Question: I need this question in 15 min please Question Your portfolio consists of 5 100.000 invested in a stock which has a beta -0.8, $150,000

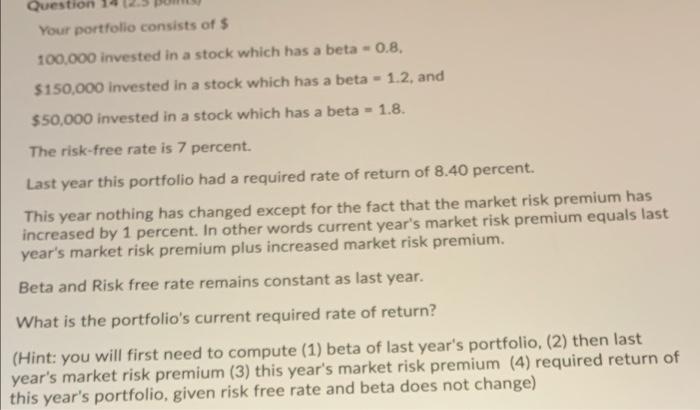

Question Your portfolio consists of 5 100.000 invested in a stock which has a beta -0.8, $150,000 invested in a stock which has a beta - 1.2, and $50,000 invested in a stock which has a beta = 1.8. The risk-free rate is 7 percent. Last year this portfolio had a required rate of return of 8.40 percent. This year nothing has changed except for the fact that the market risk premium has increased by 1 percent. In other words current year's market risk premium equals last year's market risk premium plus increased market risk premium. Beta and Risk free rate remains constant as last year. What is the portfolio's current required rate of return? (Hint: you will first need to compute (1) beta of last year's portfolio, (2) then last year's market risk premium (3) this year's market risk premium (4) required return of this year's portfolio, given risk free rate and beta does not change)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts