Question: I need to know how to input this into excel?????? (d) Suppose that the call schedule for this bond is as follows: Can be called

I need to know how to input this into excel??????

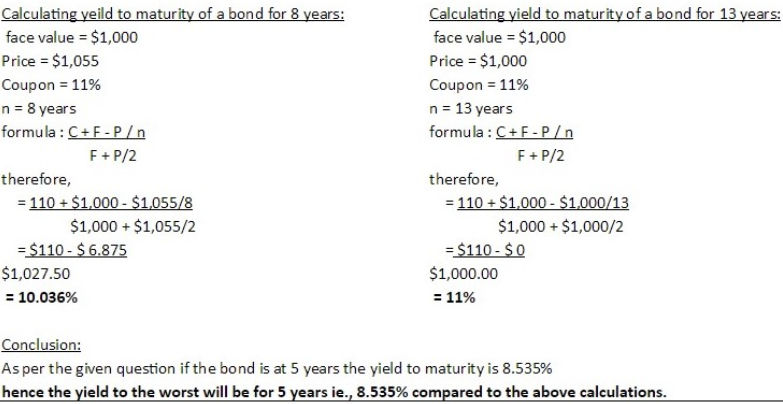

(d) Suppose that the call schedule for this bond is as follows: Can be called in eight years at $1,055 Can be called in 13 years at $1,000 And suppose this bond can only be put in five years and assume that the yield to first par call is 8.535%.What is the yield to worst for this bond? Calculating veild to maturity of a bond for 8 years: face value = $1,000 Price = $1,055 Coupon = 11% n = 8 years formula : C+F-p F+P/2 therefore, = 110 + $1,000 - $1,055/8 $1,000 + $1,055/2 = $110 - $ 6.875 $1,027.50 = 10.036% Calculating yield to maturity of a bond for 13 years: face value = $1,000 Price = $1,000 Coupon = 11% n = 13 years formula : C+F-P F+P/2 therefore, = 110 + $1,000 - $1,000/13 $1,000 + $1,000/2 = $110 - $ 0 $1,000.00 = 11% Conclusion: As per the given question if the bond is at 5 years the yield to maturity is 8.535% hence the yield to the worst will be for 5 years ie., 8.535% compared to the above calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts