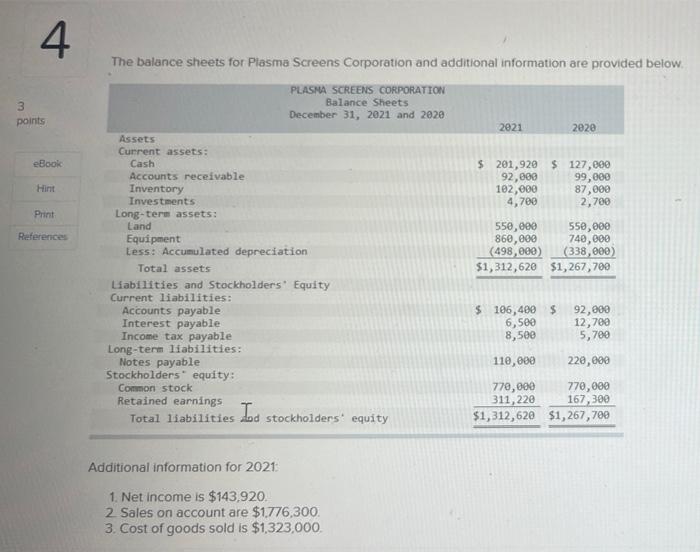

Question: I need to the solutions to this problem. 4 The balance sheets for Plasma Screens Corporation and additional information are provided below. 3 points PLASMA

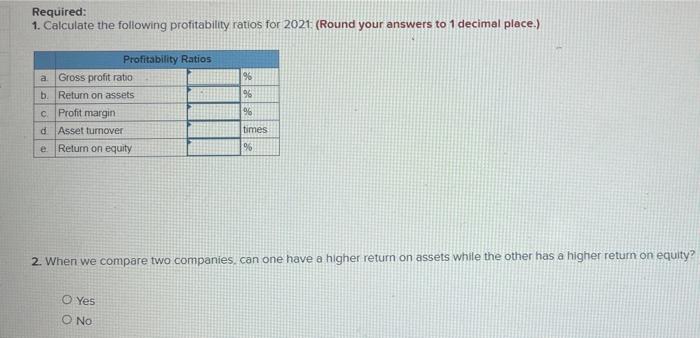

4 The balance sheets for Plasma Screens Corporation and additional information are provided below. 3 points PLASMA SCREENS CORPORATION Balance Sheets December 31, 2021 and 2020 2021 2020 eBook Hint $ 201,920 $ 127,000 92,000 99,000 102,000 87,000 4,700 2,700 Print References 550,000 550,000 860,000 740,000 (498,000) (338,000) $1,312,620 $1,267,700 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities dod stockholders' equity I. $ 106,400 $ 6,500 8,500 92,000 12,700 5,700 110,000 220,000 770,000 770,000 311,220 167, 300 $1,312,620 $1,267,700 Additional information for 2021 1. Net Income is $143,920, 2 Sales on account are $1.776,300. 3. Cost of goods sold is $1,323,000. Required: 1. Calculate the following profitability ratios for 2021 (Round your answers to 1 decimal place.) 96 96 Profitability Ratios a. Gross profit ratio b. Return on assets c. Profit margin d Asset turnover Return on equity 9 times 96 2. When we compare two companies can one have a higher return on assets while the other has a higher return on equity? Yes O No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts