Question: I need typed answer with explanation. Don't use AI BOT. I need answer step by step i will thumb up. The CS Partnership pays its

I need typed answer with explanation. Don't use AI BOT. I need answer step by step i will thumb up.

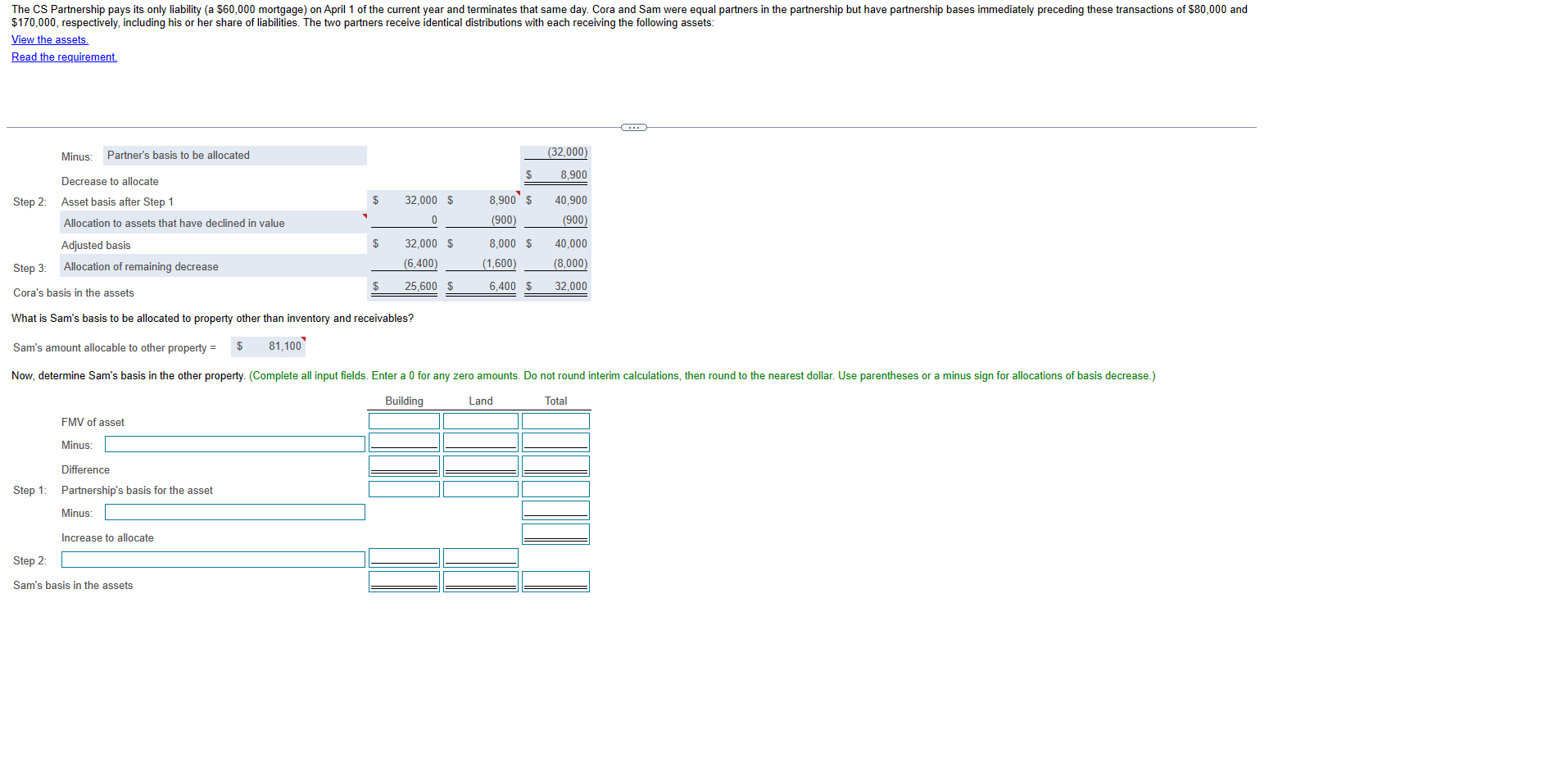

The CS Partnership pays its only liability (a $60,000 mortgage) on April 1 of the current year and terminates that same day. Cora and Sam were equal partners in the partnership but have partnership bases immediately preceding these transactions of $80,000 and $170,000, respectively, including his or her share of liabilities. The two partners receive identical distributions with each receiving the following assets: View the assets. Read the requirement. Minus: Partner's basis to be allocated (32,000) 8.900 Decrease to allocate Step 2: Asset basis after Step 1 32,000 $ 8,900 $ 40,900 Allocation to assets that have declined in value (900) (900) Adjusted basis 32,000 $ 8,000 $ 40,000 (1,600 8,000) Step 3: Allocation of remaining decrease 6,400) 25,600 $ 5,400 $ 32,000 Cora's basis in the assets What is Sam's basis to be allocated to property other than inventory and receivables? Sam's amount allocable to other property = $ 81,100 Now, determine Sam's basis in the other property. (Complete all input fields. Enter a 0 for any zero amounts. Do not round interim calculations, then round to the nearest dollar. Use parentheses or a minus sign for allocations of basis decrease.) Building Land Total FMV of asset Minus: Difference Step 1: Partnership's basis for the asset Minus: Increase to allocate Step 2: Sam's basis in the assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts