Question: I need to solve this problem by filling out thw empty chart Problem 6 (Recommended: review slides 39-70) Hoyle, Schaefer and Doupnik - Chapter 2

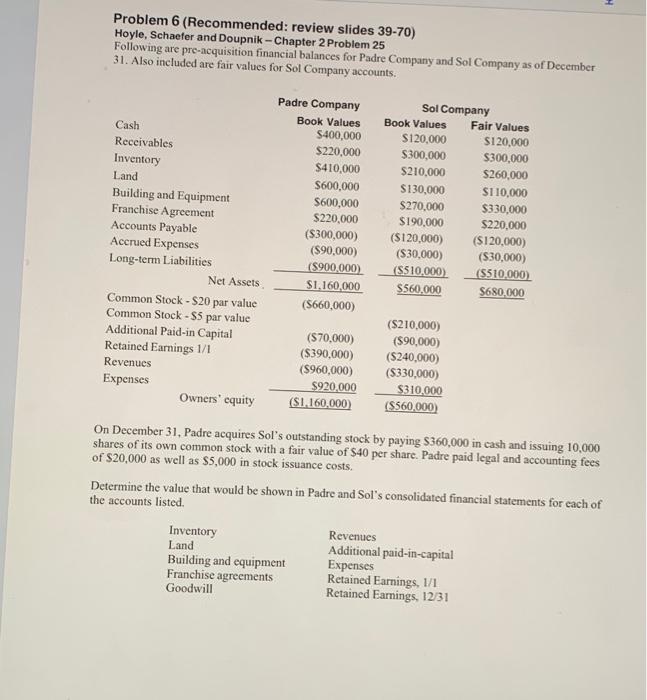

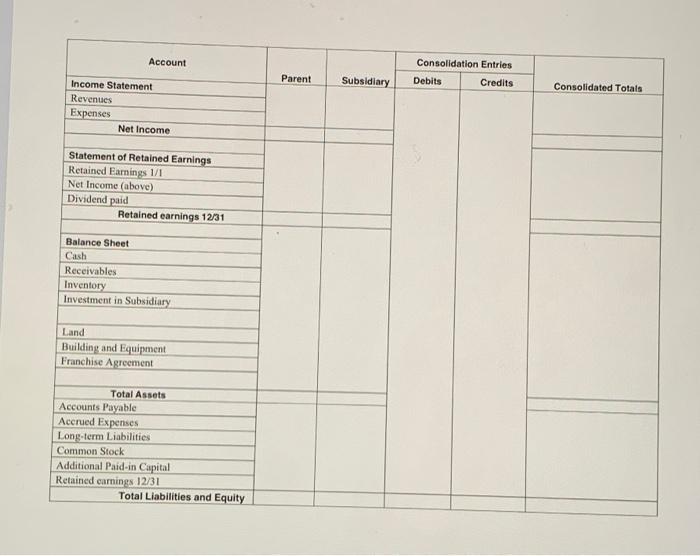

Problem 6 (Recommended: review slides 39-70) Hoyle, Schaefer and Doupnik - Chapter 2 Problem 25 Following are pre-acquisition financial balances for Padre Company and Sol Company as of December 31. Also included are fair values for Sol Company accounts. Padre Company Sol Company Book Values Book Values Fair Values Cash $400,000 $120,000 $120,000 Receivables $220,000 $300,000 $300,000 Inventory $410,000 $210,000 $260,000 Land $600,000 S130,000 $110,000 Building and Equipment $600,000 $270,000 $330,000 Franchise Agreement $220,000 $190,000 $220,000 Accounts Payable ($300,000) ($120,000) (S120,000) Accrued Expenses ($90,000) ($30,000) ($30,000) Long-term Liabilities ($900,000) (S510,000) (5510,000) Net Assets $1,160,000 $560,000 $680,000 Common Stock - S20 par value (5660,000) Common Stock - $5 par value (S210,000) Additional Paid-in Capital (S70,000) (590,000) Retained Earnings 1/1 ($390,000) ($240,000) Revenues ($960,000) ($330,000) Expenses $920,000 $310,000 Owners' equity (81.160,000) ($560,000) On December 31, Padre acquires Sol's outstanding stock by paying S360,000 in cash and issuing 10,000 shares of its own common stock with a fair value of $40 per share. Padre paid legal and accounting fees of $20,000 as well as $5,000 in stock issuance costs. Determine the value that would be shown in Padre and Sol's consolidated financial statements for each of the accounts listed Inventory Revenues Land Additional paid-in-capital Building and equipment Expenses Franchise agreements Retained Earnings, 1/1 Goodwill Retained Earnings, 12/31 Account Consolidation Entries Debits Credits Parent Subsidiary Consolidated Totals Income Statement Revenues Expenses Net Income Statement of Retained Earnings Retained Earnings 1/1 Net Income (above) Dividend paid Retained earnings 12/31 Balance Sheet Cash Receivables Inventory Investment in Subsidiary Land Building and Equipment Franchise Agreement Total Assets Accounts Payable Accrued Expenses Long-term Liabilities Common Stock Additional Paid-in Capital Retained camnings 12/31 Total Liabilities and Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts