Question: i need this asap please A small heat pump now costs $2,400 to purchase and install. It has a projected useful life of 15 years

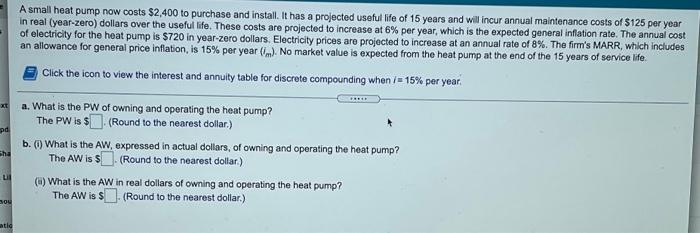

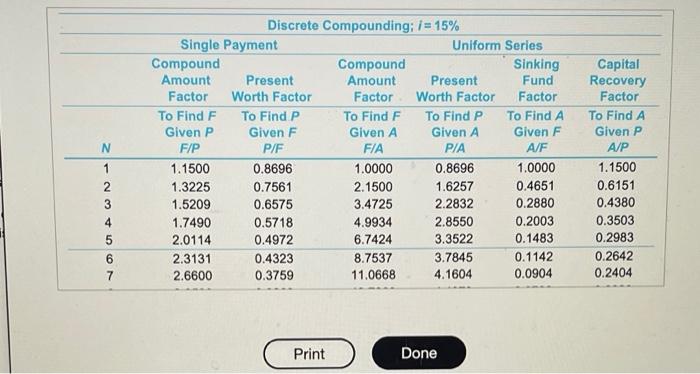

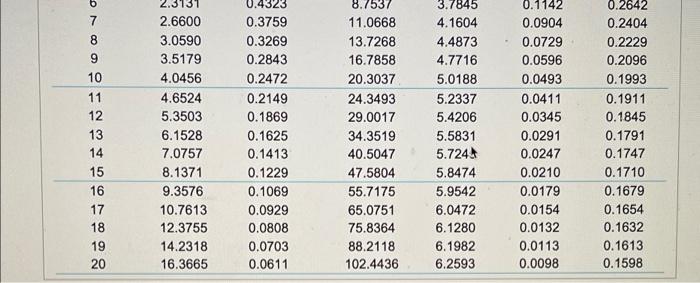

A small heat pump now costs $2,400 to purchase and install. It has a projected useful life of 15 years and will incur annual maintenance costs of $125 per year in real (year-zero) dollars over the useful life. These costs are projected to increase at 6% per year, which is the expected general inflation rate. The annual cost of electricity for the heat pump is $720 in year-zero dollars. Electricity prices are projected to increase at an annual rate of 8%. The firm's MARR, which includes an allowance for general price inflation, is 15% per year (im). No market value is expected from the heat pump at the end of the 15 years of service life. Click the icon to view the interest and annuity table for discrete compounding when /= 15% per year. xt pd a. What is the PW of owning and operating the heat pump? The PW is $(Round to the nearest dollar.) b.) What is the AW, expressed in actual dollars, of owning and operating the heat pump? The AW is (Round to the nearest dollar.) (6) What is the AW in real dollars of owning and operating the heat pump? The AW is $ (Round to the nearest dollar.) sha sou atid N AWN Z Discrete Compounding; i = 15% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F F/P P/F FIA P/A A/F 1.1500 0.8696 1.0000 0.8696 1.0000 1.3225 0.7561 2.1500 1.6257 0.4651 1.5209 0.6575 3.4725 2.2832 0.2880 1.7490 0.5718 4.9934 2.8550 0.2003 2.0114 0.4972 6.7424 3.3522 0.1483 2.3131 0.4323 8.7537 3.7845 0.1142 2.6600 0.3759 11.0668 4.1604 0.0904 Capital Recovery Factor To Find A Given P A/P 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 2 3 4 5 6 7 Print Done 6789 0 123 10 11 2.3131 2.6600 3.0590 3.5179 4.0456 4.6524 5.3503 6.1528 7.0757 8.1371 9.3576 10.7613 12.3755 14.2318 16.3665 0.4323 0.3759 0.3269 0.2843 0.2472 0.2149 0.1869 0.1625 0.1413 0.1229 0.1069 0.0929 0.0808 0.0703 0.0611 8.7537 11.0668 13.7268 16.7858 20.3037 24.3493 29.0017 34.3519 40.5047 47.5804 55.7175 65.0751 75.8364 88.2118 102.4436 3.7845 4.1604 4.4873 4.7716 5.0188 5.2337 5.4206 5.5831 5.7245 5.8474 5.9542 6.0472 6.1280 6.1982 6.2593 0.1142 0.0904 0.0729 0.0596 0.0493 0.0411 0.0345 0.0291 0.0247 0.0210 0.0179 0.0154 0.0132 0.0113 0.0098 0.2642 0.2404 0.2229 0.2096 0.1993 0.1911 0.1845 0.1791 0.1747 0.1710 0.1679 0.1654 0.1632 0.1613 0.1598 14 15 16 17 18 19 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts