Question: i need with help number 12 and 14 please Chapter 5: Mathematics of Finance 12. $45.000; monthly payments for 11 years, interest rate is 5.3%,

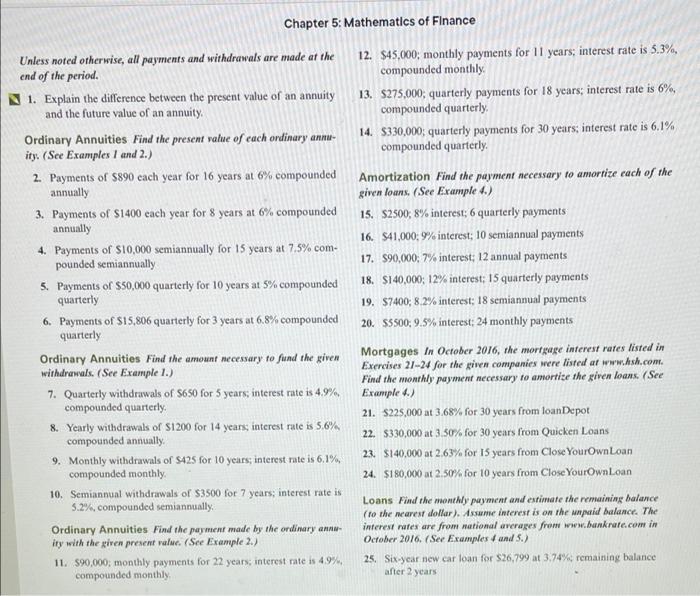

Chapter 5: Mathematics of Finance 12. $45.000; monthly payments for 11 years, interest rate is 5.3%, compounded monthly 13. $275.000, quarterly payments for 18 years; interest rate is 6%, compounded quarterly 14. $330,000; quarterly payments for 30 years, interest rate is 6.1% compounded quarterly Unless noted otherwise, all payments and withdrawals are made at the end of the period. 1. Explain the difference between the present value of an annuity and the future value of an annuity Ordinary Annuities Find the present value of each ordinary annu- ity (See Examples 1 and 2.) 2. Payments of $890 each year for 16 years at 6% compounded annually 3. Payments of S1400 each year for 8 years at 6% compounded annually 4. Payments of $10,000 semiannually for 15 years at 7.5% com- pounded semiannually 5. Payments of $50,000 quarterly for 10 years at 5% compounded quarterly 6. Payments of $15,806 quarterly for 3 years at 6.8% compounded quarterly Ordinary Annuities Find the amount necessary to fund the given withdrawals. (See Example 1.) 7. Quarterly withdrawals of S650 for 5 years, interest rate is 4.9% compounded quarterly 8. Yearly withdrawals of S1200 for 14 years, interest rate is 5.6% compounded annually 9. Monthly withdrawals of 5425 for 10 years; interest rate is 6,1%, compounded monthly 10. Semiannual withdrawals of $3500 for 7 years, interest rate is 5.2%, compounded semiannually, Ordinary Annuities Find the payment made by the ordinary anne- ity with the given present value. (See Example 2.) 11. 590,000, monthly payments for 22 years, interest rate is 49% compounded monthly Amortization Find the payment necessary to amortize each of the given loans. (See Example 4.) 15. S2500, 8% interest: 6 quarterly payments 16. $41,000; 9% interest: 10 semiannual payments 17. 590,000; 7% interest: 12 annual payments 18. $140,000; 12% interest; 15 quarterly payments 19. 57400; 8.2% interest: 18 semiannual payments 20. SS500; 9.5% interest: 24 monthly payments Mortgages in October 2016, the mortgage interest rates listed in Exercises 21-24 for the given companies were listed ar www.sh.com. Find the monthly payment necessary to amortise the given loans. (See Example 4.) 21. $225,000 at 3.68% for 30 years from loan Depot 22. $330,000 at 3.30% for 30 years from Quicken Loans 23. $140,000 at 2.63% for 15 years from Close YourOwnLoan 24. $180,000 at 2.50% for 10 years from Close YourOwnLoan Loans Find the monthly payment and estimate the remaining balance (to the wearest dollar). Assume interest is on the unpaid balance. The interest rates are from national averages from www.bankrute.com in October 2016. (See Examples and 5.) 25. Six-year new car loan for S26,799 at 3.74%, remaining balance after 2 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts