Question: i need this in excel formulas (7) Problem 117 Chapter 3 Example of unconventional cash flows - Multiple IRR issue You are considering an investment

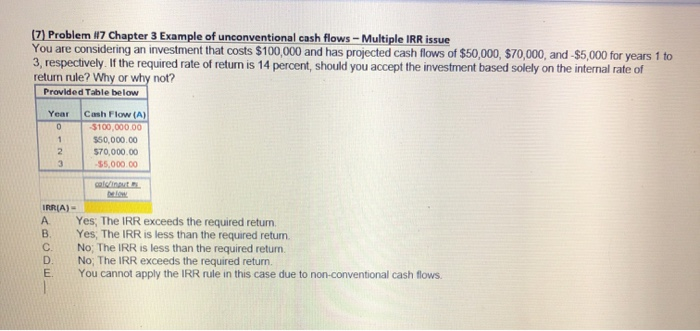

(7) Problem 117 Chapter 3 Example of unconventional cash flows - Multiple IRR issue You are considering an investment that costs $100,000 and has projected cash flows of $50,000 $70,000, and $5,000 for years 1 to 3, respectively. If the required rate of return is 14 percent, should you accept the investment based solely on the internal rate of return rule? Why or why not? Provided Table below Year Cash Flow (A) $100,000.00 550,000.00 $70,000.00 $5,000.00 ca IRRIA) Yes, The IRR exceeds the required return Yes, The IRR is less than the required return No, The IRR is less than the required retum. No, The IRR exceeds the required return You cannot apply the IRR rule in this case due to non-conventional cash flows. D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts