Question: I need to understand how to solve this problem step by step please with instructions.....Thank you 40. J-Matt, Inc, had pretax accounting income of $291,000

I need to understand how to solve this problem step by step please with instructions.....Thank you

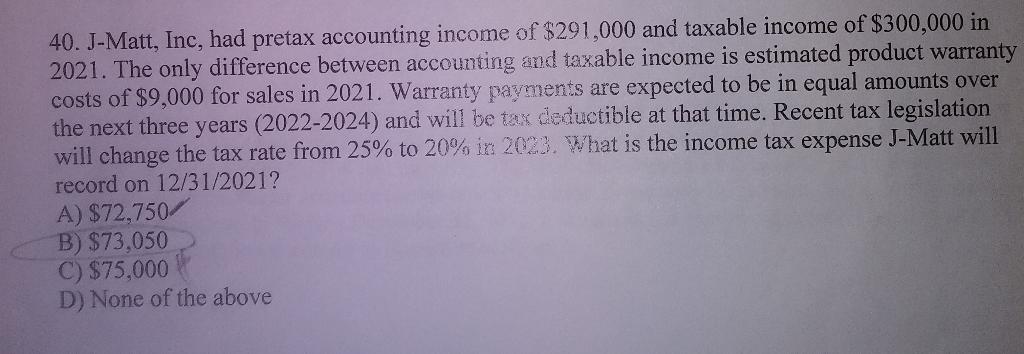

40. J-Matt, Inc, had pretax accounting income of $291,000 and taxable income of $300,000 in 2021. The only difference between accounting and taxable income is estimated product warranty costs of $9,000 for sales in 2021. Warranty payments are expected to be in equal amounts over the next three years (2022-2024) and will be tax deductible at that time. Recent tax legislation will change the tax rate from 25% to 20% in 2023. What is the income tax expense J-Matt will record on 12/31/2021? A) $72,750/ B) $73,050 C) $75,000 D) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts