Question: I need this question solved using excel please Assume that you are a manager in Financial Corporation. You have to analyze the three project that

I need this question solved using excel please

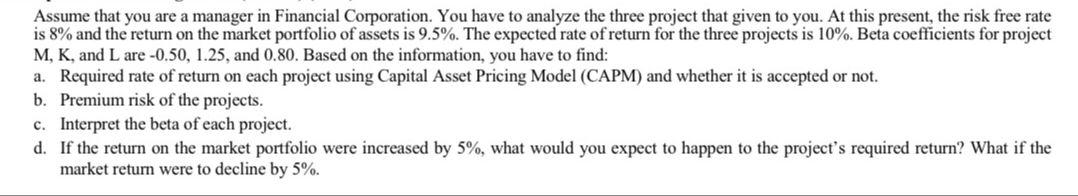

Assume that you are a manager in Financial Corporation. You have to analyze the three project that given to you. At this present, the risk free rate is 8% and the return on the market portfolio of assets is 9.5%. The expected rate of return for the three projects is 10%. Beta coefficients for project M,K, and L are 0.50,1.25, and 0.80. Based on the information, you have to find: a. Required rate of return on each project using Capital Asset Pricing Model (CAPM) and whether it is accepted or not. b. Premium risk of the projects. c. Interpret the beta of each project. d. If the return on the market portfolio were increased by 5%, what would you expect to happen to the project's required return? What if the market return were to decline by 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts