Question: i need this step by ste pls Multiple Choice Which of the following is an example of a cash flow from an operating activity in

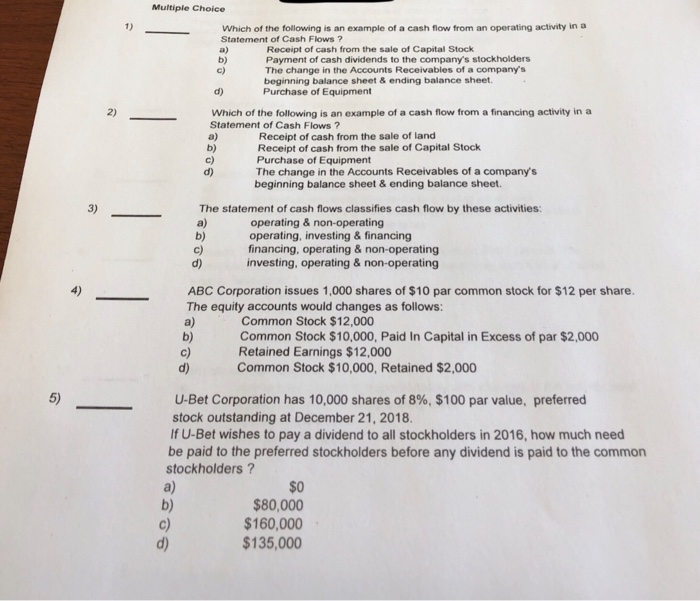

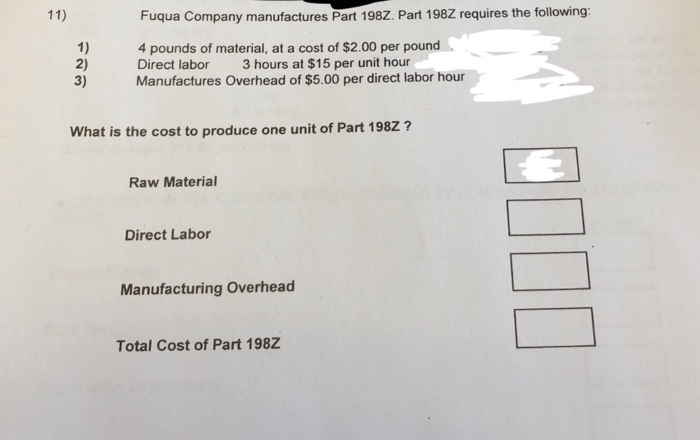

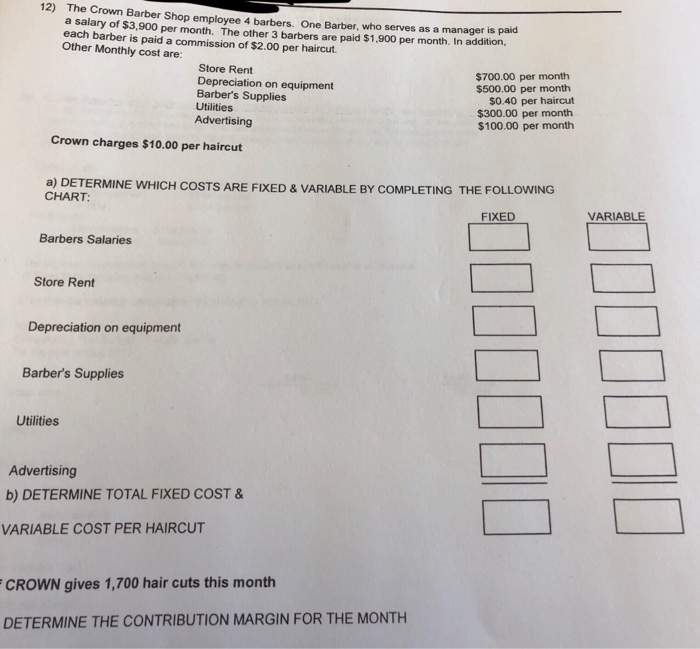

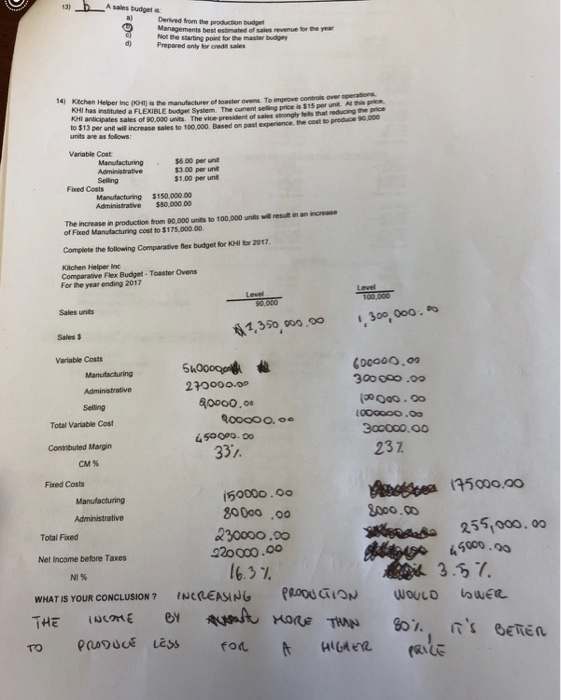

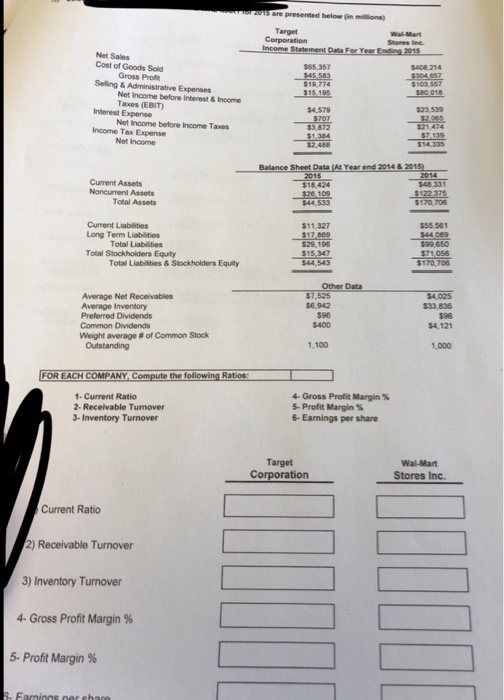

Multiple Choice Which of the following is an example of a cash flow from an operating activity in a Statement of Cash Flows? Receipt of cash from the sale of Capital Stock Payment of cash dividends to the company's stockholders The change in the Accounts Receivables of a company's beginning balance sheet & ending balance sheet Purchase of Equipment b) Which of the following is an example of a cash fnlow from a financing activity ina Statement of Cash Flows ? a) b) Receipt of cash from the sale of land Receipt of cash from the sale of Capital Stock Purchase of Equipment The change in the Accounts Receivables of a company's beginning balance sheet & ending balance sheet. The statement of cash flows classifies cash flow by these activities: operating&non-operating operating, investing& financing financing, operating & non-operating investing, operating &non-operating d) ABC Corporation issues 1,000 shares of $10 par common stock for $12 per share. The equity accounts would changes as follows: Common Stock $12,000 Common Stock $10,000, Paid In Capital in Excess of par $2,000 Retained Earnings $12,000 Common Stock $10,000, Retained $2,000 a) b) d) 5) U-Bet Corporation has 10,000 shares of 8%, $100 par value, preferred stock outstanding at December 21, 2018 If U-Bet wishes to pay a dividend to all stockholders in 2016, how much need be paid to the preferred stockholders before any dividend is paid to the common stockholders? a) b) $O $80,000 $160,000 135,000 c) d) Fuqua Company manufactures Part 198Z. Part 198Z requires the following: 1) 4 pounds of material, at a cost of $2.00 per pound 2) 3) Manufactures Overhead of $5.00 per direct labor hour Direct labor 3 hours at $15 per unit hour What is the cost to produce one unit of Part 198Z? Raw Material Direct Labor Manufacturing Overhead Total Cost of Part 198Z 12) The Crown Barber Shop employee 4 barbers. One Barber, who serves as a manager is paid a salary of $3,900 per month. The other 3 barbers are paid $1,900 per month. In addition each barber is paid a commission of $2.00 per haircut Other Monthly cost are: Store Rent Depreciation on equipment Barber's Supplies Utilities Advertising $700.00 per month $500.00 per month $0.40 per haircut $300.00 per month $100.00 per month Crown charges $10.00 per haircut a) DETERMINE WHICH COSTS ARE FIXED & VARIABLE BY COMPLETING THE FOLLOWING CHART VARIABLE FIXED Barbers Salaries Store Rent Depreciation on equipment Barber's Supplies Utilities Advertising b) DETERMINE TOTAL FIXED COST & VARIABLE COST PER HAIRCUT CROWN gives 1,700 hair cuts this month DETERMINE THE CONTRIBUTION MARGIN FOR THE MONTH 13) Derived from the producsion budget Managements Not bhe starting point for the master budgny Prepared only for credt sales best estinated of sales revenue for the year d) 14) Ktchen Helper Inc 00) s the manufacturer of toaster ovens. over operations To improve controls o natuied a FLEXIBLE budge System The curent selling price is $15 per unt Al nis prie 000 unts. The vice president of sales strongly tells that reducing he pce KHI has insatuted KHI anticipates sales of 90 to $13 per eret wil increase sales to 100,000. Based on past experience, the cost to produce 90,000 units are as follows Variable Cost $6.00 per unit $3.00 per unit $1.00 per unt Selling Fixed Costs Manufacturing $150,000.00 Administrative $80.000.00 The increase in production from 90.000 units to 100,000 units will result in an increase of Fwed Manufacturing cost to $175,000.00 Complete the folowing Comparative flex budget for KHIl for 2017 Kitchen Helper Inc Comparalive Flex Budget Toaster Ovens For the year ending 2017 00,000 Sales unt 300, 00a.s 11,350, 000.00 Sales $ Variable Costs Suoooog 27000oo0 (00000. Manutacturing 80000.0 Selling Total Variable Cost Contibuted Margin 23Z deebea 195000,00 MeRdasa 255,0.0 33/ CM % Fired Costs Manufacturing 80000 .o0 230000.0o 2oco.oo 16.5 Total Fixed Net Income before Taxes 3.67. owe WHAT IS YOUR CONCLUSION ? NCGEASING pRoodGIONWouLo for t lGra 5 are presented below n miions $65,357 Gross Proft Net Income before Interest& Income Taxes (EBIT Net Income before Income Taxes Net Income 3,872 $13 $2,488 Balance Sheet Data (At Year end 2014 &2015 Current Assets Noncurrent Assets Total Assets $170,706 Current Liabilities Long Tem Liabilities $11,327 555 561 Total Liabilities $29,196 Total Stockholders Equity $71056 $170,706 Total Liabilities & Stockholders Equity Other Data Average Net Receivables Average Inventory Preferred Dividends Common Dividends Weight average # of Common Stock $4,025 $33,836 $6,942 1,100 FOR EACH COMPANY Compute the following Ratios 4-Gross Profit Margin % 1- Current Ratio 2- Receivable Turnover 3-Inventory Turnover " Profit Margin % 6- Earnings per share Target Corporation Stores Inc. Current Ratio 2) Receivable Turnover 3) Inventory Turnover 4-Gross Profit Margin % 5-Profit Margin %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts