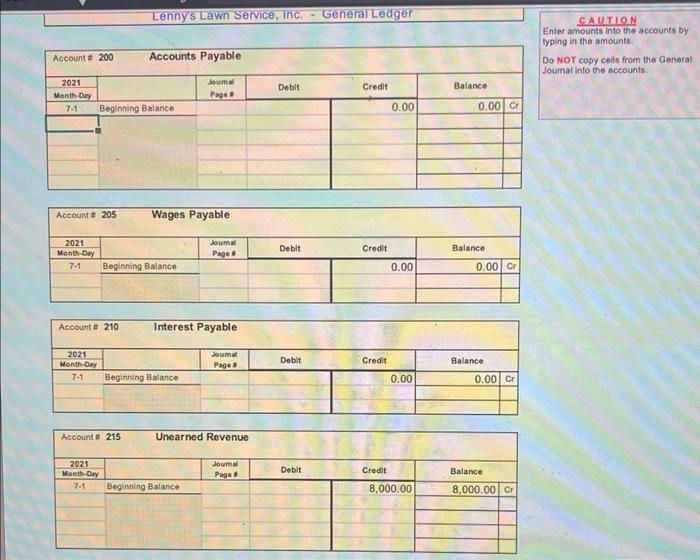

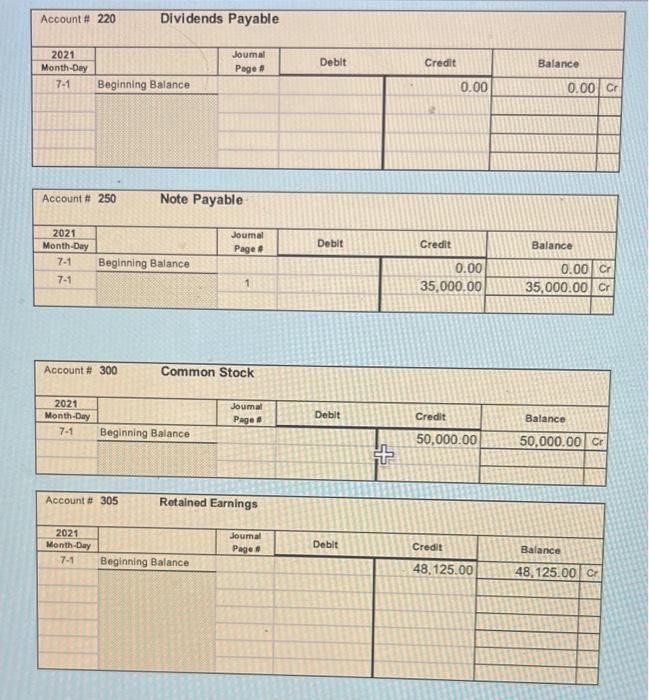

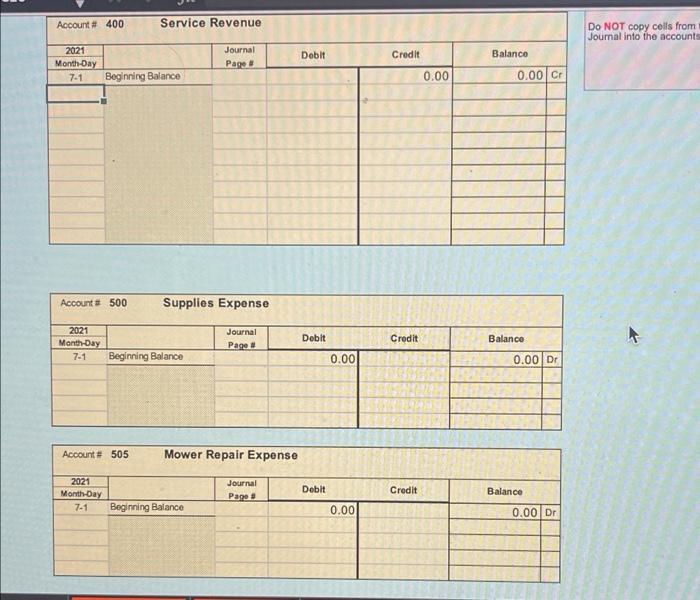

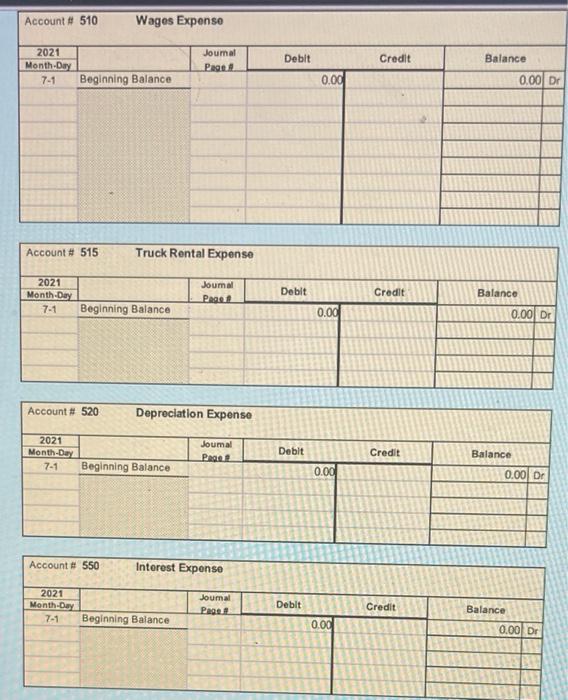

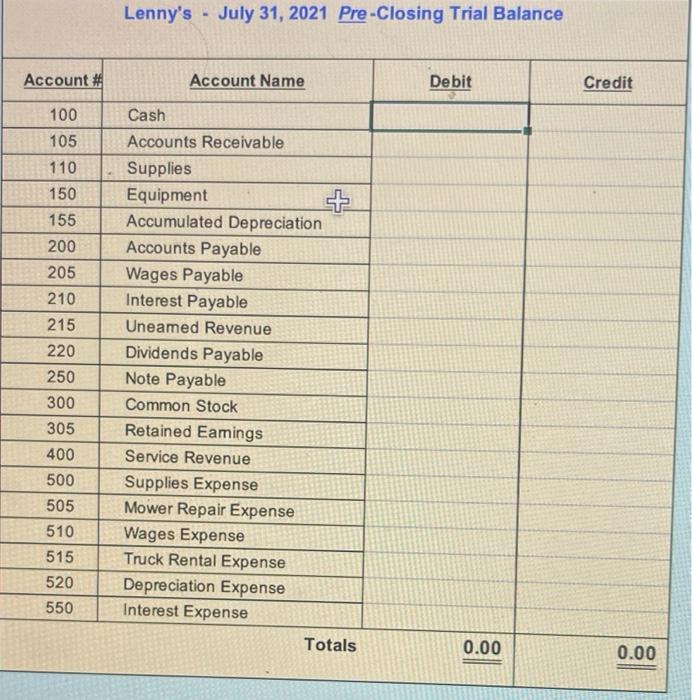

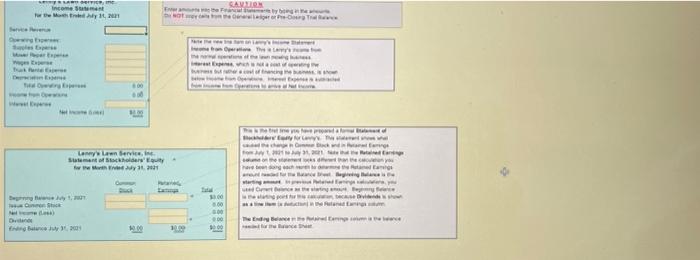

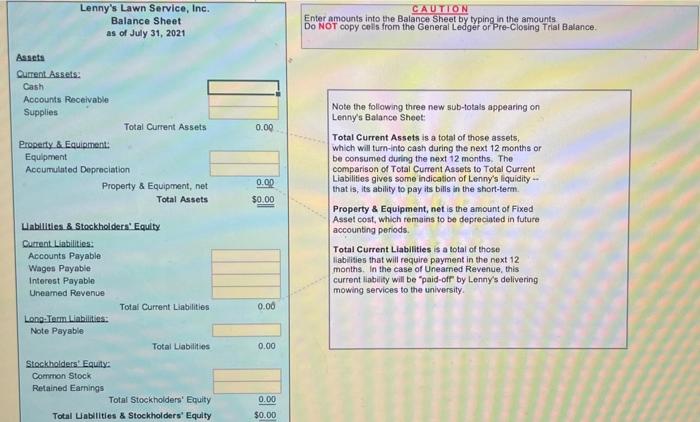

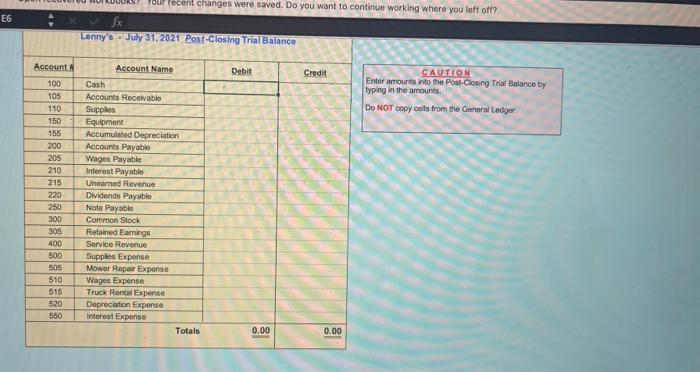

As you work on your project, be sure to save your file often. Instructions: You will be recording the July 2021 transactions for Lenny's Lawn Service, Inc. After recording the July transactions you will be preparing a Pre-Closing Trial Balance, Income Statement, Statement of Stockholders' Equity, Balance Sheet, and Post-Closing Trial Balance. You are given the following: July 2021 transactions and Additional Information - Trans tab Chart of Accounts with Account Numbers and Account Names - Chart Accts tab General Journal pages - Journal tab General Ledger - GL Assets, GL Lab-Equity, GL Rev-Exp tabs Forms for the July 31, 2021: Pre-Closing Trial Balance (Trial Bal tab), Income Statement and Calculation of Retained Earnings (IS \& RE tab), Balance Sheet (BalSht tab), and Post-Closing Trial Balance (Post Close TB tab) To Complete Your Workbook do the following: Print the July Transactions (click the Trans tab and then click the Printer Icon) Uso YoUR Transaction shoots - do not use another student's shoots Print the Chart of Accounts (click the Chart Accts tab and then click the Printer Icon) Record the July transactions in the General Journal. Click the Journal tab and record Pre-Closing Trial Balance. Print the July 31, 2021 Pre-Closing Trlal Balance by clicking the Printer icon. Using the printed July 31, 2021 Pre-Closing Trial Balance, prepare the July 2021 Income Statement. Click the is \& RE tab and enter the amounts into the income Statement. Using the prinied General Ledget and the Net Income amount, prepare the July 2021. Statement of Stockholders' Equity. Click the IS \& RE tab and enter the amounts into the Statement of Stockholders' Equity. Using the printed July 31, 2021 Pre-Closing Trial Balance and the Rotained Earnings amount from the Statement of Stockholders' Equity, prepare the July 31, 2021 Balance Sheet. Click the Balsht tab and enter the amounts into the Balance Sheet. Prepare the closing entries. Click the Journal tab and enter the closing entries into the General Journal, Place your closing entries on Page II 5 of the General Journal. Post the closing entries from the General Journal to the General Ledger accounts. Cick the GL Lab-Equity, and GL. Rev.Exp tabs to find the accounts to be posted. As you post an amount to an account be sure to enter the Ceneral Joutnal Page n into the Journal Page # column. After you post an amount to a General Ledger account, click back on the Journal tab and enter an " X " in the Posted column of the General Journal, Cick the Post Close TB tab and prepare the July 31, 2021 Post-Cosing Trial Balance. Lenny's Lawn Service, Inc. - Transactions - Additional Information July 2021 Transactions Date Description of the Transaction July 1 Borrow $35,000.00 from 1 st Bank by signing a 24 month note. (As an example of how to joumalize and post a traneaction - this traneaction has already been entered Into the General Journal and posted to the General Ledger.) July 1 Recelve $80,300.00 cash from new investors, and issue $80,300.00 of Common Stock to them. July 1 Purchase $61,800.00 of new mowing equipment, paying cash to the mower dealer. July 1 Pay $500.00 cash for the July truck rental. July 3 Involce a now customer $7,265.00 for a completed mowing job - customer will pay in 10 days. July 5 The Board of Directors dectares a cash dividend. The total amount of the dividend is $30,000.00 The Date of Record is set as July 15 . The Date of Payment is set as July 31. July 7 Pay the employees $5,900.00 for work performed during the 1st week of July. July 10 Complete a mowing job for a new customer - customer pays $4,250.00 cash for the job. July 12 Collect $3,500.00 cash from the golf course for special rush mowing job completed on May 31. July 14 Pay the employees $7,100.00 for work performed during the 2 nd week of July. July 15 Purchase $1,825.00 of supplies from the mower dealer. The supplies are consumed immediately. Lenny's will pay the mower dealer for the supplies in about 2 weeks. July 15 Collect $7,265.00 on account. The cash that is received is from the new customer for the job that was completed on July 3 . July 17 One of the original mowers purchased in January of 2020 broke down and is repaired by the mower dealer. The cost of the Mower Repairjob is $955.00. Lenny's wil pay the mower dealer in 30 days. The $48,000.00 beginning balance in the Equipment account relates to the mowing equipment which was purchased on January 2, 2020. For infomation related to this mowing equipment see Page 70 in the Solid Footing text (PDF 07 - Intro to Adjusting Entries). This equipment continues to be used and should be depreciated for the month of July. The following information relates to the new equipment which was purchased on July 1,2021 : The new equipment was placed into service on July 1, 2021 and should be depreciated for the month of July. The estimated useful life of the new equipment is 5 years. At the end of 5 years, the new equipment will have no future value and will be scrapped. The new equipment wil be depreciated using the straight-line method. Supplies: At the end of July there are $27,880,00 supplies on-hand. Mowing Service at the University: The monthly mowing service was provided to the university per the contract signed on April 1 , 2021. For infomation on the contract with the university and the related advance payment, see Pages 95 and 98 in the Solid Footing text (PDF 08 - Adjusting Entries Continued). Wages Due the Employees: The last wage payment was made to the employees on July 28, 2021. The employees worked on July 29, 30, and 31 . For these three days of work the employees eamed $2,495,00 of wages. These three days of wages will be paid to the workers during the first week of August. Bank Loan: The interest on the loan from 1 st Bank will be paid every three months. The first interest payment to the bank will be made on September 30,2021 . Lenny's calls the bank on July 31 and the bank indicates that the interest on the loan for July is $870.00. \begin{tabular}{|l|l|l|l|r|r|} \hline 715 & 110 & Supplies & X & 1,825.00 & 1,825.00 \\ \hline & 250 & Note Payable & \\ \hline 715 & 105 & Account Receivable & \\ \hline & 400 & Service Revenue & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|r|} \hline 727 & 110 & Supplies & X & \\ \hline & 500 & Supplies Expense & X & 1,825.00 \\ \hline 728 & 510 & Wages Expense & X & 6,00 \\ \hline & 100 & Cash & X & \\ \hline & & & & \\ \hline 731 & 510 & Wages Expense & X & \\ \hline & & Wages Payable & X & \\ \hline & & & \\ \hline \end{tabular} Lenny's Lawn Service, Inc. - General Ledger Enter amounts into the accounts by typing in the ameunts. Do NOT copy celis from the General Joumal into the accounts. Do NOT copy cells from Joumal into the accounts Lenny's - July 31, 2021 Pre-Closing Trial Balance CAUTION Enter amounts into the Balance Sheet by typing in the amounts Do NOT copy cois from the General Ledget or Pre-Closing Trial Balance. Note the following three new sub-totals appearing on Lenny's Balance Sheet: Total Current Assets is a total of those assets, which will turn-into cash during the next 12 months or be consumed during the next 12 menths. The comparison of Total Current Assets to Total Current Liabilities gives some indication of Lenny's liquidity that is, its ability to pay its bills in the short-term. Property \& Equipment, net is the amount of Fixed Asset cost, which remains to be depreciated in future accounting periods. Total Current Liablities is a total of those liabilities that will require payment in the next 12 months. In the case of Uneamed Revenue, this current liability will be "paid-off" by Lenny's delivering mowing services to the university. Lenny's " Juty 31.2021 Pest-Closing TrialBalance Enter amounts lato the PoseGesis Enter arnounts into the Poss-Closing Triat Balance by typing in the amounts. Do NOT Copy oils from the General Ledger

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts