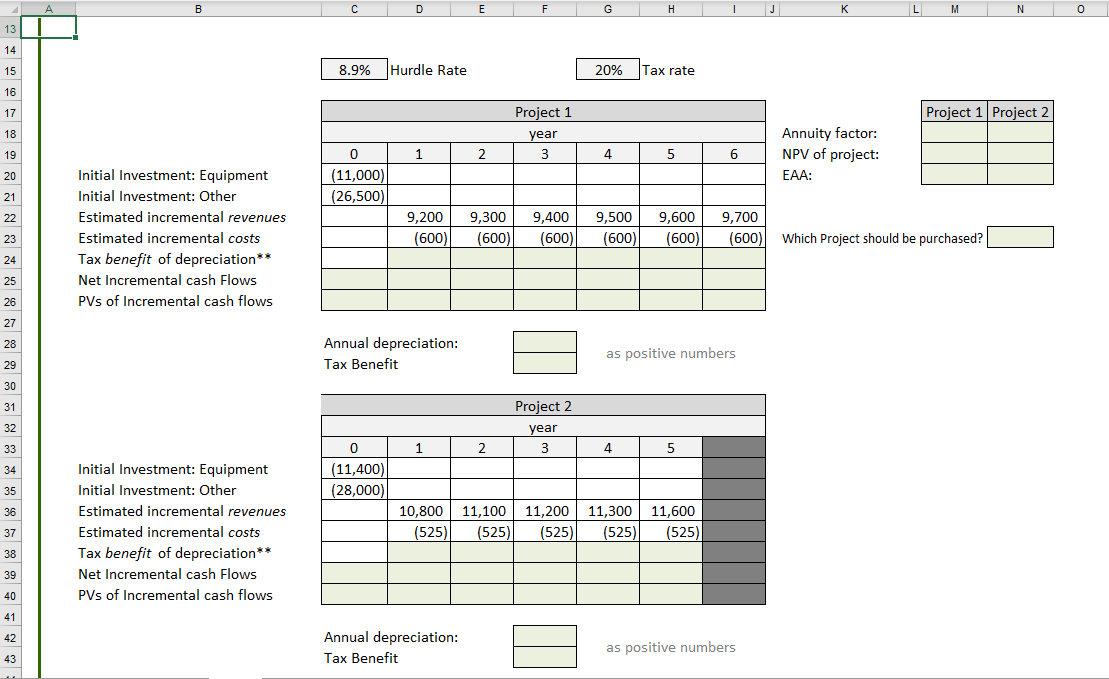

Question: I need this question answered, with excel calculations shown please. So all spots that area light grey need to be answered. A B D E

I need this question answered, with excel calculations shown please. So all spots that area "light grey" need to be answered.

A B D E F G H M N 0 13 14 15 8.9% Hurdle Rate 20% Tax rate 16 17 Project 1 Project 2 18 Project 1 year 3 19 1 2 4 5 6 Annuity factor: NPV of project: EAA: 0 (11,000) (26,500) 20 21 22 Initial Investment: Equipment Initial Investment: Other Estimated incremental revenues Estimated incremental costs Tax benefit of depreciation** Net Incremental cash Flows PVs of Incremental cash flows 9,200 (600) 9,300 (600) 9,400 (600) 9,500 (600) 9,600 (600) 9,700 (600) 23 Which Project should be purchased? 24 25 26 27 28 Annual depreciation: Tax Benefit as positive numbers 29 30 31 32 Project 2 year 3 33 0 1 2 4 5 34 (11,400) (28,000) 35 36 11,600 Initial Investment: Equipment Initial Investment: Other Estimated incremental revenues Estimated incremental costs Tax benefit of depreciation** Net Incremental cash Flows PVs of Incremental cash flows 10,800 (525) 11,100 (525) 11,200 (525) 11,300 (525) 37 (525) 38 39 40 41 42 Annual depreciation: Tax Benefit as positive numbers 43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts