Question: I need to do Tax Return Project. Notes: W-2 form for Robert: 1099 -R form for Robert: 1099- INT form for Robert: Schedule K-1 (form

I need to do Tax Return Project.

Notes:

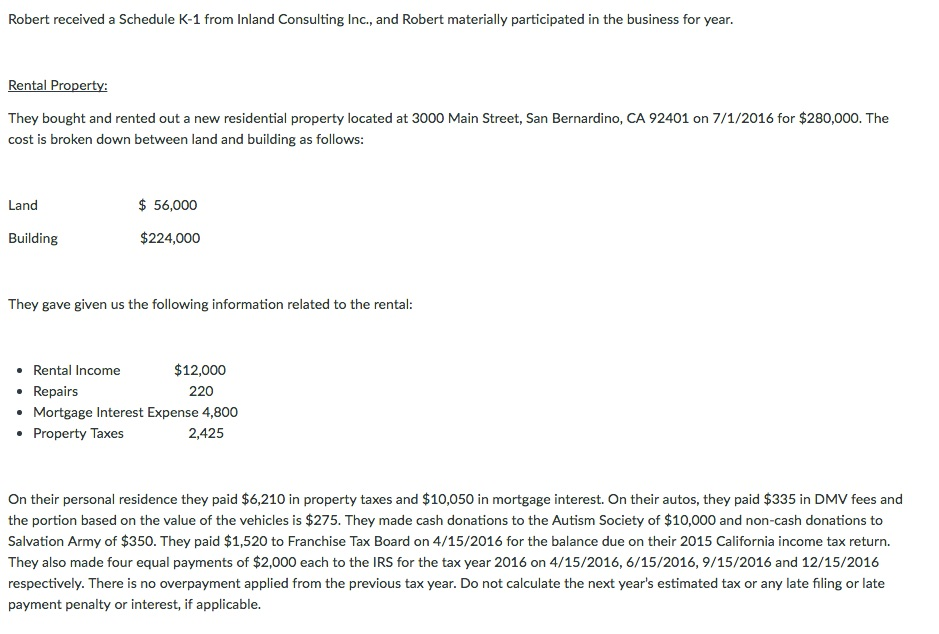

W-2 form for Robert:

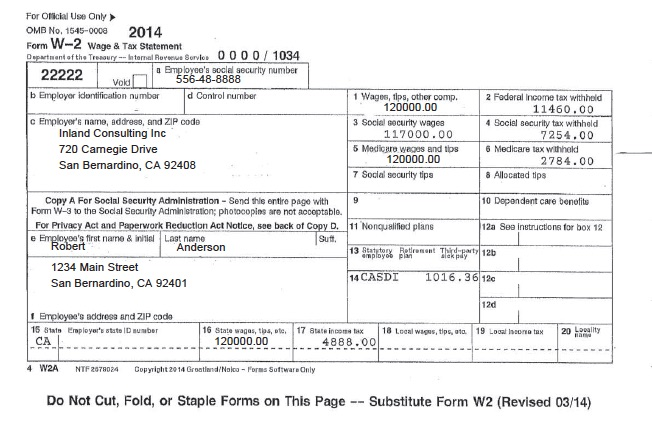

1099 -R form for Robert:

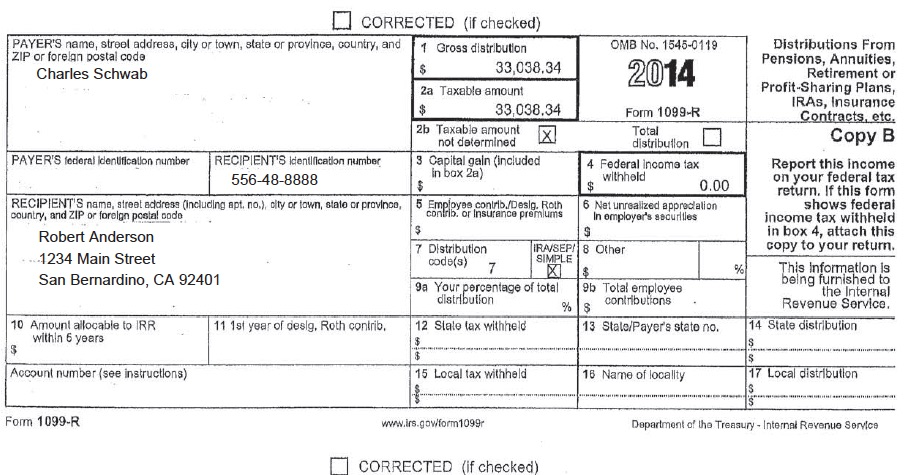

1099- INT form for Robert:

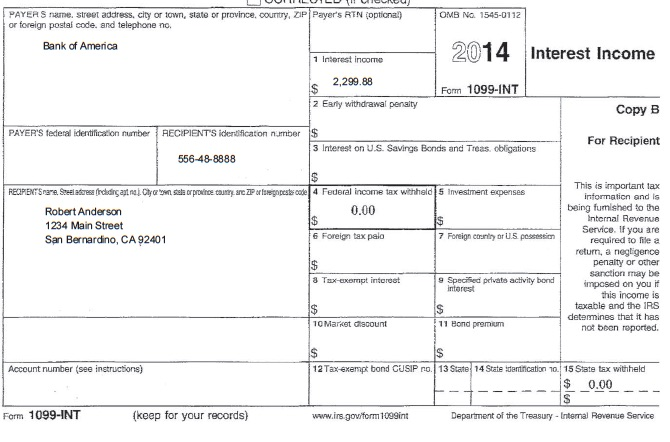

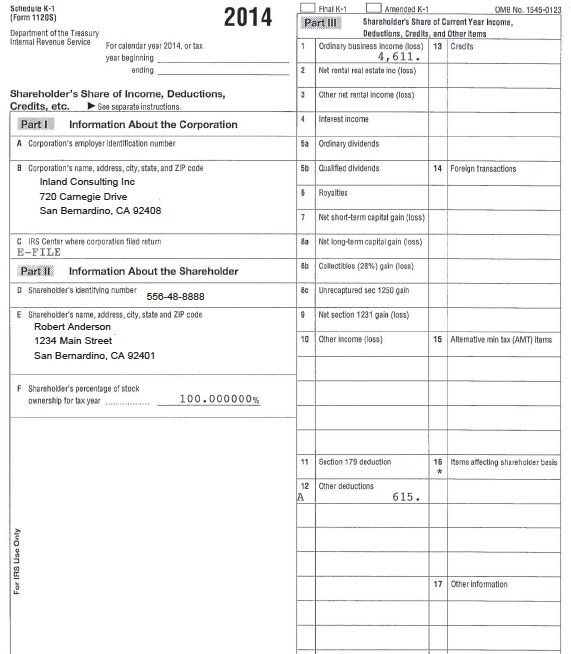

Schedule K-1 (form 1120S):

I NEED HELP TO FIND OUT TOTAL INCOME AND AGI? WHICH FORM DO I NEED TO FILL OUT FOR TAX RETURN?

I know AGI how to be $160,771, temized Deduction how to be $34,924, Total Payments how to be $19,460 but I don't know how find out all those numbers. Is it correct total tas $24906?

Robert received a Schedule K-1 from Inland Consulting Inc., and Robert materially participated in the business for year. Rental Prope They bought and rented out a new residential property located at 3000 Main Street, San Bernardino, CA 92401 on 7/1/2016 for $280,000. The cost is broken down between land and building as follows: 56,000 Land $224,000 Building They gave given us the following information related to the rental: $12,000 Rental Income Repairs 220 Mortgage Interest Expense 4,800 2,425 Property Taxes On their personal residence they paid $6,210 in property taxes and $10,050 in mortgage interest. On their autos, they paid $335 in DMV fees and the portion based on the value of the vehicles is $275. They made cash donations to the Autism Society of $10,000 and non-cash donations to Salvation Army of $350. They paid $1,520 to Franchise Tax Board on 4/15/2016 for the balance due on their 2015 California income tax return. They also made four equal payments of $2,000 each to the IRS for the tax year 2016 on 4/15/2016, 6/15/2016, 9/15/2016 and 12/15/2016 respectively. There is no overpayment applied from the previous tax year. Do not calculate the next year's estimated tax or any late filing or late payment penalty or interest, if applicable. Robert received a Schedule K-1 from Inland Consulting Inc., and Robert materially participated in the business for year. Rental Prope They bought and rented out a new residential property located at 3000 Main Street, San Bernardino, CA 92401 on 7/1/2016 for $280,000. The cost is broken down between land and building as follows: 56,000 Land $224,000 Building They gave given us the following information related to the rental: $12,000 Rental Income Repairs 220 Mortgage Interest Expense 4,800 2,425 Property Taxes On their personal residence they paid $6,210 in property taxes and $10,050 in mortgage interest. On their autos, they paid $335 in DMV fees and the portion based on the value of the vehicles is $275. They made cash donations to the Autism Society of $10,000 and non-cash donations to Salvation Army of $350. They paid $1,520 to Franchise Tax Board on 4/15/2016 for the balance due on their 2015 California income tax return. They also made four equal payments of $2,000 each to the IRS for the tax year 2016 on 4/15/2016, 6/15/2016, 9/15/2016 and 12/15/2016 respectively. There is no overpayment applied from the previous tax year. Do not calculate the next year's estimated tax or any late filing or late payment penalty or interest, if applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts