Question: i need to do all task1,2,3 then just do task 1 and 2 Tastal AO Grain is one of the major regional grain producers in

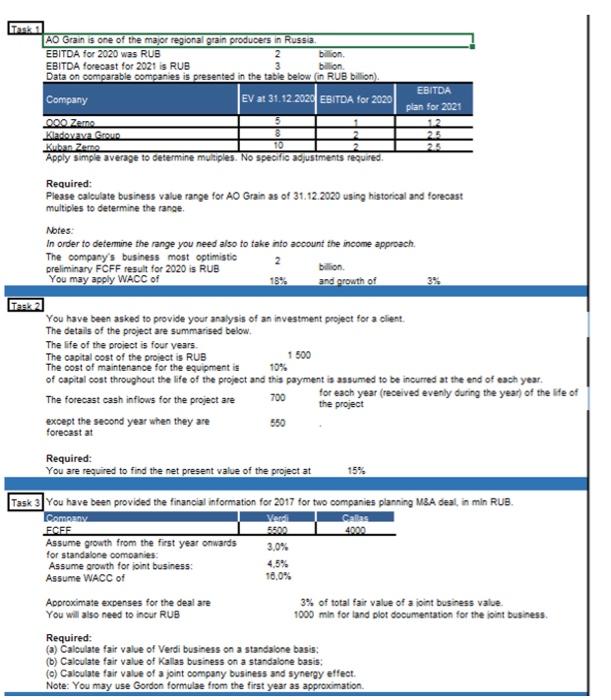

Tastal AO Grain is one of the major regional grain producers in Russia EBITDA for 2020 was RUB billion EBITDA forecast for 2021 is RUB Data on comparable companies is presented in the table below in RUB billion), EBITDA Company EV at 31.12.2020 EBITDA for 2020 plan for 2021 000 Zema 12 Kladovava Group 225 Kuban Zerne 225 Apply simple average to determine multiples. No specific adjustments required Required: Please calculate business value range for AO Grain as of 31.12.2020 using historical and forecast multiples to determine the range Notes In order to determine the range you need also to take into account the income approach, The company's business most optimistic 2 preliminary FCFF result for 2020 is RUB billion You may apply WACC of 15% and prowth of Taska You have been asked to provide your analysis of an investment project for a client The details of the project are summarised below. The life of the project is four years. The capital cost of the project is RUB 1 500 The cost of maintenance for the equipment is 10% of capital cost throughout the life of the project and this payment is assumed to be incurred at the end of each year. The forecast cash inflows for the project are 700 for each year (received evenly during the years of the life of the project except the second year when they are 550 forecast at Required: You are required to find the net present value of the project at Task 3 You have been provided the financial information for 2017 for two companies planning MBA deal, in min RUB. Cam Mars Calling ECEF 5800 4000 Assume growth from the first year onwards 3,0% for standalone companies Assume growth for joint business Assume WACC of 18,0% Approximate expenses for the deal are 3% of total fair value of a joint business value. You will also need to inour RUB 1000 min for land plot documentation for the joint business. Required: () Calculate fair value of Verdi business on a standalone basis: (b) Calculate fair value of Kallas business on a standalone basis: (c) Calculate fair value of a joint company business and synergy effect. Note: You may use Gordon formulae from the first year as approximation. Tastal AO Grain is one of the major regional grain producers in Russia EBITDA for 2020 was RUB billion EBITDA forecast for 2021 is RUB Data on comparable companies is presented in the table below in RUB billion), EBITDA Company EV at 31.12.2020 EBITDA for 2020 plan for 2021 000 Zema 12 Kladovava Group 225 Kuban Zerne 225 Apply simple average to determine multiples. No specific adjustments required Required: Please calculate business value range for AO Grain as of 31.12.2020 using historical and forecast multiples to determine the range Notes In order to determine the range you need also to take into account the income approach, The company's business most optimistic 2 preliminary FCFF result for 2020 is RUB billion You may apply WACC of 15% and prowth of Taska You have been asked to provide your analysis of an investment project for a client The details of the project are summarised below. The life of the project is four years. The capital cost of the project is RUB 1 500 The cost of maintenance for the equipment is 10% of capital cost throughout the life of the project and this payment is assumed to be incurred at the end of each year. The forecast cash inflows for the project are 700 for each year (received evenly during the years of the life of the project except the second year when they are 550 forecast at Required: You are required to find the net present value of the project at Task 3 You have been provided the financial information for 2017 for two companies planning MBA deal, in min RUB. Cam Mars Calling ECEF 5800 4000 Assume growth from the first year onwards 3,0% for standalone companies Assume growth for joint business Assume WACC of 18,0% Approximate expenses for the deal are 3% of total fair value of a joint business value. You will also need to inour RUB 1000 min for land plot documentation for the joint business. Required: () Calculate fair value of Verdi business on a standalone basis: (b) Calculate fair value of Kallas business on a standalone basis: (c) Calculate fair value of a joint company business and synergy effect. Note: You may use Gordon formulae from the first year as approximation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts