Question: I need these corrected please kindly. Requlred Information [The following information applies to the questions displayed below.] Griffin Service Company. Incorporated, was organized by Bennett

I need these corrected please kindly.

![to the questions displayed below.] Griffin Service Company. Incorporated, was organized by](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66d3343247b2d_48966d33431c1a24.jpg)

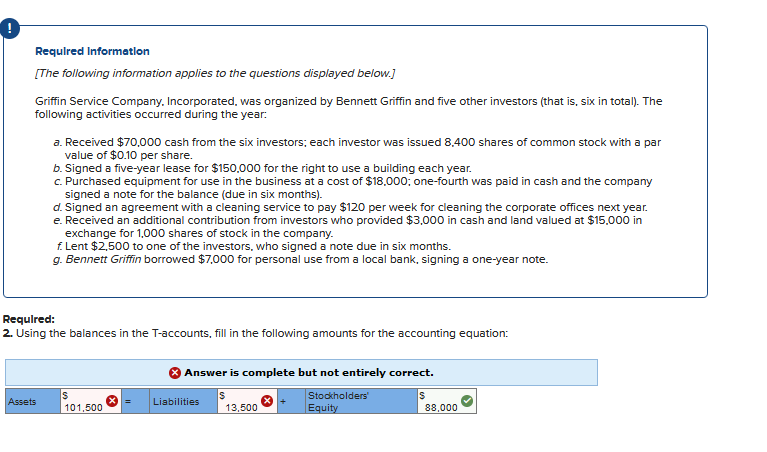

Requlred Information [The following information applies to the questions displayed below.] Griffin Service Company. Incorporated, was organized by Bennett Griffin and five other investors (that is, six in total). The following activities occurred during the year: a. Received $70,000 cash from the six investors; each investor was issued 8,400 shares of common stock with a par value of $0.10 per share. b. Signed a five-year lease for $150,000 for the right to use a building each year. c. Purchased equipment for use in the business at a cost of $18,000; one-fourth was paid in cash and the company signed a note for the balance (due in six months). d. Signed an agreement with a cleaning service to pay $120 per week for cleaning the corporate offices next year. e. Received an additional contribution from investors who provided $3,000 in cash and land valued at $15,000 in exchange for 1,000 shares of stock in the company. f. Lent $2,500 to one of the investors, who signed a note due in six months. g. Bennett Griffin borrowed $7,000 for personal use from a local bank, signing a one-year note. Required: 2. Using the balances in the T-accounts, fill in the following amounts for the accounting equation: Answer is complete but not entirely correct. Requlred Information [The following information applies to the questions displayed below.] Griffin Service Company. Incorporated, was organized by Bennett Griffin and five other investors (that is, six in total). The following activities occurred during the year: a. Received $70,000 cash from the six investors; each investor was issued 8,400 shares of common stock with a par value of $0.10 per share. b. Signed a five-year lease for $150,000 for the right to use a building each year. c. Purchased equipment for use in the business at a cost of $18,000; one-fourth was paid in cash and the company signed a note for the balance (due in six months). d. Signed an agreement with a cleaning service to pay $120 per week for cleaning the corporate offices next year. e. Received an additional contribution from investors who provided $3,000 in cash and land valued at $15.000 in exchange for 1,000 shares of stock in the company. f. Lent $2,500 to one of the investors, who signed a note due in six months. g. Bennett Griffin borrowed $7,000 for personal use from a local bank, signing a one-year note. Requlred: 1. For each of the preceding transactions, record the effects of the transaction in the appropriate T-accounts. Answer is not complete

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts