Question: I need your help with information about Amazon from Yahoo Finance which I don't know how to do a graph. however, I need Amazon information

I need your help with information about Amazon from Yahoo Finance which I don't know how to do a graph. however, I need Amazon information about Abnormal return, Competitor comparison, and Financial Result and performance. which I need it as soon possible thank!

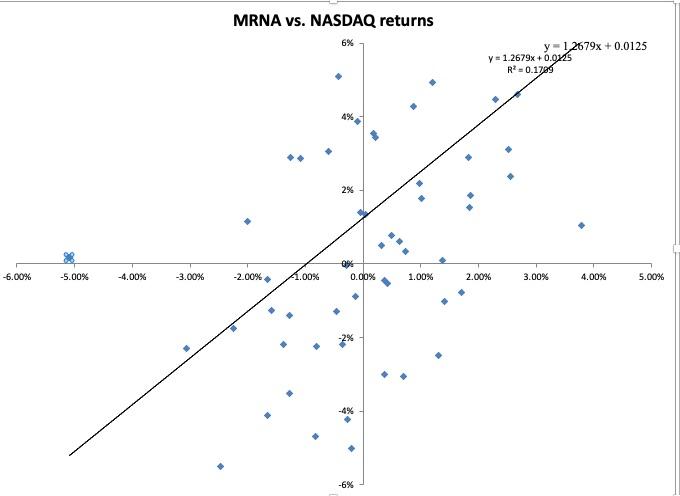

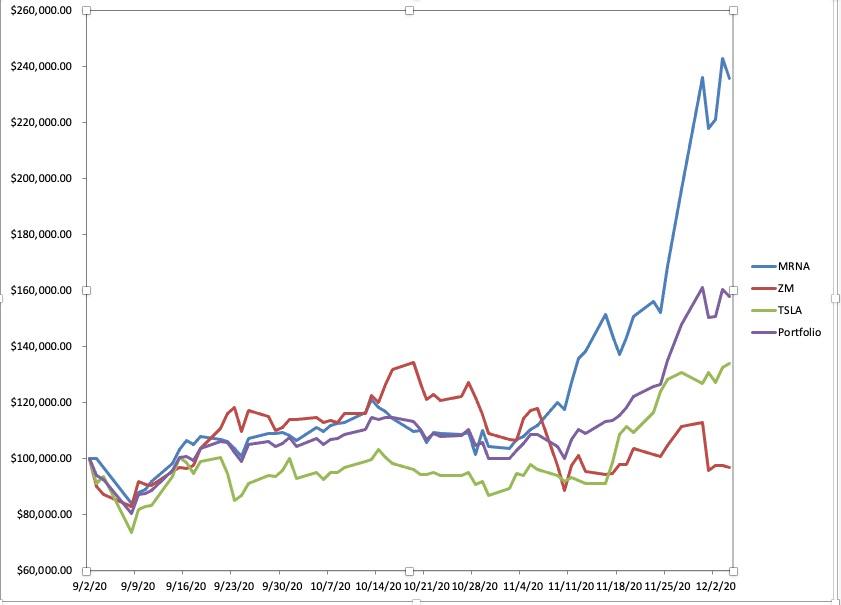

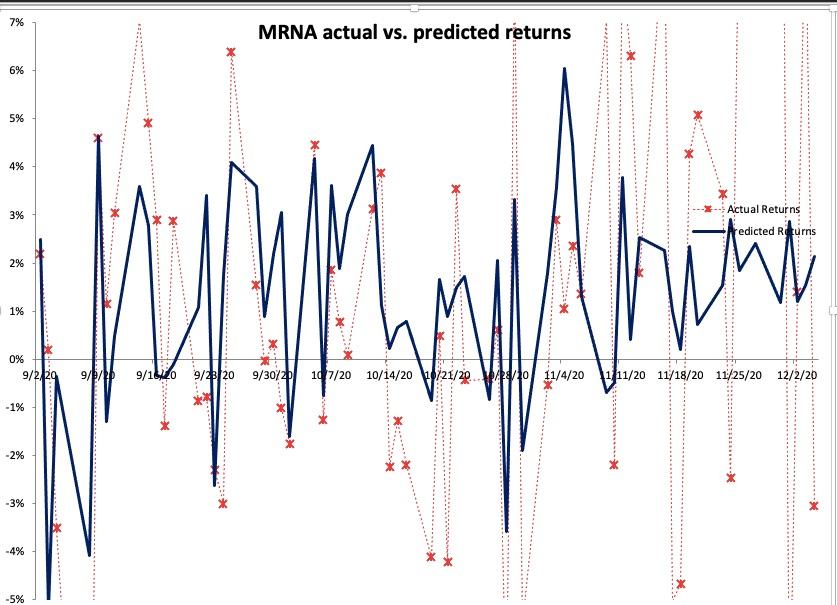

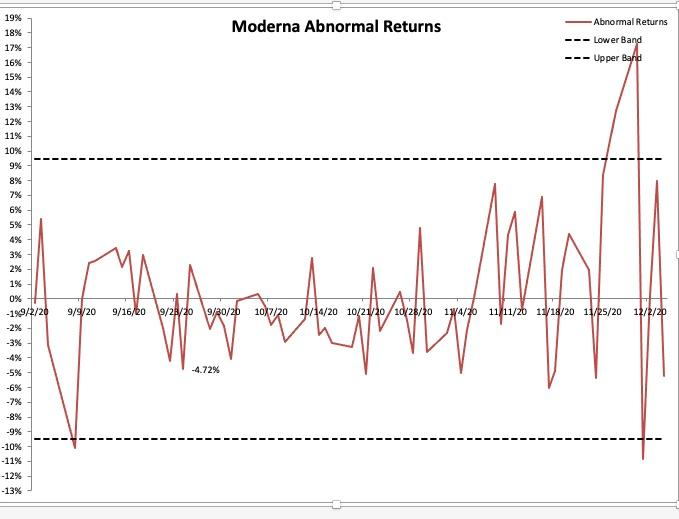

here some example picture!

MRNA vs. NASDAQ returns 6% y-1 2679x + 0.0125 Y-12679x + 0.025 R? -0.1799 2% -6.00% -5.00% -4.00% -3.00% -2.00% 1.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% -4% -6% $260,000.00 $240,000.00 $220,000.00 $200,000.00 $180,000.00 MRNA $160,000.00 ZM N TSLA Portfolio $140,000.00 $120,000.00 $100,000.00 $80,000.00 $60,000.00 9/2/20 9/9/20 9/16/20 9/23/20 9/30/20 10/7/20 10/14/20 10/21/20 10/28/20 11/4/20 11/11/2011/18/20 11/25/20 12/2/20 7% MRNA actual vs. predicted returns 6% 5% 4% Actual Returns 3% dicted Return 2% ht 1% * * 0% 9/229 9/b/ 9/11/Zo 9/28/20 9/30/2107/20 10/14/20/21/200) 11/4/20 111/20 11/18/20 11/25/20 12/2/20 - 1% * -2% * * X:35 -3% -4% -5% Moderna Abnormal Returns Abnormal Returns ---Lower Band --- Upper Band 19 18N 17 16 15% 14 13% 12 11 10% 8% 7% 6% 320 9/16/to 25/20 197}26 10720 1b14/20 12120/id/2821420 11/11/2t1|i820 11/5/20 1:// 5% 45 2% 1% 0% -1220 -2% -3 -45 -5 -6% -7 -B -g% -10 -11% -12 -13% 4. MRNA vs. NASDAQ returns 6% y-1 2679x + 0.0125 Y-12679x + 0.025 R? -0.1799 2% -6.00% -5.00% -4.00% -3.00% -2.00% 1.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% -4% -6% $260,000.00 $240,000.00 $220,000.00 $200,000.00 $180,000.00 MRNA $160,000.00 ZM N TSLA Portfolio $140,000.00 $120,000.00 $100,000.00 $80,000.00 $60,000.00 9/2/20 9/9/20 9/16/20 9/23/20 9/30/20 10/7/20 10/14/20 10/21/20 10/28/20 11/4/20 11/11/2011/18/20 11/25/20 12/2/20 7% MRNA actual vs. predicted returns 6% 5% 4% Actual Returns 3% dicted Return 2% ht 1% * * 0% 9/229 9/b/ 9/11/Zo 9/28/20 9/30/2107/20 10/14/20/21/200) 11/4/20 111/20 11/18/20 11/25/20 12/2/20 - 1% * -2% * * X:35 -3% -4% -5% Moderna Abnormal Returns Abnormal Returns ---Lower Band --- Upper Band 19 18N 17 16 15% 14 13% 12 11 10% 8% 7% 6% 320 9/16/to 25/20 197}26 10720 1b14/20 12120/id/2821420 11/11/2t1|i820 11/5/20 1:// 5% 45 2% 1% 0% -1220 -2% -3 -45 -5 -6% -7 -B -g% -10 -11% -12 -13% 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts