Question: i need your urgent help please Question 6 (RR & Portfolio) (Marks: 1) Which of the following statements is true? A. An investor may reduce

i need your urgent help please

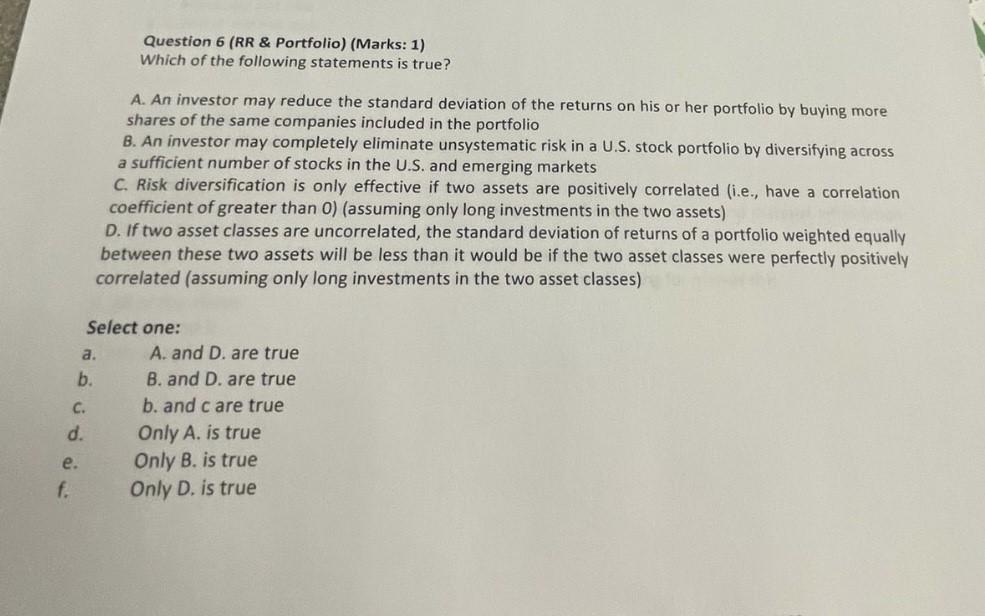

Question 6 (RR \& Portfolio) (Marks: 1) Which of the following statements is true? A. An investor may reduce the standard deviation of the returns on his or her portfolio by buying more shares of the same companies included in the portfolio B. An investor may completely eliminate unsystematic risk in a U.S. stock portfolio by diversifying across a sufficient number of stocks in the U.S. and emerging markets C. Risk diversification is only effective if two assets are positively correlated (i.e., have a correlation coefficient of greater than 0) (assuming only long investments in the two assets) D. If two asset classes are uncorrelated, the standard deviation of returns of a portfolio weighted equally between these two assets will be less than it would be if the two asset classes were perfectly positively correlated (assuming only long investments in the two asset classes) Select one: a. A. and D. are true B. and D. are true b. and c are true Only A. is true Only B. is true Only D. is true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts