Question: I need this answer early as soon as possible. 1. 2018 2019 2020 300 350 350 600 500 400 600 550 500 1200 1100 2600

I need this answer early as soon as possible.

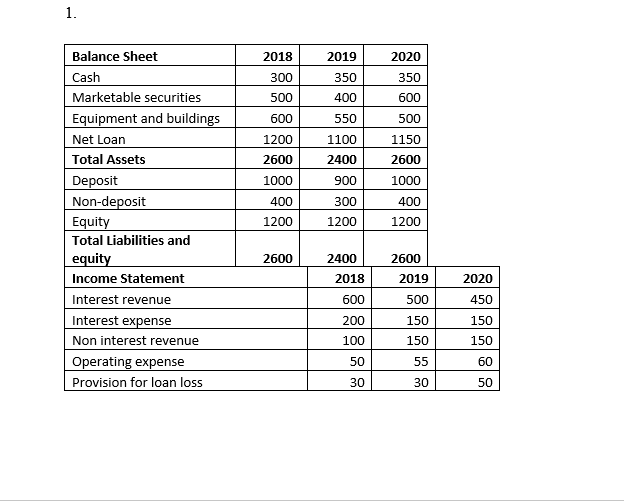

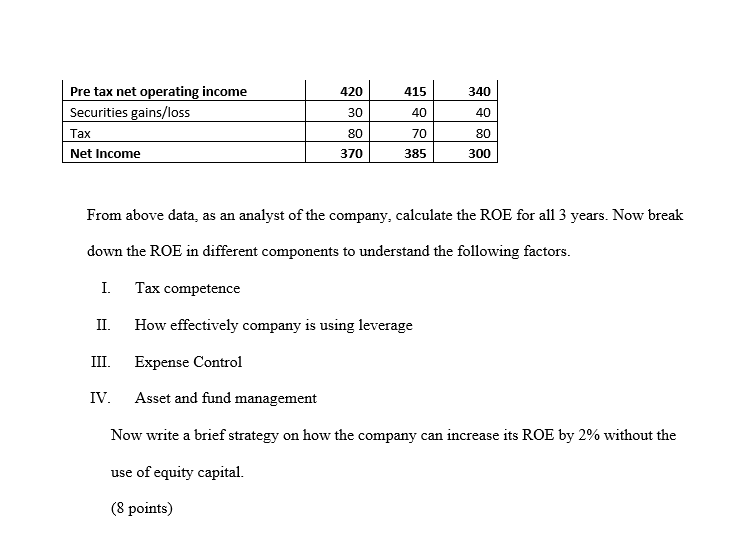

1. 2018 2019 2020 300 350 350 600 500 400 600 550 500 1200 1100 2600 2400 900 Balance Sheet Cash Marketable securities Equipment and buildings Net Loan Total Assets Deposit Non-deposit Equity Total Liabilities and equity Income Statement Interest revenue Interest expense Non interest revenue Operating expense Provision for loan loss 1000 400 1200 1150 2600 1000 400 1200 300 1200 2600 2400 2018 2600 2019 2020 600 500 450 150 150 200 100 150 150 50 55 60 30 30 50 340 420 30 415 40 40 Pre tax net operating income Securities gains/loss Tax Net Income 80 70 80 370 385 300 From above data, as an analyst of the company, calculate the ROE for all 3 years. Now break down the ROE in different components to understand the following factors. I. Tax competence II. How effectively company is using leverage III. Expense Control IV. Asset and fund management Now write a brief strategy on how the company can increase its ROE by 2% without the use of equity capital. (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts