Question: I need to use incremental IRR analysis with MARR as my decision point (No excel please I need calculations) 39. +Dark Skies Observatory is considering

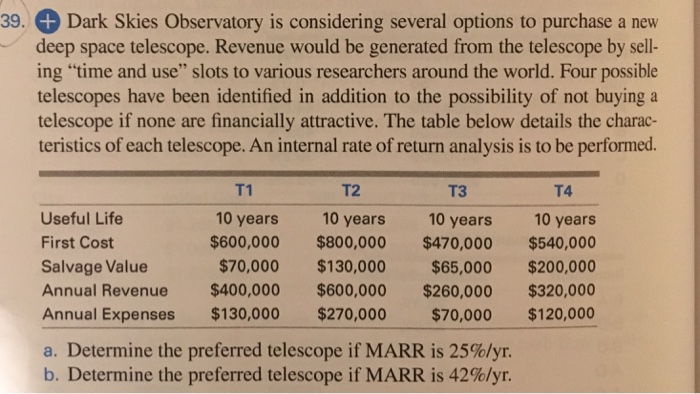

39. +Dark Skies Observatory is considering several options to purchase a new deep space telescope. Revenue would be generated from the telescope by sell- ing "time and use" slots to various researchers around the world. Four possible telescopes have been identified in addition to the possibility of not buying a telescope if none are financially attractive. The table below details the charac- teristics of each telescope. An internal rate of return analysis is to be performed. T1 T2 T3 T4 Useful Life First Cost Salvage Value Annual Revenue $400,000 $600,000 $260,000 $320,000 Annual Expenses $%130,000 $270,000 $70,000 $120,000 10 years 10 years 10 years 10 years $600,000 $800,000 $470,000$540,000 $70,000 $130,000 $65,000 $200,000 a. Determine the preferred telescope if MARR is 25%/yr b. Determine the preferred telescope if MARR is 42%/yr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts