Question: I need to see this with all the appropriate forms (1120, 1125a, schedule g, schedule m-3, 1125e) for 2020 instead of 2019 please :) So,

I need to see this with all the appropriate forms (1120, 1125a, schedule g, schedule m-3, 1125e) for 2020 instead of 2019 please :) So, just change all of the dates to 2020 instead of 2019 for the purposes of this assignment. Thanks :)

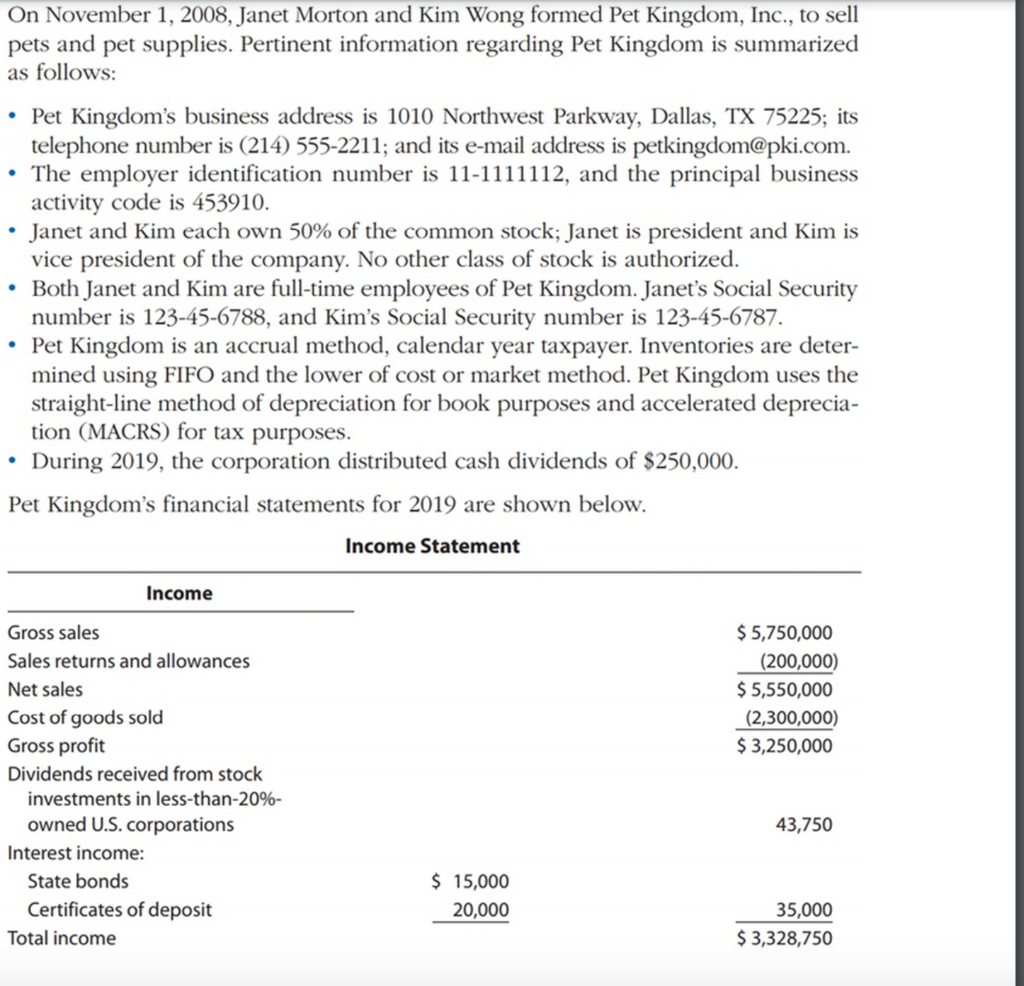

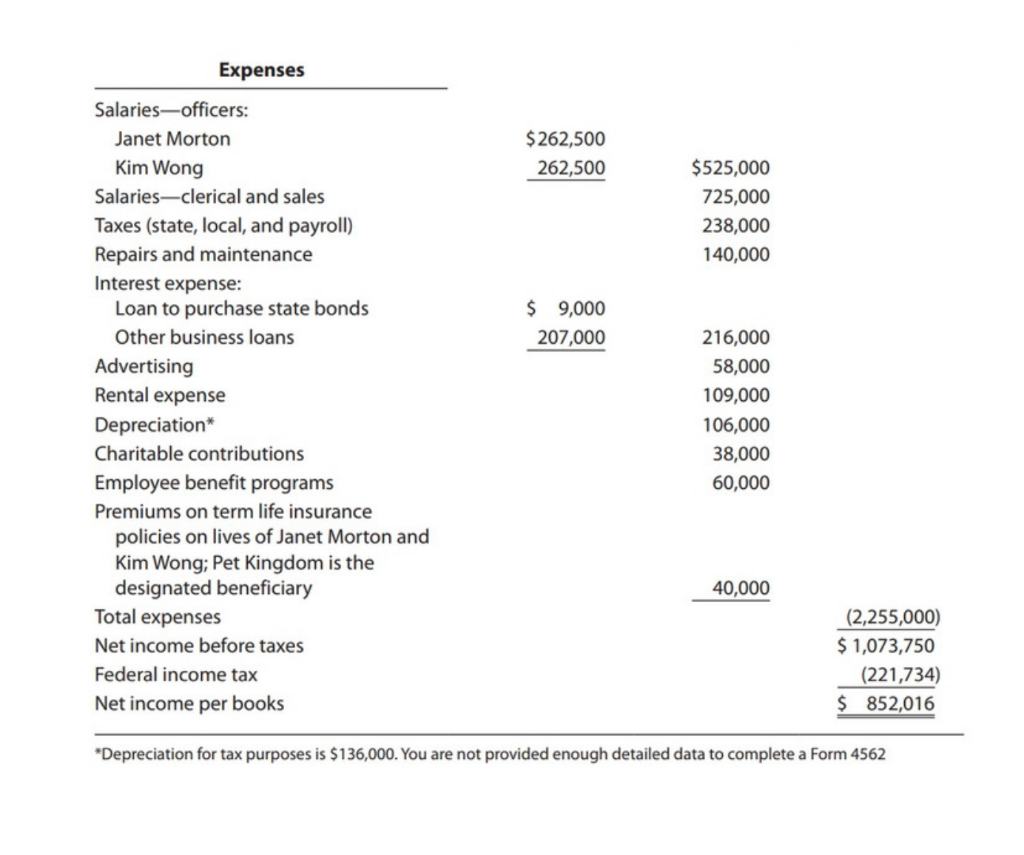

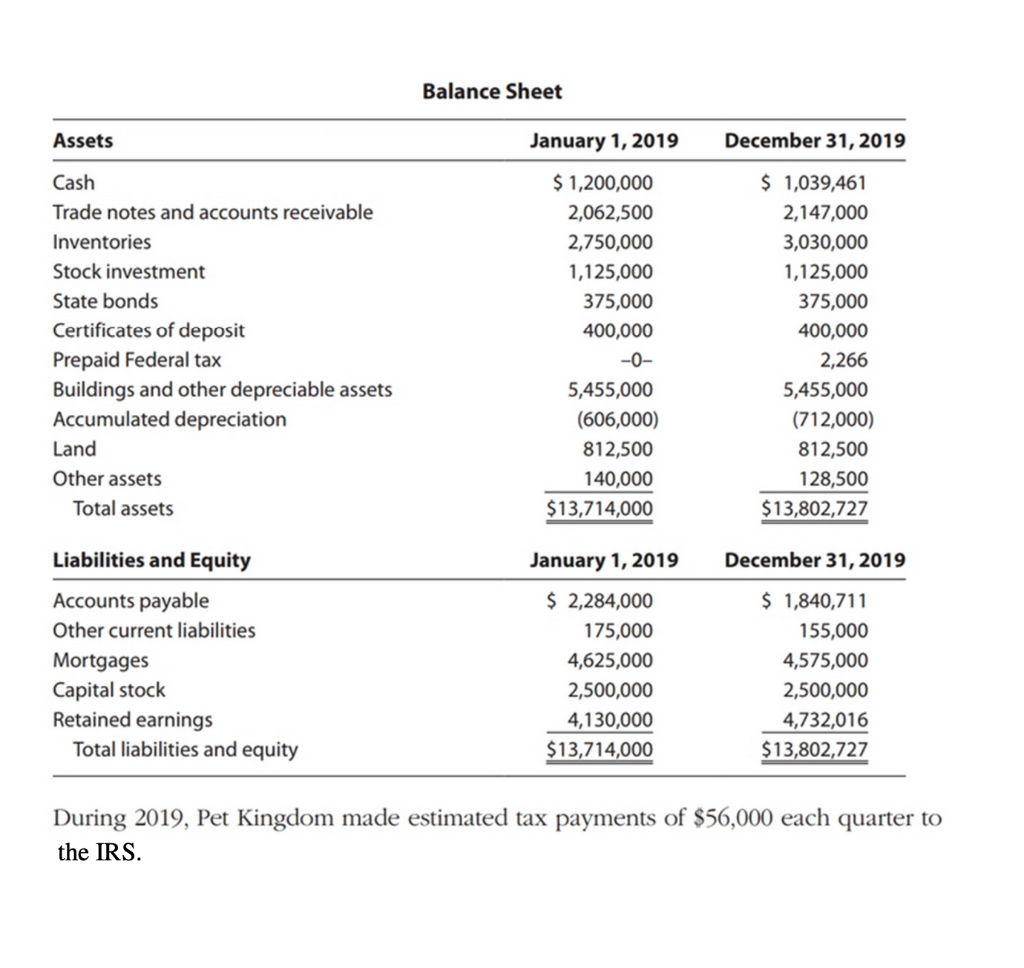

On November 1, 2008, Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows: Pet Kingdom's business address is 1010 Northwest Parkway, Dallas, TX 75225; its telephone number is (214) 555-2211; and its e-mail address is petkingdom@pki.com. The employer identification number is 11-1111112, and the principal business activity code is 453910. Janet and Kim each own 50% of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized. Both Janet and Kim are full-time employees of Pet Kingdom. Janet's Social Security number is 123-45-6788, and Kim's Social Security number is 123-45-6787. Pet Kingdom is an accrual method, calendar year taxpayer. Inventories are deter- mined using FIFO and the lower of cost or market method. Pet Kingdom uses the straight-line method of depreciation for book purposes and accelerated deprecia- tion (MACRS) for tax purposes. During 2019, the corp distributed cash dividends of $250,000. Pet Kingdom's financial statements for 2019 are shown below. Income Statement Income $ 5,750,000 (200,000) $ 5,550,000 (2,300,000) $3,250,000 Gross sales Sales returns and allowances Net sales Cost of goods sold Gross profit Dividends received from stock investments in less-than-20%- owned U.S. corporations Interest income: State bonds Certificates of deposit Total income 43,750 $ 15,000 20,000 35,000 $3,328,750 Expenses $ 262,500 262,500 $525,000 725,000 238,000 140,000 $ 9,000 207,000 Salaries-officers: Janet Morton Kim Wong Salaries-clerical and sales Taxes (state, local, and payroll) Repairs and maintenance Interest expense: Loan to purchase state bonds Other business loans Advertising Rental expense Depreciation* Charitable contributions Employee benefit programs Premiums on term life insurance policies on lives of Janet Morton and Kim Wong; Pet Kingdom is the designated beneficiary Total expenses Net income before taxes Federal income tax Net income per books 216,000 58,000 109,000 106,000 38,000 60,000 40,000 (2,255,000) $ 1,073,750 (221,734) $ 852,016 *Depreciation for tax purposes is $136,000. You are not provided enough detailed data to complete a Form 4562 Balance Sheet Assets January 1, 2019 December 31, 2019 $ 1,200,000 2,062,500 2,750,000 1,125,000 375,000 400,000 Cash Trade notes and accounts receivable Inventories Stock investment State bonds Certificates of deposit Prepaid Federal tax Buildings and other depreciable assets Accumulated depreciation Land Other assets Total assets $ 1,039,461 2,147,000 3,030,000 1,125,000 375,000 400,000 2,266 5,455,000 (712,000) 812,500 128,500 $13,802,727 5,455,000 (606,000) 812,500 140,000 $13,714,000 Liabilities and Equity January 1, 2019 December 31, 2019 Accounts payable Other current liabilities Mortgages Capital stock Retained earnings Total liabilities and equity $ 2,284,000 175,000 4,625,000 2,500,000 4,130,000 $13,714,000 $ 1,840,711 155,000 4,575,000 2,500,000 4,732,016 $ 13,802,727 During 2019, Pet Kingdom made estimated tax payments of $56,000 each quarter to the IRS. On November 1, 2008, Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows: Pet Kingdom's business address is 1010 Northwest Parkway, Dallas, TX 75225; its telephone number is (214) 555-2211; and its e-mail address is petkingdom@pki.com. The employer identification number is 11-1111112, and the principal business activity code is 453910. Janet and Kim each own 50% of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized. Both Janet and Kim are full-time employees of Pet Kingdom. Janet's Social Security number is 123-45-6788, and Kim's Social Security number is 123-45-6787. Pet Kingdom is an accrual method, calendar year taxpayer. Inventories are deter- mined using FIFO and the lower of cost or market method. Pet Kingdom uses the straight-line method of depreciation for book purposes and accelerated deprecia- tion (MACRS) for tax purposes. During 2019, the corp distributed cash dividends of $250,000. Pet Kingdom's financial statements for 2019 are shown below. Income Statement Income $ 5,750,000 (200,000) $ 5,550,000 (2,300,000) $3,250,000 Gross sales Sales returns and allowances Net sales Cost of goods sold Gross profit Dividends received from stock investments in less-than-20%- owned U.S. corporations Interest income: State bonds Certificates of deposit Total income 43,750 $ 15,000 20,000 35,000 $3,328,750 Expenses $ 262,500 262,500 $525,000 725,000 238,000 140,000 $ 9,000 207,000 Salaries-officers: Janet Morton Kim Wong Salaries-clerical and sales Taxes (state, local, and payroll) Repairs and maintenance Interest expense: Loan to purchase state bonds Other business loans Advertising Rental expense Depreciation* Charitable contributions Employee benefit programs Premiums on term life insurance policies on lives of Janet Morton and Kim Wong; Pet Kingdom is the designated beneficiary Total expenses Net income before taxes Federal income tax Net income per books 216,000 58,000 109,000 106,000 38,000 60,000 40,000 (2,255,000) $ 1,073,750 (221,734) $ 852,016 *Depreciation for tax purposes is $136,000. You are not provided enough detailed data to complete a Form 4562 Balance Sheet Assets January 1, 2019 December 31, 2019 $ 1,200,000 2,062,500 2,750,000 1,125,000 375,000 400,000 Cash Trade notes and accounts receivable Inventories Stock investment State bonds Certificates of deposit Prepaid Federal tax Buildings and other depreciable assets Accumulated depreciation Land Other assets Total assets $ 1,039,461 2,147,000 3,030,000 1,125,000 375,000 400,000 2,266 5,455,000 (712,000) 812,500 128,500 $13,802,727 5,455,000 (606,000) 812,500 140,000 $13,714,000 Liabilities and Equity January 1, 2019 December 31, 2019 Accounts payable Other current liabilities Mortgages Capital stock Retained earnings Total liabilities and equity $ 2,284,000 175,000 4,625,000 2,500,000 4,130,000 $13,714,000 $ 1,840,711 155,000 4,575,000 2,500,000 4,732,016 $ 13,802,727 During 2019, Pet Kingdom made estimated tax payments of $56,000 each quarter to the IRS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts