Question: i need tp create a cash flow statement for the following company Pearce Information Processing Company provides software support services for its clients. Pearce uses

i need tp create a cash flow statement for the following company

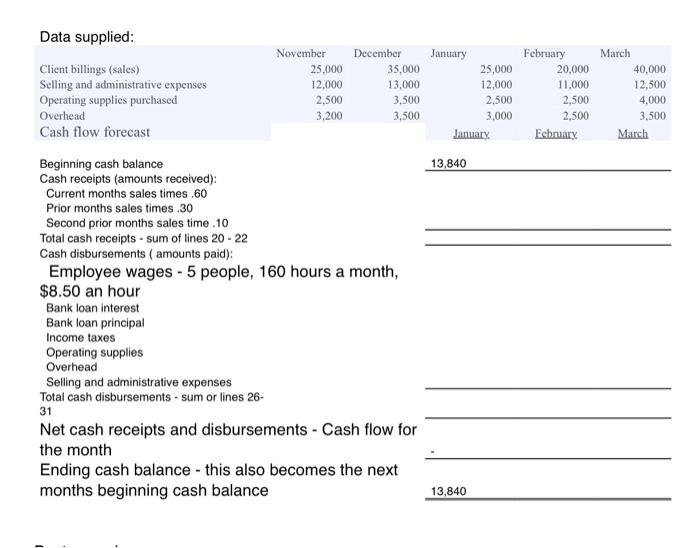

Pearce Information Processing Company provides software support services for its clients. Pearce uses at support staff of five (5) people who each average 160 hours of work a month. The following table sets out information developed by the budget officer:

November | December | January | February | March | |

Client billings (sales) | 25,000 | 35,000 | 25,000 | 20,000 | 40,000 |

Selling and administrative expenses | 12,000 | 13,000 | 12,000 | 11,000 | 12,500 |

Operating supplies purchased | 2,500 | 3,500 | 2,500 | 2,500 | 4,000 |

Overhead | 3,200 | 3,500 | 3,000 | 2,500 | 3,500 |

The company has a bank loan of $12,000 at a 12% interest annual rate. Interest is paid monthly, and $2,000 of the principal of the loan is due on February 28. Income taxes of $4,550 are due and payable on March 15. The companys five employees earn $8.50 an hour.

For the items included in the table above assume the following conditions:

Client billings (sales):

60% are cash sales collected during the month of sale

30% are collected in the first month following the sale

10% are collected in the second month following the sale

Operating supplies (expenses):

Paid for in the month purchased

Selling and administrative and overhead expenses:

Paid in the month following the costs incurrence

The cash balance on December 31 is expected to be $13,840

i also need a monthly cash budget for the three-month period ending March 31 (the months of January, February and March). A recommended template for use in completing this assignment is attached.

Data supplied: Client billings (sales) Selling and administrative expenses Operating supplies purchased Overhead Cash flow forecast November 25,000 12,000 2.500 3.200 December 35,000 13,000 3,500 3,500 January 25,000 12,000 2,500 3.000 January February 20,000 11.000 2,500 2.500 February March 40,000 12,500 4.000 3,500 March 13,840 Beginning cash balance Cash receipts (amounts received): Current months sales times .60 Prior months sales times.30 Second prior months sales time 10 Total cash receipts - sum of lines 20-22 Cash disbursements ( amounts paid): Employee wages - 5 people, 160 hours a month, $8.50 an hour Bank loan interest Bank loan principal Income taxes Operating supplies Overhead Selling and administrative expenses Total cash disbursements - sum or lines 26- 31 Net cash receipts and disbursements - Cash flow for the month Ending cash balance - this also becomes the next months beginning cash balance 13,840

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts