Question: I need this as soon as possible 7 Required information The following information applies to the questions displayed belowJ On January 16 of year 1

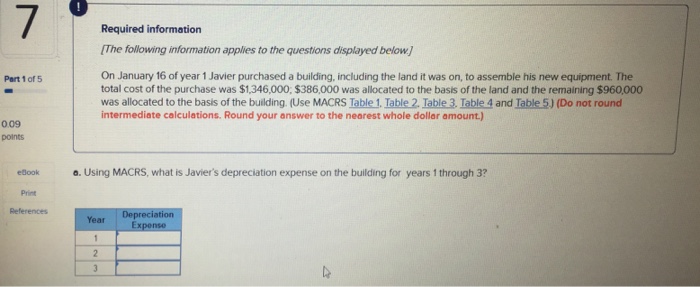

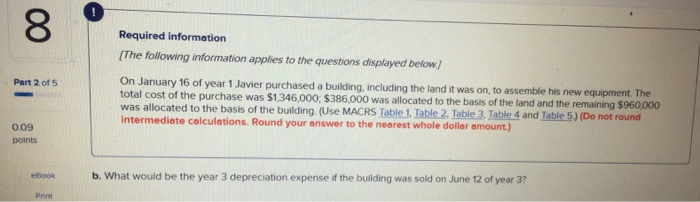

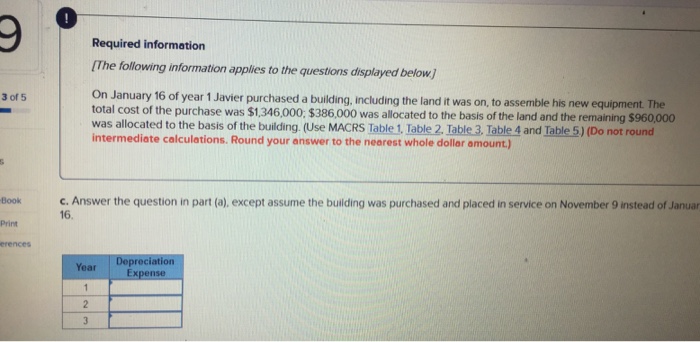

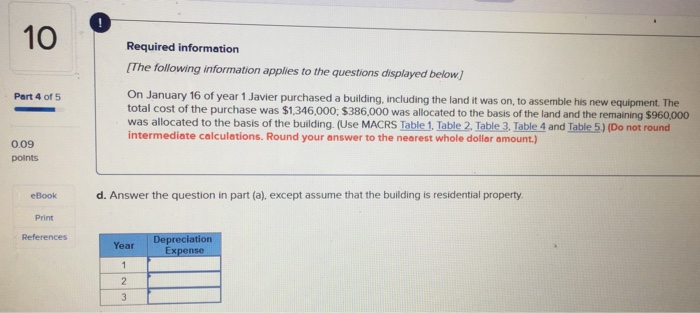

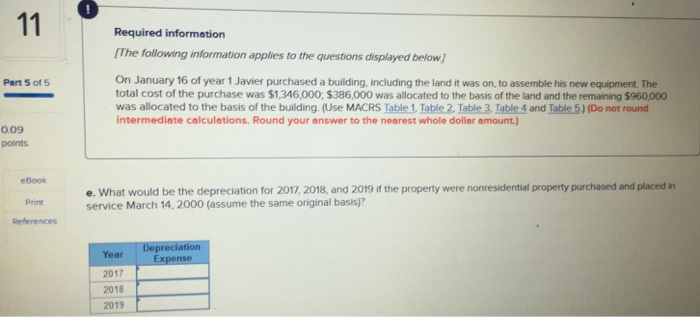

7 Required information The following information applies to the questions displayed belowJ On January 16 of year 1 Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,346,000, $386,000 was allocated to the basis of the land and the remaining $960,000 was allocated to the basis of the building. (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5) (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount) Part 1 of 5 009 points elook a. Using MACRS, what is Javier's depreciation expense on the building for years 1 through 3? Print at Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts