I need urgent help with this question. An early respone shall highly be appreciated.

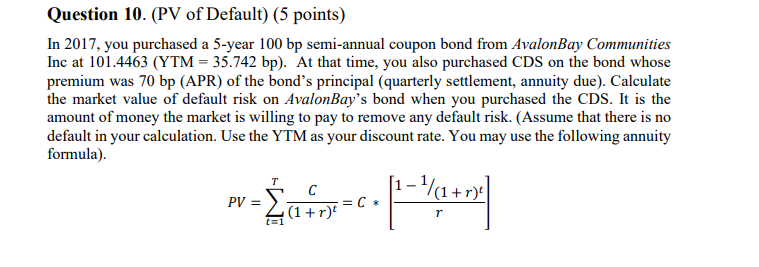

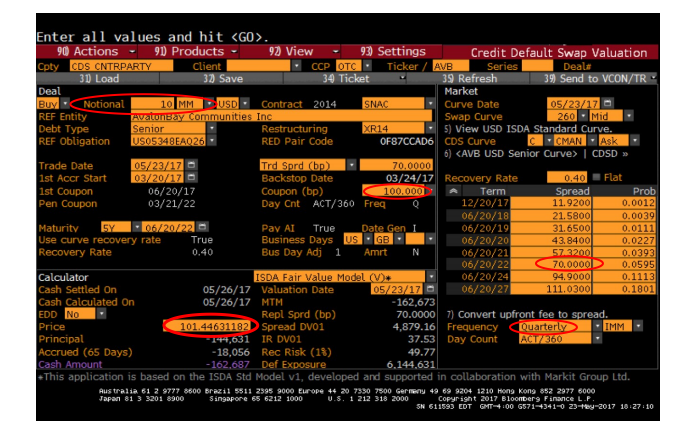

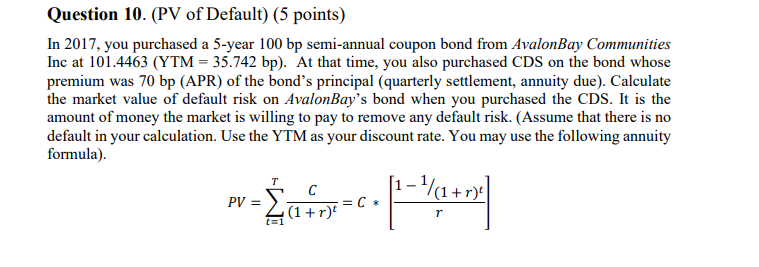

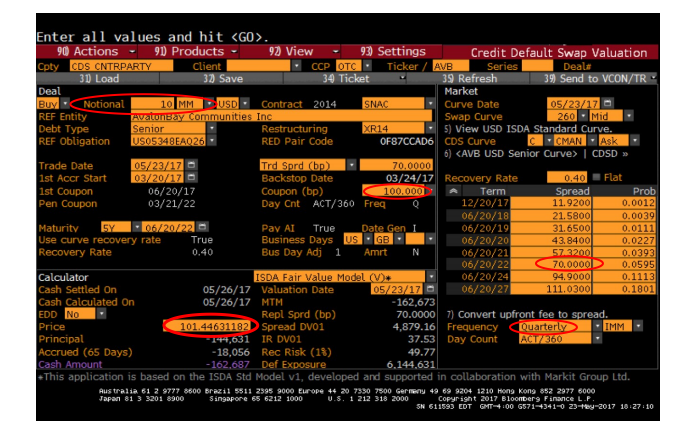

Question 10. (PV of Default) (5 points) In 2017, you purchased a 5-year 100 bp semi-annual coupon bond from Avalon Bay Communities Inc at 101.4463 (YTM = 35.742 bp). At that time, you also purchased CDS on the bond whose premium was 70 bp (APR) of the bond's principal (quarterly settlement, annuity due). Calculate the market value of default risk on Avalon Bay's bond when you purchased the CDS. It is the amount of money the market is willing to pay to remove any default risk. (Assume that there is no default in your calculation. Use the YTM as your discount rate. You may use the following annuity formula). Enter all values and hit | CDSD >> Trade Date 05/23/17 Trd Sprd (bp) 70.0000 1st Accr Start 03/20/170 Backstop Date 03/24/17 Recovery Rate 0.40 Flat 1st Coupon 06/20/17 Coupon (bp) 100.000 Term Spread Prob Pen Coupon 03/21/22 Day Cnt ACT/360 Freq Q 12/20/17 11.9200 0.0012 06/20/18 21.5800 0.0039 Maturity SY . 06/20/22 - Pay AI True Date Gen 1 06/20/191 31.65001 0.0111 Use curve recovery rate True Business Days Us. GB 06/20/20 43.84000 0.0227 Recovery Rate 0.40 Bus Day Adj 1 Amrt N 06/20/21 57.3200 0.0393 06/20/22 70.0000D 0.0595 Calculator ISDA Fair Value Model + 06/20/24 94.90001 0.1113 Cash Settled on 05/26/17 Valuation Date 05/23/17 - 06/20/27 111.0300 0.1801 Cash Calculated On 05/26/17 MTM - 162,673 EDD NO : Repl Sprd (bp) 70.0000 7) Convert upfront fee to spread. Price 101.44631182 Spread DV01 4,879.16 Frequency Quarterly - IMM Principal - 144,631 IR DVO1 37.53 Day Count ACT360 Accrued (65 Days) -18,056 Rec Risk (18) 49.77 Cash Amount -162,687 Def Exposure 6.144,631 *This application is based on the ISDA Std Model vi, developed and supported in collaboration with Markit Group Ltd. Australia 61 2 9777 8600 Brazil 5511 2395 9000 Europe 44 20 7330 7500 Gerreny 49 69 9204 1210 Hong Kong 852 2977 6000 Japan 81 3 3201 8900 Singapore 65 6212 1000 U.S. 1 212 318 2000 Copyright 2017 Bloomberg Finance L.F. SN 611593 EDT GMT-4:00 G571 +341-0 23- -2017 18:27:10 Question 10. (PV of Default) (5 points) In 2017, you purchased a 5-year 100 bp semi-annual coupon bond from Avalon Bay Communities Inc at 101.4463 (YTM = 35.742 bp). At that time, you also purchased CDS on the bond whose premium was 70 bp (APR) of the bond's principal (quarterly settlement, annuity due). Calculate the market value of default risk on Avalon Bay's bond when you purchased the CDS. It is the amount of money the market is willing to pay to remove any default risk. (Assume that there is no default in your calculation. Use the YTM as your discount rate. You may use the following annuity formula). Enter all values and hit | CDSD >> Trade Date 05/23/17 Trd Sprd (bp) 70.0000 1st Accr Start 03/20/170 Backstop Date 03/24/17 Recovery Rate 0.40 Flat 1st Coupon 06/20/17 Coupon (bp) 100.000 Term Spread Prob Pen Coupon 03/21/22 Day Cnt ACT/360 Freq Q 12/20/17 11.9200 0.0012 06/20/18 21.5800 0.0039 Maturity SY . 06/20/22 - Pay AI True Date Gen 1 06/20/191 31.65001 0.0111 Use curve recovery rate True Business Days Us. GB 06/20/20 43.84000 0.0227 Recovery Rate 0.40 Bus Day Adj 1 Amrt N 06/20/21 57.3200 0.0393 06/20/22 70.0000D 0.0595 Calculator ISDA Fair Value Model + 06/20/24 94.90001 0.1113 Cash Settled on 05/26/17 Valuation Date 05/23/17 - 06/20/27 111.0300 0.1801 Cash Calculated On 05/26/17 MTM - 162,673 EDD NO : Repl Sprd (bp) 70.0000 7) Convert upfront fee to spread. Price 101.44631182 Spread DV01 4,879.16 Frequency Quarterly - IMM Principal - 144,631 IR DVO1 37.53 Day Count ACT360 Accrued (65 Days) -18,056 Rec Risk (18) 49.77 Cash Amount -162,687 Def Exposure 6.144,631 *This application is based on the ISDA Std Model vi, developed and supported in collaboration with Markit Group Ltd. Australia 61 2 9777 8600 Brazil 5511 2395 9000 Europe 44 20 7330 7500 Gerreny 49 69 9204 1210 Hong Kong 852 2977 6000 Japan 81 3 3201 8900 Singapore 65 6212 1000 U.S. 1 212 318 2000 Copyright 2017 Bloomberg Finance L.F. SN 611593 EDT GMT-4:00 G571 +341-0 23- -2017 18:27:10