Question: I need this in 30 min 3. Jack & Jill, a married couple filing jointly, have a projected 2017 taxable income of $300,000. Their neighbor

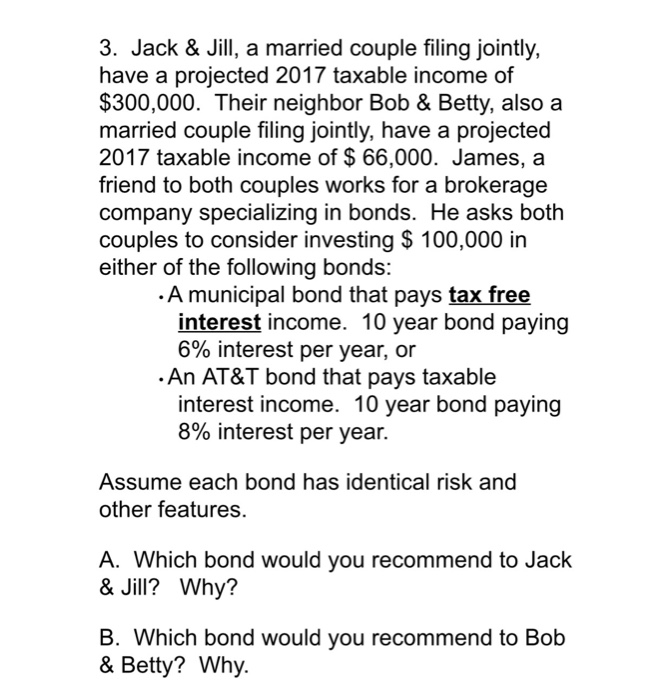

3. Jack & Jill, a married couple filing jointly, have a projected 2017 taxable income of $300,000. Their neighbor Bob & Betty, also a married couple filing jointly, have a projected 2017 taxable income of $ 66,000. James, a friend to both couples works for a brokerage company specializing in bonds. He asks both couples to consider investing $ 100,000 in either of the following bonds: A municipal bond that pays tax free interest income. 10 year bond paying 6% interest per year, or An AT&T bond that pays taxable interest income. 10 year bond paying 8% interest per year. Assume each bond has identical risk and other features. A. Which bond would you recommend to Jack & Jill? Why? B. Which bond would you recommend to Bob & Betty? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts