Question: i need this answer Due Jul 10 by 11:59pm Points 50 Submitting an external tool III Your grade has been recorded in the Gradebook. Sat,

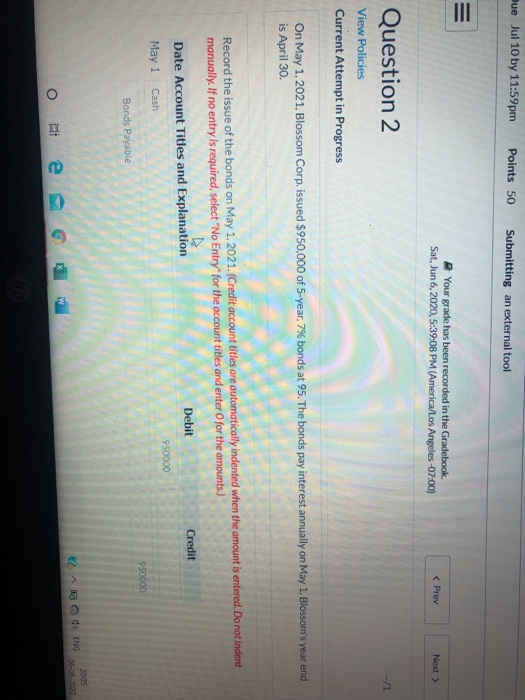

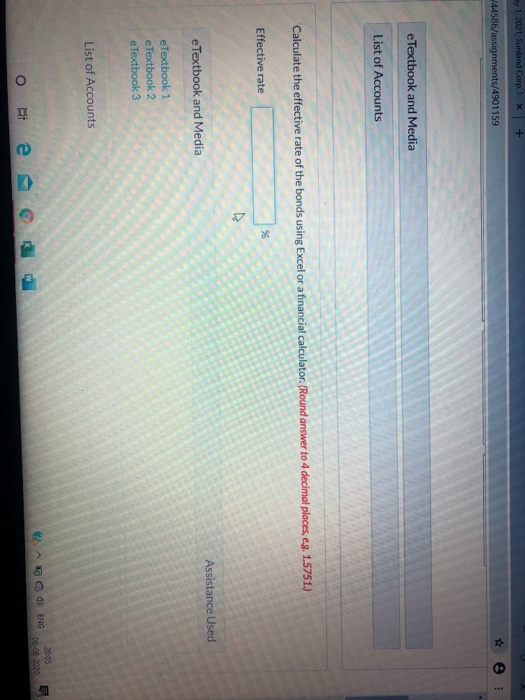

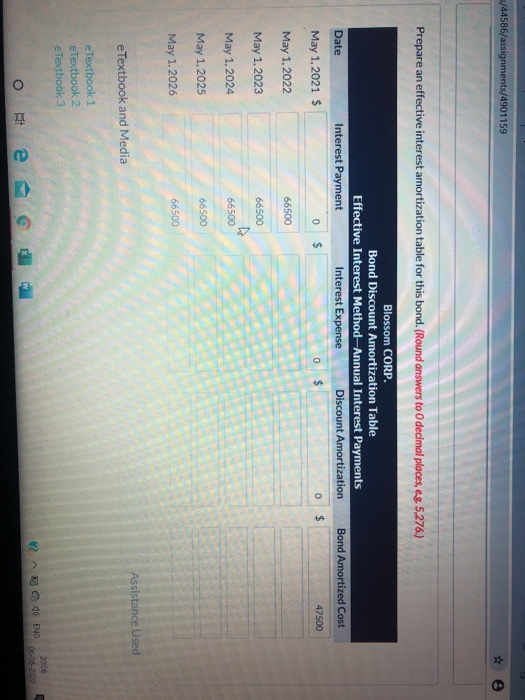

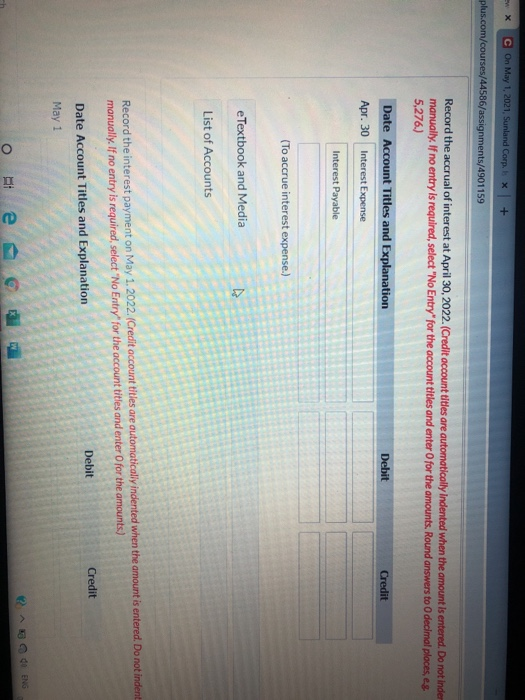

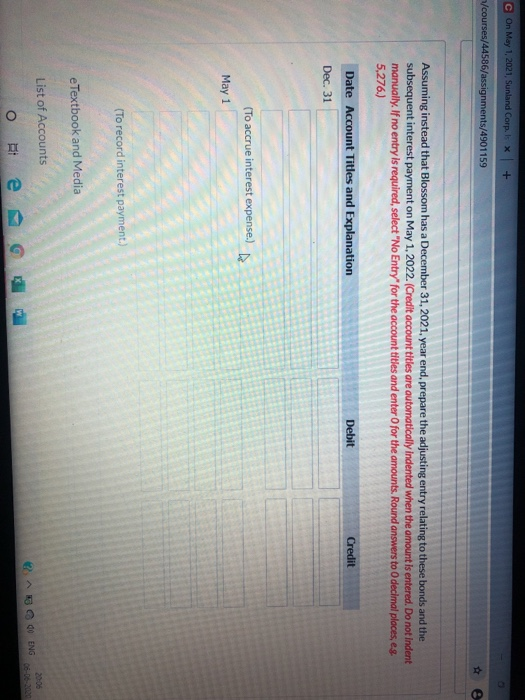

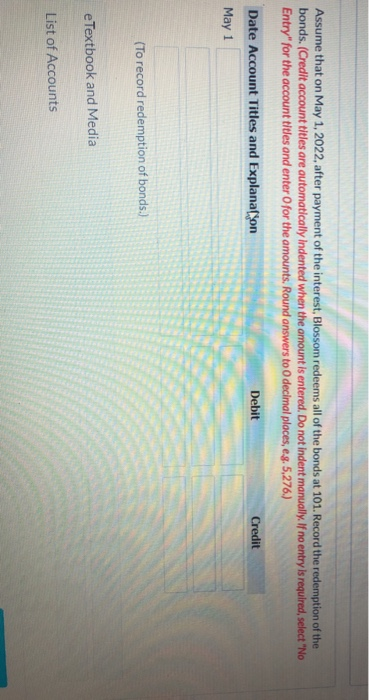

Due Jul 10 by 11:59pm Points 50 Submitting an external tool III Your grade has been recorded in the Gradebook. Sat, Jun 6, 2020,5:39:08 PM (America/Los Angeles -07:00) --/1 Question 2 View Policies Current Attempt in Progress On May 1, 2021, Blossom Corp. issued $950,000 of 5-year, 7% bonds at 95. The bonds pay interest annually on May 1. Blossom's year end is April 30. Record the issue of the bonds on May 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation May 1 Cash 950000 950000 Bonds Payable 2005 16 ENG G my 1, 2021, Sunland Corp. IX + 44586/assignments/4901159 e Textbook and Media List of Accounts Calculate the effective rate of the bonds using Excel or a financial calculator. (Round answer to 4 decimal places, eg. 1.5751.) Effective rate % Assistance Used e Textbook and Media e Textbook 1 e Textbook 2 e Textbook 3 List of Accounts do ENG 20:05 05-05-2020 5 6 e 3/44586/assignments/4901159 Prepare an effective interest amortization table for this bond. (Round answers to decimal places, eg. 5,276.) Blossom CORP. Bond Discount Amortization Table Effective Interest MethodAnnual Interest Payments Interest Payment Interest Expense Discount Amortization 0 $ 0 $ 0 Date Bond Amortized Cost $ 47500 May 1, 2021 $ May 1, 2022 66500 May 1, 2023 66500 May 1.2024 66500 May 1, 2025 66500 May 1, 2026 66500 Assistance Used e Textbook and Media e Textbook 1 e Textbook 2 e Textbook 3 2006 O do ENG it e G c On May 1, 2021. Sunland Corp. x + plus.com/courses/44586/assignments/4901159 Record the accrual of interest at April 30, 2022. (Credit account titles are automatically Indented when the amount is entered. Do not inder manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to decimal places, es 5,276.) Debit Credit Date Account Titles and Explanation Interest Expense Apr. 30 Interest Payable (To accrue interest expense.) e Textbook and Media List of Accounts Record the interest payment on May 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit May 1 I ENG O it C On May 1, 2021, Sunland Corp. X + /courses/44586/assignments/4901159 He Assuming instead that Blossom has a December 31, 2021. year end, prepare the adjusting entry relating to these bonds and the subsequent interest payment on May 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round answers to decimal places, es 5,276.) Debit Credit Date Account Titles and Explanation Dec. 31 (To accrue interest expense.) May 1 (To record interest payment. e Textbook and Media List of Accounts 30 ENG x DI o w e G Assume that on May 1, 2022, after payment of the interest, Blossom redeems all of the bonds at 101. Record the redemption of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts, Round answers to decimal places, eg,5,276.) Debit Credit Date Account Titles and Explanation May 1 (To record redemption of bonds.) e Textbook and Media List of Accounts Due Jul 10 by 11:59pm Points 50 Submitting an external tool III Your grade has been recorded in the Gradebook. Sat, Jun 6, 2020,5:39:08 PM (America/Los Angeles -07:00) --/1 Question 2 View Policies Current Attempt in Progress On May 1, 2021, Blossom Corp. issued $950,000 of 5-year, 7% bonds at 95. The bonds pay interest annually on May 1. Blossom's year end is April 30. Record the issue of the bonds on May 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation May 1 Cash 950000 950000 Bonds Payable 2005 16 ENG G my 1, 2021, Sunland Corp. IX + 44586/assignments/4901159 e Textbook and Media List of Accounts Calculate the effective rate of the bonds using Excel or a financial calculator. (Round answer to 4 decimal places, eg. 1.5751.) Effective rate % Assistance Used e Textbook and Media e Textbook 1 e Textbook 2 e Textbook 3 List of Accounts do ENG 20:05 05-05-2020 5 6 e 3/44586/assignments/4901159 Prepare an effective interest amortization table for this bond. (Round answers to decimal places, eg. 5,276.) Blossom CORP. Bond Discount Amortization Table Effective Interest MethodAnnual Interest Payments Interest Payment Interest Expense Discount Amortization 0 $ 0 $ 0 Date Bond Amortized Cost $ 47500 May 1, 2021 $ May 1, 2022 66500 May 1, 2023 66500 May 1.2024 66500 May 1, 2025 66500 May 1, 2026 66500 Assistance Used e Textbook and Media e Textbook 1 e Textbook 2 e Textbook 3 2006 O do ENG it e G c On May 1, 2021. Sunland Corp. x + plus.com/courses/44586/assignments/4901159 Record the accrual of interest at April 30, 2022. (Credit account titles are automatically Indented when the amount is entered. Do not inder manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to decimal places, es 5,276.) Debit Credit Date Account Titles and Explanation Interest Expense Apr. 30 Interest Payable (To accrue interest expense.) e Textbook and Media List of Accounts Record the interest payment on May 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit May 1 I ENG O it C On May 1, 2021, Sunland Corp. X + /courses/44586/assignments/4901159 He Assuming instead that Blossom has a December 31, 2021. year end, prepare the adjusting entry relating to these bonds and the subsequent interest payment on May 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round answers to decimal places, es 5,276.) Debit Credit Date Account Titles and Explanation Dec. 31 (To accrue interest expense.) May 1 (To record interest payment. e Textbook and Media List of Accounts 30 ENG x DI o w e G Assume that on May 1, 2022, after payment of the interest, Blossom redeems all of the bonds at 101. Record the redemption of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts, Round answers to decimal places, eg,5,276.) Debit Credit Date Account Titles and Explanation May 1 (To record redemption of bonds.) e Textbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts