Question: I need your help ASAP it it important Question 2 Storm Ltd is a manufacturing company based in Manchester. The following trial balance has been

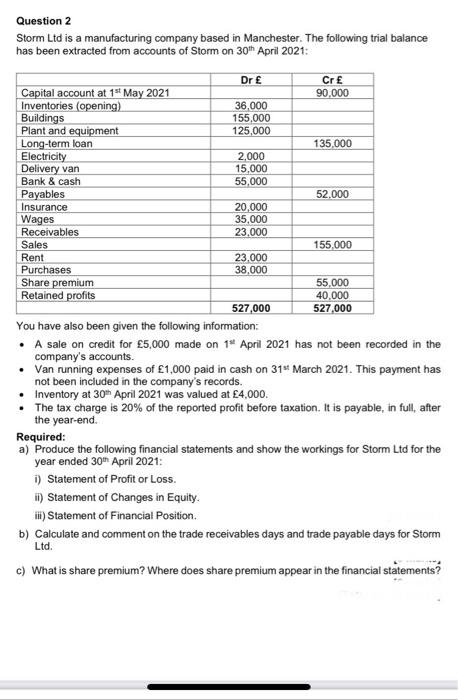

Question 2 Storm Ltd is a manufacturing company based in Manchester. The following trial balance has been extracted from accounts of Storm on 30th April 2021: Dr CrE Capital account at 15 May 2021 90.000 Inventories (opening) 36.000 Buildings 155,000 Plant and equipment 125,000 Long-term loan 135.000 Electricity 2,000 Delivery van 15,000 Bank & cash 55,000 Payables 52.000 Insurance 20,000 Wages 35,000 Receivables 23.000 Sales 155,000 Rent 23,000 Purchases 38.000 Share premium 55,000 Retained profits 40,000 527,000 527,000 You have also been given the following information: A sale on credit for 5,000 made on 1* April 2021 has not been recorded in the company's accounts. . Van running expenses of 1,000 paid in cash on 31st March 2021. This payment has not been included in the company's records. Inventory at 30 April 2021 was valued at 4,000. The tax charge is 20% of the reported profit before taxation. It is payable, in full, after the year-end. Required: a) Produce the following financial statements and show the workings for Storm Ltd for the year ended 30 April 2021: 1) Statement of Profit or Loss i) Statement of Changes in Equity. ii) Statement of Financial Position b) Calculate and comment on the trade receivables days and trade payable days for Storm Ltd. c) What is share premium? Where does share premium appear in the financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts