Question: I need to fill out a tax return form Jack O. White, born August 1, 1980, is a single taxpayer who works for TaskForce X.

I need to fill out a tax return form

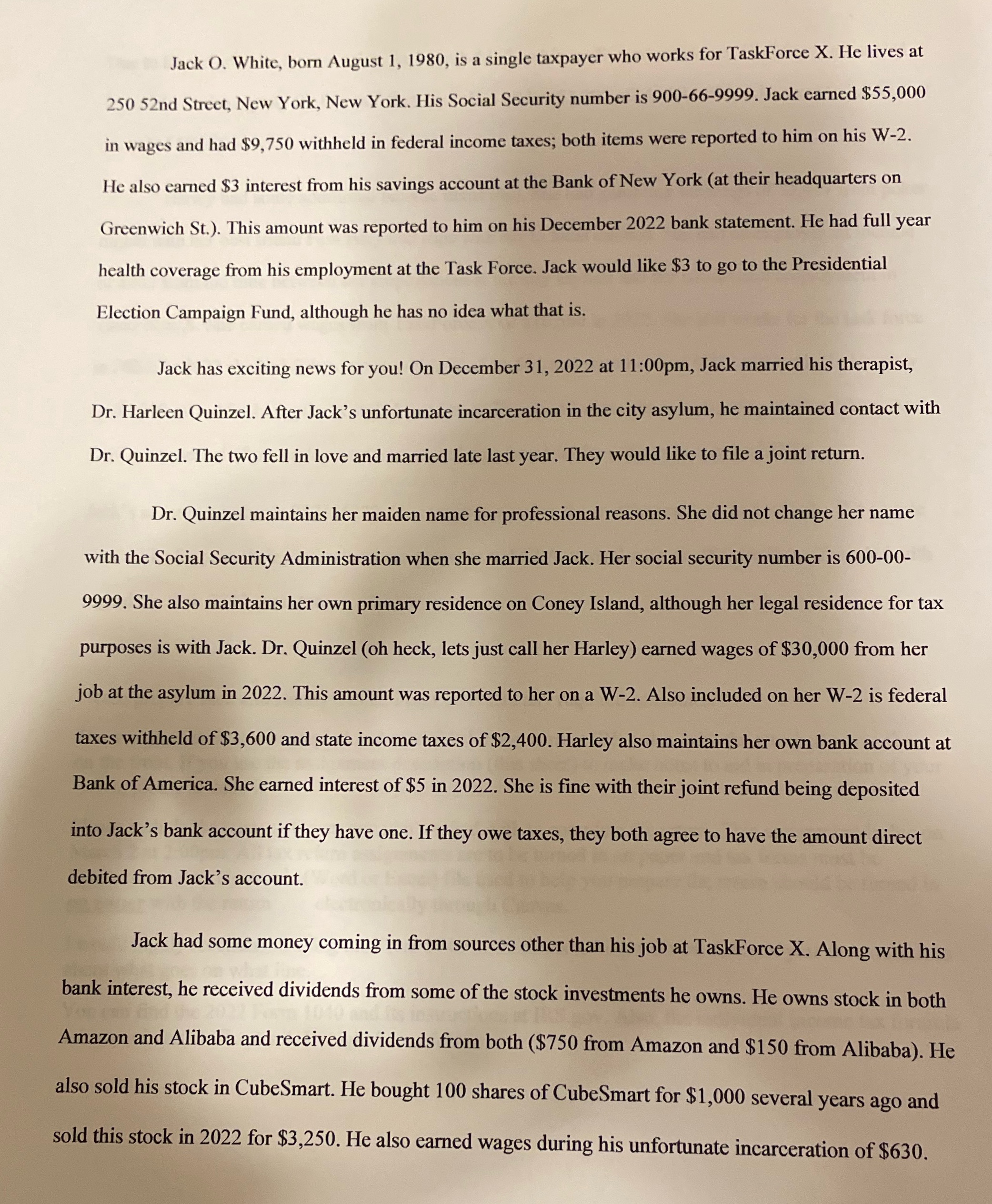

Jack O. White, born August 1, 1980, is a single taxpayer who works for TaskForce X. He lives at 250 52nd Street, New York, New York. His Social Security number is 900-66-9999. Jack earned $55,000 in wages and had $9,750 withheld in federal income taxes; both items were reported to him on his W-2. He also earned $3 interest from his savings account at the Bank of New York (at their headquarters on Greenwich St.). This amount was reported to him on his December 2022 bank statement. He had full year health coverage from his employment at the Task Force. Jack would like $3 to go to the Presidential Election Campaign Fund, although he has no idea what that is. Jack has exciting news for you! On December 31, 2022 at 11:00pm, Jack married his therapist, Dr. Harleen Quinzel. After Jack's unfortunate incarceration in the city asylum, he maintained contact with Dr. Quinzel. The two fell in love and married late last year. They would like to file a joint return. Dr. Quinzel maintains her maiden name for professional reasons. She did not change her name with the Social Security Administration when she married Jack. Her social security number is 600-00- 9999. She also maintains her own primary residence on Coney Island, although her legal residence for tax purposes is with Jack. Dr. Quinzel (oh heck, lets just call her Harley) earned wages of $30,000 from her job at the asylum in 2022. This amount was reported to her on a W-2. Also included on her W-2 is federal taxes withheld of $3,600 and state income taxes of $2,400. Harley also maintains her own bank account at Bank of America. She earned interest of $5 in 2022. She is fine with their joint refund being deposited into Jack's bank account if they have one. If they owe taxes, they both agree to have the amount direct debited from Jack's account. Jack had some money coming in from sources other than his job at TaskForce X. Along with his bank interest, he received dividends from some of the stock investments he owns. He owns stock in both Amazon and Alibaba and received dividends from both ($750 from Amazon and $150 from Alibaba). He also sold his stock in CubeSmart. He bought 100 shares of CubeSmart for $1,000 several years ago and sold this stock in 2022 for $3,250. He also earned wages during his unfortunate incarceration of $630

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts