Question: I need two different answers?thank you very much? Scenario: Mr. Franklin is 70 years of age, is in excellent health, pursues a simple but active

I need two different answers?thank you very much?

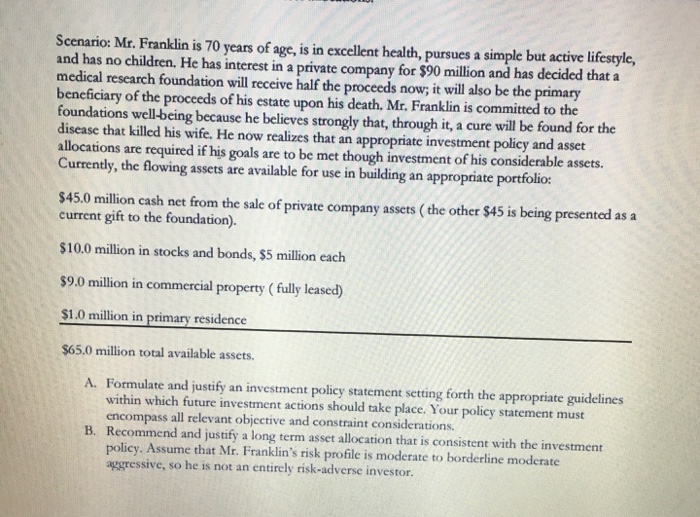

I need two different answers?thank you very much?Scenario: Mr. Franklin is 70 years of age, is in excellent health, pursues a simple but active lifestyle, find has no children. He has interest in a private company for $90 million and has decided that a medical research foundation will receive half the proceeds now; it will also be the primary beneficiary of the proceeds of his estate upon his death. Mr. Franklin is committed to the foundations well-being because he believes strongly that, through it, a cure will be found for the disease that killed his wife. He now realizes that an appropriate investment policy and asset allocations are required if his goals arc to be met though investment of his considerable assets. Currently, the flowing assets arc available for use in building an appropriate portfolio: $45.0 million cash net from the sale of private company assets (the other $45 is being presented as a current gift to the foundation). $10.0 million in stocks and bonds, $5 million each Formulate and justify an investment policy statement setting forth the appnipriate guidelines within which future investment actions should take place. Your policy statement must encompass all relevant objective and constraint considerations. Recommend and justify a long term asset allocation that is consistent with the investment policy. Assume that Mr. Franklin's risk profile is moderate to borderline moderate aggressive, so he is not an entirely risk-adverse investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts