Question: I needed help with this for Bloomberg Absolute & Relative Value Presentation. Absolute Valuation Analysis: Thoroughly analyze your stock using Bloomberg's DDM & XLTP XDCF

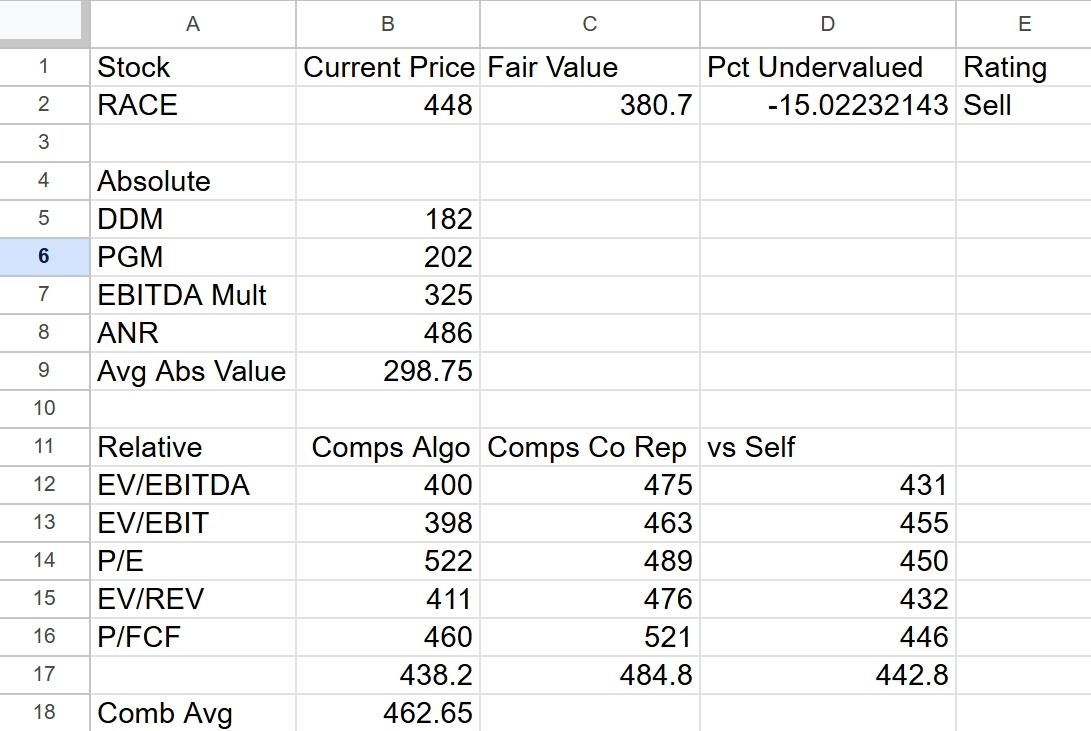

I needed help with this for Bloomberg Absolute & Relative Value Presentation. Absolute Valuation Analysis: Thoroughly analyze your stock using Bloomberg's DDM & XLTP XDCF models and ANR Target price. Ensure to analyze and update key inputs such as the longterm growth rate, BETA, WACC, and EBITDA Multiple and convert the ANR target price to today's present value by dividing it by either or its WACC. Relative Valuation Analysis: Thoroughly analyze your stock using Bloomberg's EQRV vs Comps and vs Self functions. Ensure to update EQRV "Settings" "Select Multiples..." to choose the most relevant multiples for your stock. Demonstrate whether your stock is undervalued or overvalued.

A B C D Stock Current Price Fair Value Pct Undervalued Rating RACE Sell Absolute DDM PGM EBITDA Mult ANR Avg Abs Value Relative Comps Algo Comps Co Rep vs Self EVEBITDA EVEBIT PE EVREV PFCF Comb Avg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock