Question: I need this solved in excel, please. A company has been selling endowment assurances to 50 -year-old males with a term of 5 years and

I need this solved in excel, please.

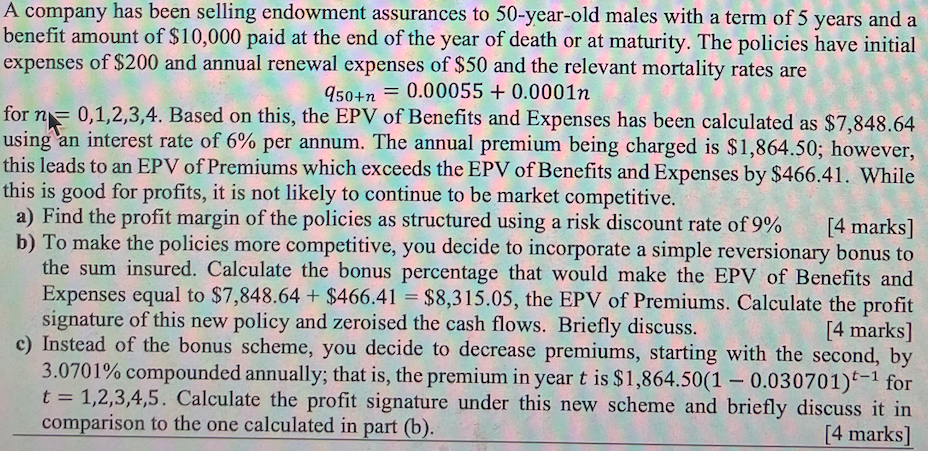

A company has been selling endowment assurances to 50 -year-old males with a term of 5 years and a benefit amount of $10,000 paid at the end of the year of death or at maturity. The policies have initial expenses of $200 and annual renewal expenses of $50 and the relevant mortality rates are q50+n=0.00055+0.0001n for n=0,1,2,3,4. Based on this, the EPV of Benefits and Expenses has been calculated as $7,848.64 using an interest rate of 6% per annum. The annual premium being charged is $1,864.50; however, this leads to an EPV of Premiums which exceeds the EPV of Benefits and Expenses by $466.41. While this is good for profits, it is not likely to continue to be market competitive. a) Find the profit margin of the policies as structured using a risk discount rate of 9% [4 marks] b) To make the policies more competitive, you decide to incorporate a simple reversionary bonus to the sum insured. Calculate the bonus percentage that would make the EPV of Benefits and Expenses equal to $7,848.64+$466.41=$8,315.05, the EPV of Premiums. Calculate the profit signature of this new policy and zeroised the cash flows. Briefly discuss. [4arks] c) Instead of the bonus scheme, you decide to decrease premiums, starting with the second, by 3.0701% compounded annually; that is, the premium in year t is $1,864.50(10.030701)t1 for t=1,2,3,4,5. Calculate the profit signature under this new scheme and briefly discuss it in comparison to the one calculated in part (b). [4 marks ] A company has been selling endowment assurances to 50 -year-old males with a term of 5 years and a benefit amount of $10,000 paid at the end of the year of death or at maturity. The policies have initial expenses of $200 and annual renewal expenses of $50 and the relevant mortality rates are q50+n=0.00055+0.0001n for n=0,1,2,3,4. Based on this, the EPV of Benefits and Expenses has been calculated as $7,848.64 using an interest rate of 6% per annum. The annual premium being charged is $1,864.50; however, this leads to an EPV of Premiums which exceeds the EPV of Benefits and Expenses by $466.41. While this is good for profits, it is not likely to continue to be market competitive. a) Find the profit margin of the policies as structured using a risk discount rate of 9% [4 marks] b) To make the policies more competitive, you decide to incorporate a simple reversionary bonus to the sum insured. Calculate the bonus percentage that would make the EPV of Benefits and Expenses equal to $7,848.64+$466.41=$8,315.05, the EPV of Premiums. Calculate the profit signature of this new policy and zeroised the cash flows. Briefly discuss. [4arks] c) Instead of the bonus scheme, you decide to decrease premiums, starting with the second, by 3.0701% compounded annually; that is, the premium in year t is $1,864.50(10.030701)t1 for t=1,2,3,4,5. Calculate the profit signature under this new scheme and briefly discuss it in comparison to the one calculated in part (b). [4 marks ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts