Question: I need to get this assignment done today as due to traveling I could not complete it. Microdrive considers borrowing around USD 30 million (present

I need to get this assignment done today as due to traveling I could not complete it.

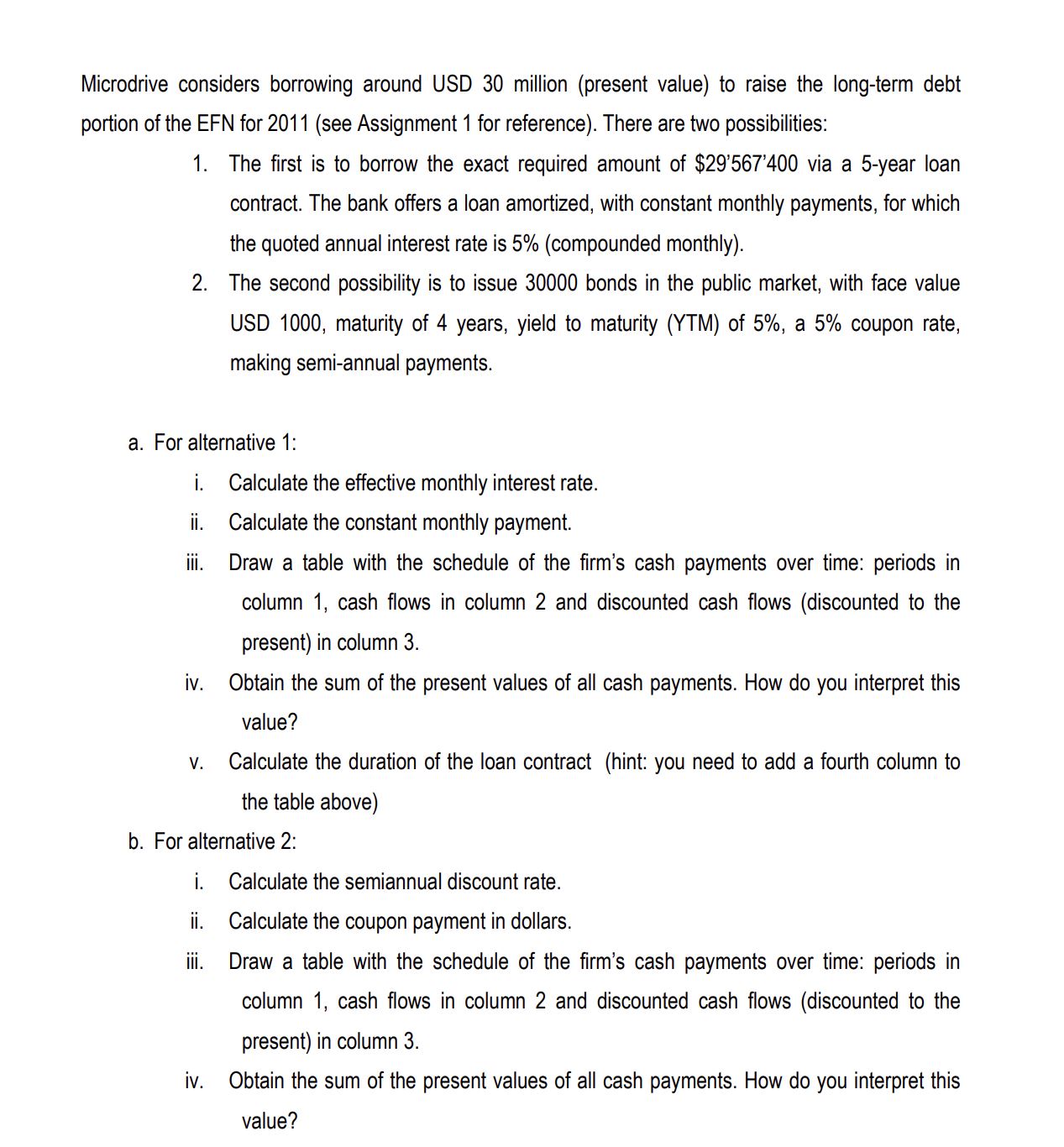

Microdrive considers borrowing around USD 30 million (present value) to raise the long-term debt portion of the EFN for 2011 (see Assignment 1 for reference). There are two possibilities: 1. The first is to borrow the exact required amount of $29567400 via a 5-year loan contract. The bank offers a loan amortized, with constant monthly payments, for which the quoted annual interest rate is 5% (compounded monthly). 2. The second possibility is to issue 30000 bonds in the public market, with face value USD 1000, maturity of 4 years, yield to maturity (YTM) of 5%, a 5% coupon rate, making semi-annual payments. a. For alternative 1: i. Calculate the effective monthly interest rate. ii. Calculate the constant monthly payment. iii. Draw a table with the schedule of the firms cash payments over time: periods in column 1, cash flows in column 2 and discounted cash flows (discounted to the present) in column 3. iv. Obtain the sum of the present values of all cash payments. How do you interpret this value? v. Calculate the duration of the loan contract (hint: you need to add a fourth column to the table above) b. For alternative 2: i. Calculate the semiannual discount rate. ii. Calculate the coupon payment in dollars. iii. Draw a table with the schedule of the firms cash payments over time: periods in column 1, cash flows in column 2 and discounted cash flows (discounted to the present) in column 3. iv. Obtain the sum of the present values of all cash payments. How do you interpret this value?v. Calculate the duration of the bond contract (hint: you need to add a fourth column to the table above) c. Compare the two alternatives and discuss the advantages or disadvantages of each, by considering the following criteria: Compare the sum of present values of all cash payments. Compare the schedule of payments over time Compare the value of the constant payment in every period Compare the maturities Compare the duration (express duration of both alternatives in the same units of time, e.g. years) d. If interest rates are expected to decrease, which alternative is the best for Microdrive? Discuss.

Microdrive considers borrowing around USD 30 million (present value) to raise the long-term debt portion of the EFN for 2011 (see Assignment 1 for reference). There are two possibilities: 1. The first is to borrow the exact required amount of $29567400 via a 5-year loan contract. The bank offers a loan amortized, with constant monthly payments, for which the quoted annual interest rate is 5% (compounded monthly). 2. The second possibility is to issue 30000 bonds in the public market, with face value USD 1000, maturity of 4 years, yield to maturity (YTM) of 5%, a 5% coupon rate, making semi-annual payments. a. For alternative 1: i. Calculate the effective monthly interest rate. ii. Calculate the constant monthly payment. iii. Draw a table with the schedule of the firm's cash payments over time: periods in column 1, cash flows in column 2 and discounted cash flows (discounted to the present) in column 3. iv. Obtain the sum of the present values of all cash payments. How do you interpret this value? v. Calculate the duration of the loan contract (hint: you need to add a fourth column to the table above) b. For alternative 2 : i. Calculate the semiannual discount rate. ii. Calculate the coupon payment in dollars. iii. Draw a table with the schedule of the firm's cash payments over time: periods in column 1, cash flows in column 2 and discounted cash flows (discounted to the present) in column 3. iv. Obtain the sum of the present values of all cash payments. How do you interpret this value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts