Question: I need you to do only part 2 please You want to invest in real estate. You decide to buy a house and finance it

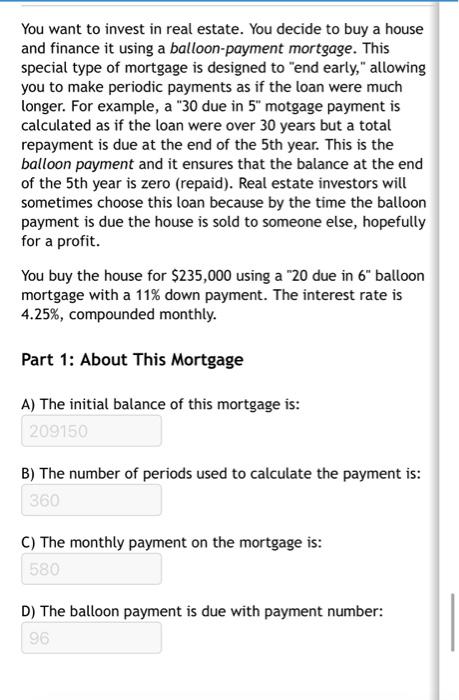

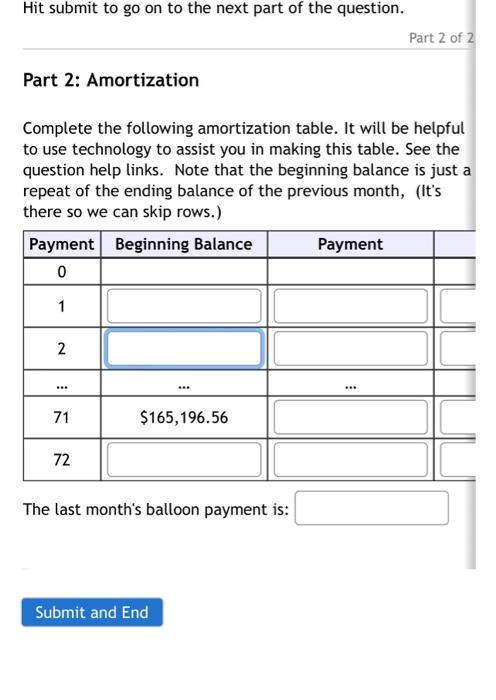

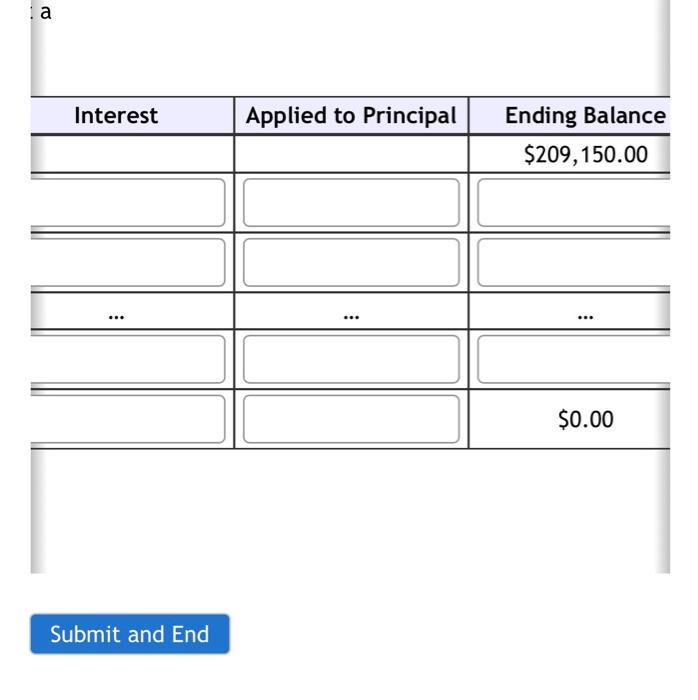

You want to invest in real estate. You decide to buy a house and finance it using a balloon-payment mortgage. This special type of mortgage is designed to "end early," allowing you to make periodic payments as if the loan were much longer. For example, a "30 due in 5" motgage payment is calculated as if the loan were over 30 years but a total repayment is due at the end of the 5th year. This is the balloon payment and it ensures that the balance at the end of the 5th year is zero (repaid). Real estate investors will sometimes choose this loan because by the time the balloon payment is due the house is sold to someone else, hopefully for a profit. You buy the house for $235,000 using a "20 due in 6" balloon mortgage with a 11% down payment. The interest rate is 4.25%, compounded monthly. Part 1: About This Mortgage A) The initial balance of this mortgage is: 209150 B) The number of periods used to calculate the payment is: 360 C) The monthly payment on the mortgage is: 580 D) The balloon payment is due with payment number: 96 Hit submit to go on to the next part of the question. Part 2 of 2 Part 2: Amortization Complete the following amortization table. It will be helpful to use technology to assist you in making this table. See the question help links. Note that the beginning balance is just a repeat of the ending balance of the previous month, (It's there so we can skip rows.) Payment Beginning Balance Payment 0 1 2 *** *** *** 71 $165,196.56 72 The last month's balloon payment is: Submit and End a Interest Submit and End Applied to Principal Ending Balance $209,150.00 $0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts