Question: I need this put into an excel document with fomulas. a) Year a a*b FCF discount factor at 10 Discount factor calculation PV b 2019

I need this put into an excel document with fomulas.

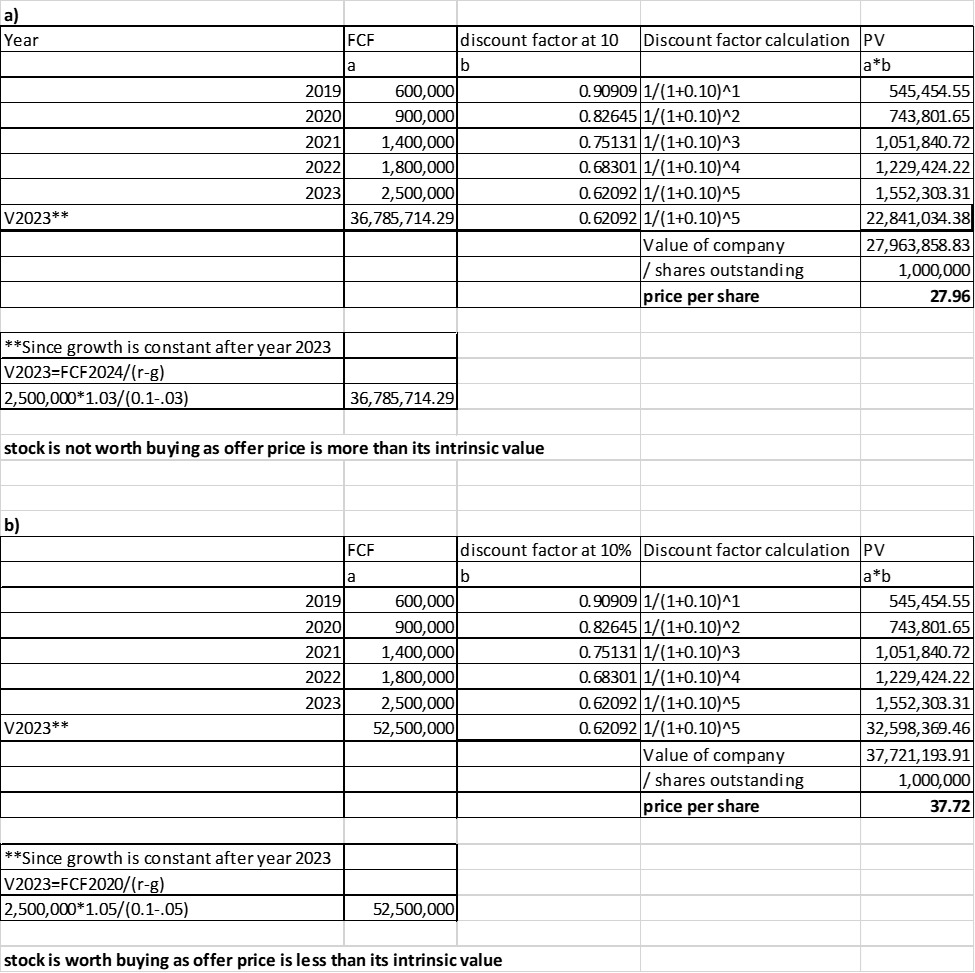

a) Year a a*b FCF discount factor at 10 Discount factor calculation PV b 2019 600,000 0.90909 1/(1+0.10)^1 545,454.55 2020 900,000 0.82645 1/(1+0.10)^2 743,801.65 2021 1,400,000 0.75131 1/(1+0.10)^3 1,051,840.72 2022 1,800,000 0.68301 1/(1+0.10)^4 1,229,424.22 2023 2,500,000 0.62092 1/(1+0.10)^5 1,552,303.31 36,785,714.29 0.62092 1/(1+0.10)^5 22,841,034.38 Value of company 27,963,858.83 shares outstanding 1,000,000 price per share 27.96 V2023** **Since growth is constant after year 2023 V2023=FCF2024/(r-g) 2,500,000*1.03/(0.1-.03) 36,785,714.29 stock is not worth buying as offer price is more than its intrinsic value b) b FCF discount factor at 10% Discount factor calculation PV a*b 2019 600,000 0.90909 1/(1+0.10)^1 545,454.55 2020 900,000 0.82645 1/(1+0.10)^2 743,801.65 2021 1,400,000 0.75131 1/(1+0.10)^3 1,051,840.72 2022 1,800,000 0.68301 1/(1+0.10)^4 1,229,424.22 2023 2,500,000 0.62092 1/(1+0.10)^5 1,552,303.31 52,500,000 0.62092 1/(1+0.10)^5 32,598,369.46 Value of company 37,721, 193.91 / shares outstanding 1,000,000 price per share 37.72 V2023** **Since growth is constant after year 2023 V2023=FCF2020/(r-g) 2,500,000*1.05/(0.1-.05) 52,500,000 stock is worth buying as offer price is less than its intrinsic value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts