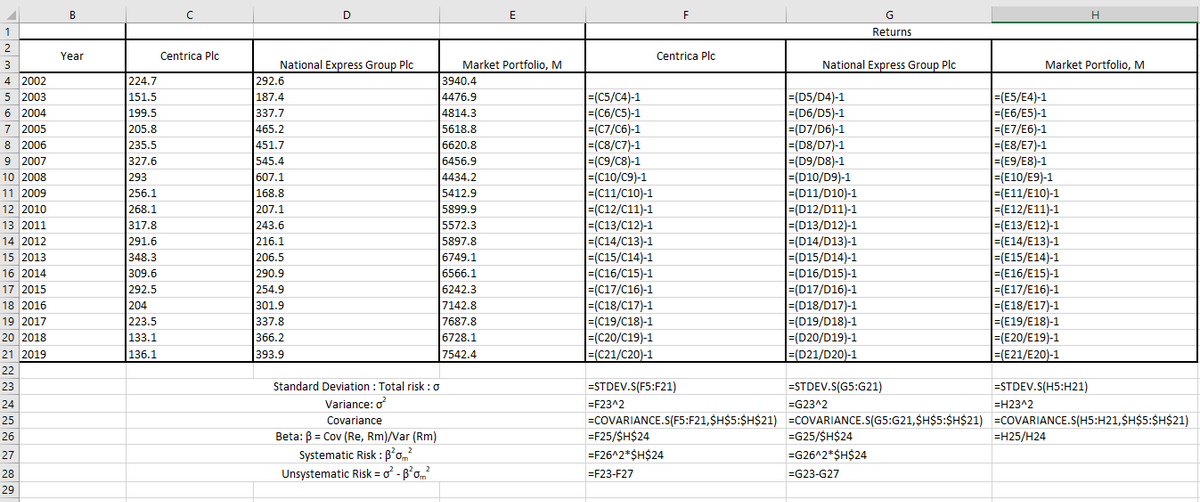

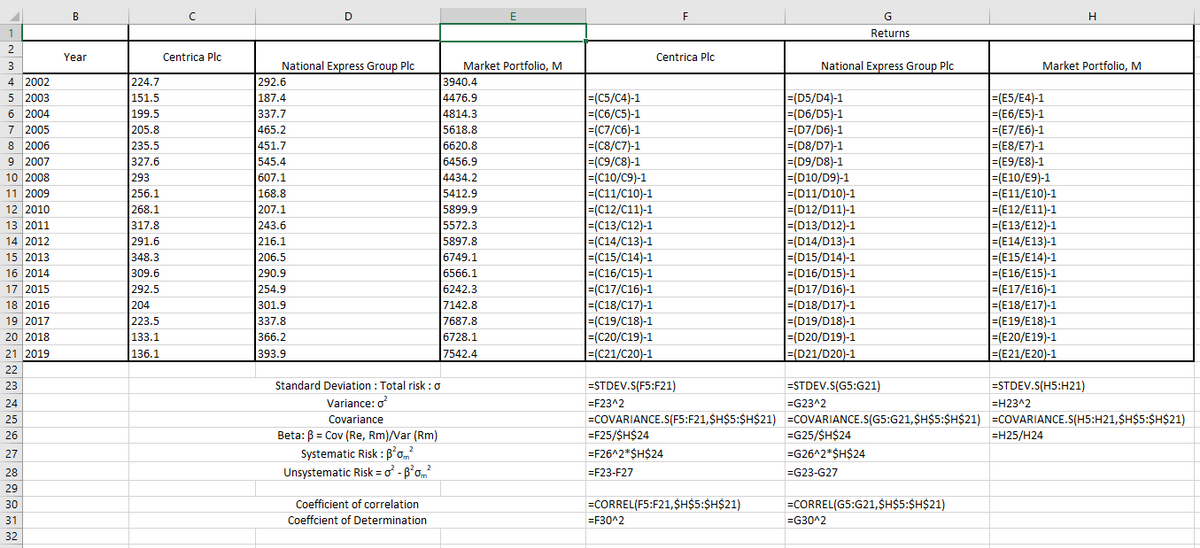

Question: i need these tables in Excel format with solved values so i can copy paste it on MS office B D E F G H

i need these tables in Excel format with solved values so i can copy paste it on MS office

B D E F G H Returns Year Centrica PIC Centrica PIC 1 2 2 > 3 4 4 2002 5 Market Portfolio, M 3940.4 National Express Group Plc Market Portfolio, M 5 2003 4476.9 6 6 2004 7 2005 4814.3 5618.8 16620.0 , LE SIE10/E9)-1 e 2006 8 2006 9 2007 o 2007 10 2008 11 11 2009 1 2010 12 2010 12 2014 13 2011 13040 14 2012 152045 15 2013 16 2017 16 2014 17 2018 17 2015 224.7 151.5 199.5 205.8 1235.5 327.6 292 1293 256.1 1260 268.1 12170 317.8 12916 1291.6 348.3 309.6 1292.5 204 223.5 133.1 136.1 National Express Group Plc 292.6 187.4 337.7 465.2 12512 1451.7 545.4 607.1 aco 168.8 202 207.1 1226 243.6 1216 1216.1 12065 206.5 lona 1290.9 254.9 301.9 337.8 366.2 393.9 IEC22 sea78 6620.8 6156 6456.9 MA 4434.2 5420 5412.9 500g 5899.9 5572.3 5897.8 157101 6749.1 6566.1 162423 6242.3 7142.8 7687.8 6728.1 7542.4 = (C5/C4)-1 = (C6/C5)-1 = (C7/C6)-1 =(C8/C7)-1 =(C9/C8)-1 =(C10/09)-1 LICHCL1 =(C11/C10)-1 =(C12/C11)-1 =(C13/C12)-1 Leto =(C14/C13)-1 Lic IC141,1 FC15/C14)-1 =(C16/015)-1 - C16/6151.1 =(C17/C16)-1 =(C18/017)-1 =(C19/C18)-1 =(C20/C19)-1 =(C21/C20-1 =(D5/D4)-1 =(D6/05)-1 =(07/D6)-1 =(D8/07)-1 =(D9/D8)-1 =(D10/09)-1 =(D11/D10)-1 =(D12/D11)-1 =(D13/D12)-1 LIDL121.1 =(D14/D13)-1 -1015101111 =(D15/D14)-1 -1016/01511 =(D16/D15)-1 FI017/0161.1 =(D17/D16)-1 =(D18/D17)-1 =(D19/D18)-1 =(D20/D19)-1 =(D21/D20-1 =(E5/E4)-1 = (E6/E5)-1 = (E7/E6)-1 =(E8/E7)-1 =(E9/E8)-1 FIE/E81-1 = |=(E11/E10)-1 = (E12/E11)-1 =(E13/E12)-1 ACTO =(E14/E13)-1 =(E15/E14)-1 LEASE 14.1 Licn66151 =(E16/E15)-1 =(E17/E16)-1 FIF 17/E161.1 = (E18/E17)-1 1=(E19/E18)-1 1=(E20/E19)-1 =(E21/E20)-1 ICECS1 18 2016 19 2017 20 2018 21 2019 22 23 24 25 26 27 28 29 Standard Deviation : Total risk: 0 Variance: o Covariance Beta: B = Cov (Re, Rm)/Var (Rm) Systematic Risk: Bom? Unsystematic Risk = 0' - Bo? ESTDEV.S(F5:F21) =STDEV.S(G5:621) ESTDEV.S(H5:H21) =F23^2 =G23^2 =H2342 =COVARIANCE.S(F5:F21, SH$5:$H$21) COVARIANCE.S(G5:621,SH$5:SH$21) =COVARIANCE.S(H5:H21, SH$5:$H$21) =F25/SH$24 =G25/SH$24 =H25/H24 =F26^2*SH$24 =G26^2*SH$24 =F23-F27 =G23-G27 : B D E F H G G Returns Year Centrica Plc Centrica Plc 1 2 3 4 2002 5 2003 National Express Group Plc Market Portfolio, M 6 2004 7 224.7 151.5 199.5 205.8 5 235.5 2025 327.6 200 293 REC 256.1 CO 268.1 2170 317.8 291.6 348.3 2005 309.6 292.5 204 204 223.5 133.1 7 2005 os 8 2006 2007 9 2007 100g 10 2008 11 2009 11 long 12 2010 12 2010 1212011 13 2011 14 2012 2015 15 2013 16 2014 17 2015 18 2016 19 2017 20 2018 21 2019 22 23 24 25 26 National Express Group Plc 292.6 187.4 337.7 465.2 A5 451.7 SA 545.4 607.1 co 168.8 2021 207.1 2426 243.6 216.1 2161 206.5 290.9 254.9 301.9 337.8 366.2 393.9 Market Portfolio, M 3940.4 4476.9 4814.3 5618.8 8600 6620.8 SAEG 6456.9 14243 4434.2 54100 5412.9 5000 5899.9 55792 5572.3 5897 5897.8 6749.1 6566.1 6242.3 =(C5/C4)-1 =(C6/C5)-1 = (C7/C6)-1 =(C8/07)-1 =(09/C8)-1 =(C10/09)-1 CUCI =(C11/C10)-1 =(C12/C11)-1 LiCt C111 =(C13/C12)-1 LICC1211 =(C14/C13)-1 LicSICAL IF(C15/C14 -1 LC16C151.1 =(C16/C15)-1 =(C17/016)-1 =(C18/017)-1 =(C19/C18)-1 =(C20/C19)-1 1=(C21/C20)-1 IF(D5/D4)-1 =(06/05)-1 =(07/D6)-1 =(D8/07)-1 =(09/08)-1 =(010/09)-1 =(D11/010)-1 =(012/011)-1 LO1.1 =(D13/D12)-1 I=(D14/D13)-1 =/ Fin15/01411 =(D15/014)-1 1016/015.1 =(D16/D15)-1 = ED17/0161-1 =(D17/D16)-1 |=(D18/D17)-1 =(D19/018)-1 =(D20/D19)-1 =(021/D20)-1 =(E5/E4)-1 =(E6/E5)-1 =(E7/E6)-1 =(E8/E7)-1 LICE1 LEON I=(E9/E8)-1 I=(E10/E9)-1 LiceCROLL =(E11/E10)-1 =(E12/E11)-1 1/12/2011 =(E13/E12)-1 FIFA/F121.1 I=(E14/E13)-1 1.1515141.1 I=(E15/E14)-1 FIF 16/5151.1 I=(E16/E15)-1 I.CA/61611 I=(E17/E16)-1 | =(E18/E17)-1 =(E19/E18)-1 =(E20/E19)-1 =(E21/E20)-1 7142.8 7687.8 6728.1 7542.4 136.1 Standard Deviation : Total risk: 0 Variance: o Covariance Beta: B = Cov (Re, Rm)/Var (Rm) Systematic Risk: Bo? Unsystematic Risk = 0'- B on? ESTDEV.S(F5:F21) ESTDEV.S(G5:621) =STDEV.S(H5:H21) =F23^2 =G2312 =H2342 =COVARIANCE.S(F5:F21,SH$5:SH$21) ECOVARIANCE.S(G5:621,SH$5:SH$21) =COVARIANCE.S(H5:H21,SH$5:$H$21) =F25/$H$24 =G25/$H$24 =H25/H24 =F26^2*$H$24 =G26^2SH$24 =F23-F27 =G23-G27 27 28 29 30 31 32 Coefficient of correlation Coeffcient of Determination =CORREL(F5:F21, SH$5:SH$21) =F3042 =CORREL(G5:21,$H$5:SH$21) =G3042

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts