Question: I need to see this problem solved out in excel with formulas/steps visible so I am able to replicate and understand the process. 7) Consider

I need to see this problem solved out in excel with formulas/steps visible so I am able to replicate and understand the process.

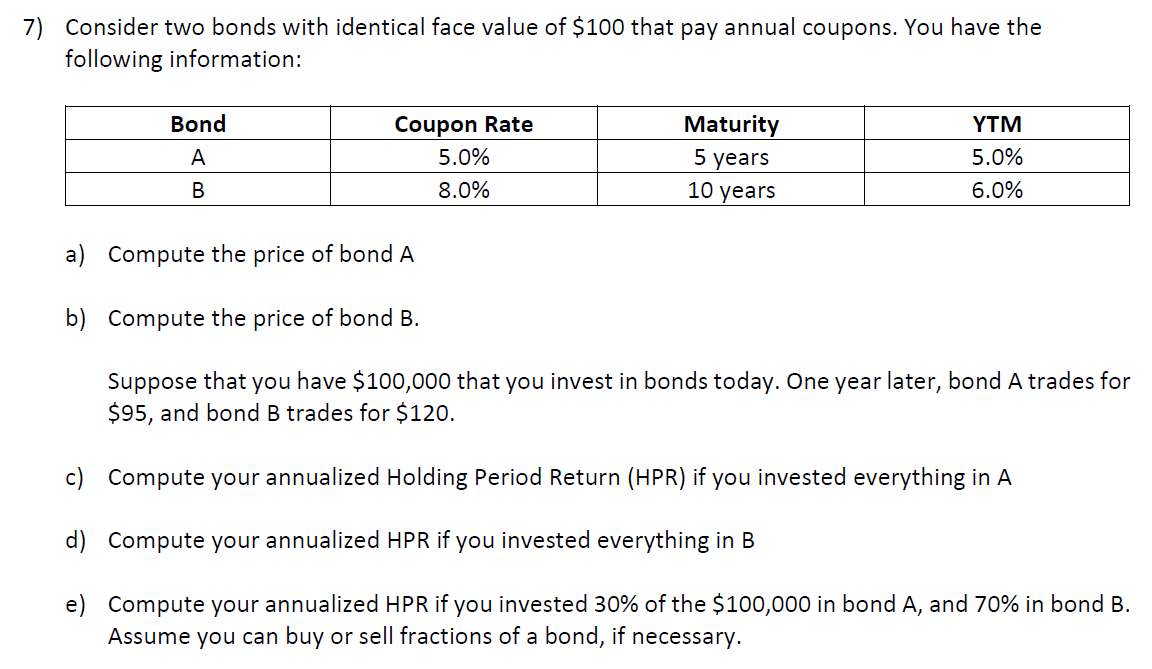

7) Consider two bonds with identical face value of $100 that pay annual coupons. You have the following information: Bond A Coupon Rate 5.0% 8.0% Maturity 5 years 10 years YTM 5.0% 6.0% B a) Compute the price of bond A b) Compute the price of bond B. Suppose that you have $100,000 that you invest in bonds today. One year later, bond A trades for $95, and bond B trades for $120. c) Compute your annualized Holding Period Return (HPR) if you invested everything in A d) Compute your annualized HPR if you invested everything in B e) Compute your annualized HPR if you invested 30% of the $100,000 in bond A, and 70% in bond B. Assume you can buy or sell fractions of a bond, if necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts