Question: i need your help pls help me Aston Ltd is a luxury goods manufacturer in the process of diversifying its business. Aston Ltd has reached

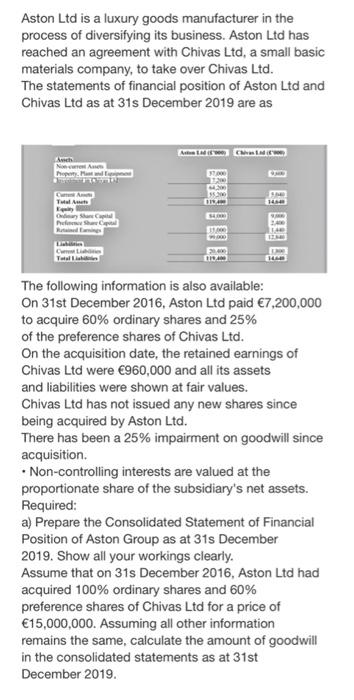

Aston Ltd is a luxury goods manufacturer in the process of diversifying its business. Aston Ltd has reached an agreement with Chivas Ltd, a small basic materials company, to take over Chivas Ltd. The statements of financial position of Aston Ltd and Chivas Ltd as at 31 s December 2019 are as The following information is also available: On 31st December 2016, Aston Ltd paid 7,200,000 to acquire 60% ordinary shares and 25% of the preference shares of Chivas Ltd. On the acquisition date, the retained earnings of Chivas Ltd were 960,000 and all its assets and liabilities were shown at fair values. Chivas Ltd has not issued any new shares since being acquired by Aston Ltd. There has been a 25% impairment on goodwill since acquisition. - Non-controlling interests are valued at the proportionate share of the subsidiary's net assets. Required: a) Prepare the Consolidated Statement of Financial Position of Aston Group as at 31s December 2019. Show all your workings clearly. Assume that on 31s December 2016, Aston Ltd had acquired 100% ordinary shares and 60% preference shares of Chivas Ltd for a price of 15,000,000. Assuming all other information remains the same, calculate the amount of goodwill in the consolidated statements as at 31st December 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts