Question: i need this ASAP !!! just the answer is fine!! View Policies Current Attempt in Progress A company is considering purchasing a machine that costs

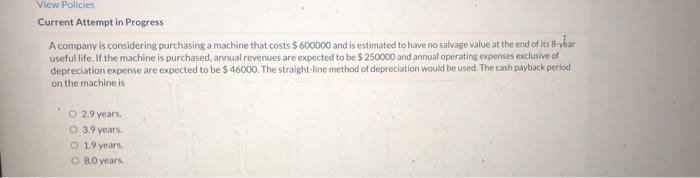

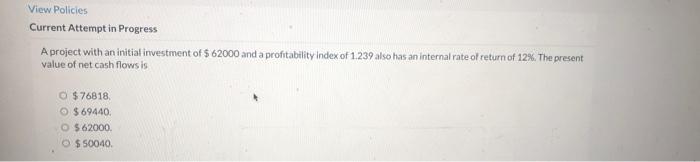

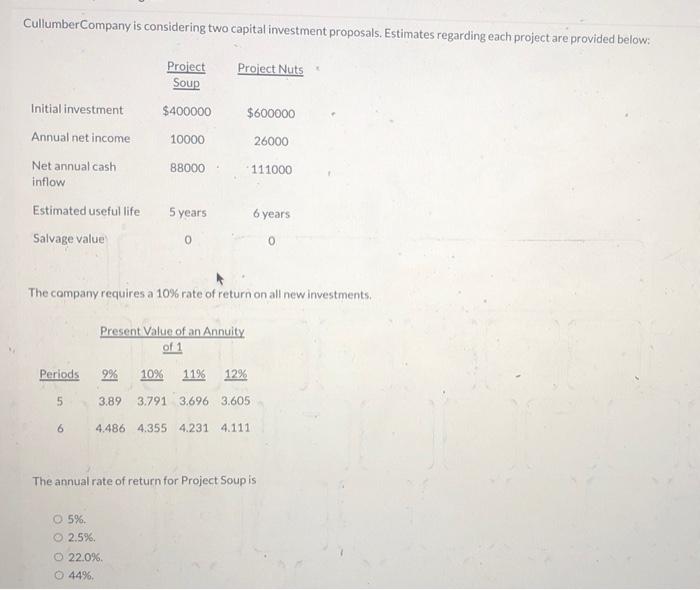

View Policies Current Attempt in Progress A company is considering purchasing a machine that costs $600000 and is estimated to have no salvage value at the end of les 8-ybar useful life. If the machine is purchased annual revenues are expected to be $ 250000 and annual operating expenses exclusive of depreciation expense are expected to be $46000. The straight-line method of depreciation would be used. The cash payback period on the machine is O 2.9 years 3.9 years O 1.9 years OB. O years View Policies Current Attempt in Progress A project with an initial investment of $ 62000 and a profitability Index of 1.239 also has an internal rate of return of 12%. The present value of net cash flows is a O $76818 $ 69440 562000 $50040 Cullumber Company is considering two capital investment proposals. Estimates regarding each project are provided below: Project Soup Project Nuts Initial investment $400000 $600000 Annual net income 10000 26000 Net annual cash inflow 88000 111000 Estimated useful life 5 years 6 years Salvage value 0 O The company requires a 10% rate of return on all new investments, Present Value of an Annuity of 1 Periods 9% 10% 1196 12% 5 3.89 3.791 3,696 3.605 6 4.486 4.355 4.231 4.111 The annual rate of return for Project Soupis 05% 2.5% 22.0% 44%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts