Question: i need to make sure if my first question is correct and for the second one im not sure of the answer too so can

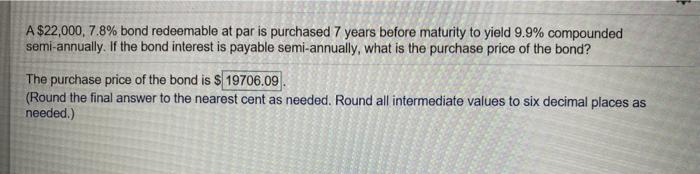

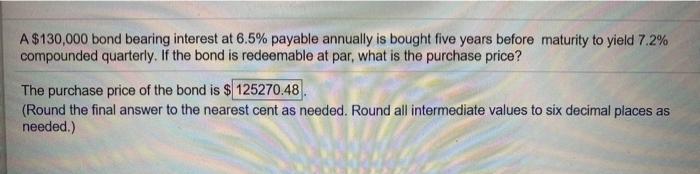

A $22,000, 7.8% bond redeemable at par is purchased 7 years before maturity to yield 9.9% compounded semi-annually. If the bond interest is payable semi-annually, what is the purchase price of the bond? The purchase price of the bond is $ 19706.09 (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) A $130,000 bond bearing interest at 6.5% payable annually is bought five years before maturity to yield 7.2% compounded quarterly. If the bond is redeemable at par, what is the purchase price? The purchase price of the bond is $ 125270.48 (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts