Question: I need urgent help with these HW problems! Please show all work and answer as soon as possible. The best answer is GUARANTEED A THUMBS

I need urgent help with these HW problems! Please show all work and answer as soon as possible. The best answer is GUARANTEED A THUMBS UP!!!

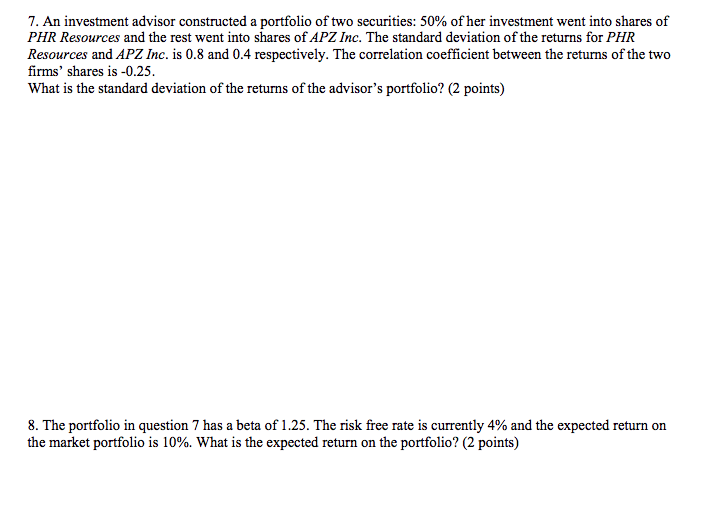

7. An investment advisor constructed a portfolio of two securities: 50% of her investment went into shares of PHR Resources and the rest went into shares of APZ Inc. The standard deviation of the returns for PHR Resources and APZ Inc. is 0.8 and 0.4 respectively. The correlation coefficient between the returns of the two firms' shares is -0.25. What is the standard deviation of the returns of the advisor's portfolio? (2 points) 8. The portfolio in question 7 has a beta of 1.25. The risk free rate is currently 4% and the expected return on the market portfolio is 10%. What is the expected return on the portfolio? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts