Question: I need to know the dec. 31 - adjusting debit and credit entries please! Entries for Bad Debt Expense Under the Allowance Methods The following

I need to know the "dec. 31 - adjusting" debit and credit entries please!

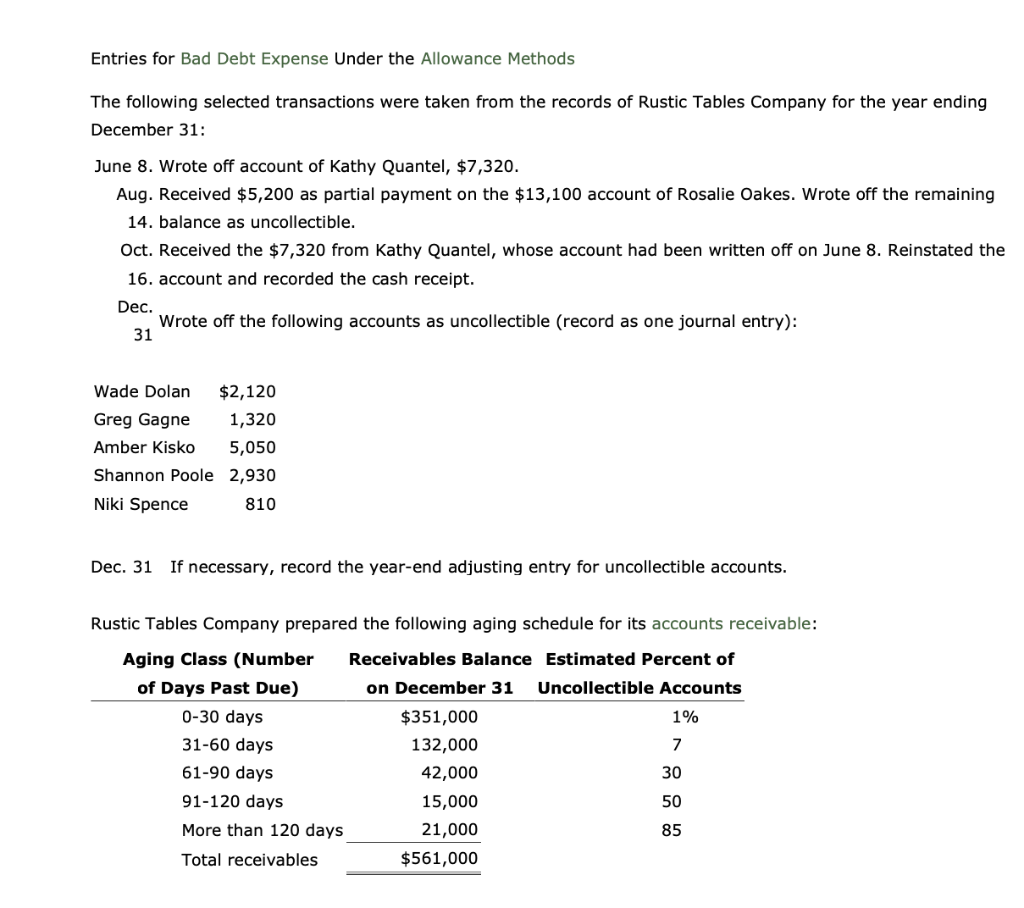

Entries for Bad Debt Expense Under the Allowance Methods The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8. Wrote off account of Kathy Quantel, $7,320. Aug. Received $5,200 as partial payment on the $13,100 account of Rosalie Oakes. Wrote off the remaining 14. balance as uncollectible. Oct. Received the $7,320 from Kathy Quantel, whose account had been written off on June 8 . Reinstated the 16. account and recorded the cash receipt. Dec. 31 Wrote off the following accounts as uncollectible (record as one journal entry): Dec. 31 If necessary, record the year-end adjusting entry for uncollectible accounts. Rustic Tables Company prepared the following aging schedule for its accounts receivable: a. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts