Question: I neeeed this pleaaase answer it Question 7 5 pts Loss Probability $3,000,000 0.03 1,500,000 0.01 0 0.96 Greater American Insurance Group underwrites the property

I neeeed this pleaaase answer it

I neeeed this pleaaase answer it

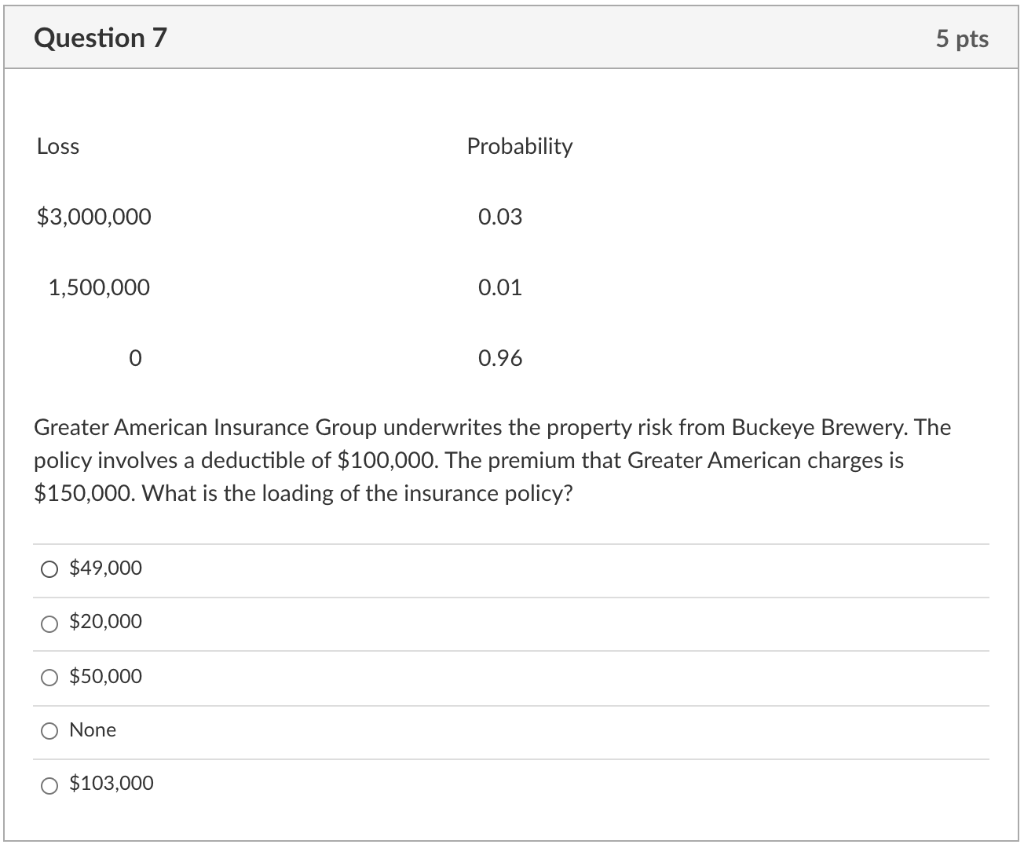

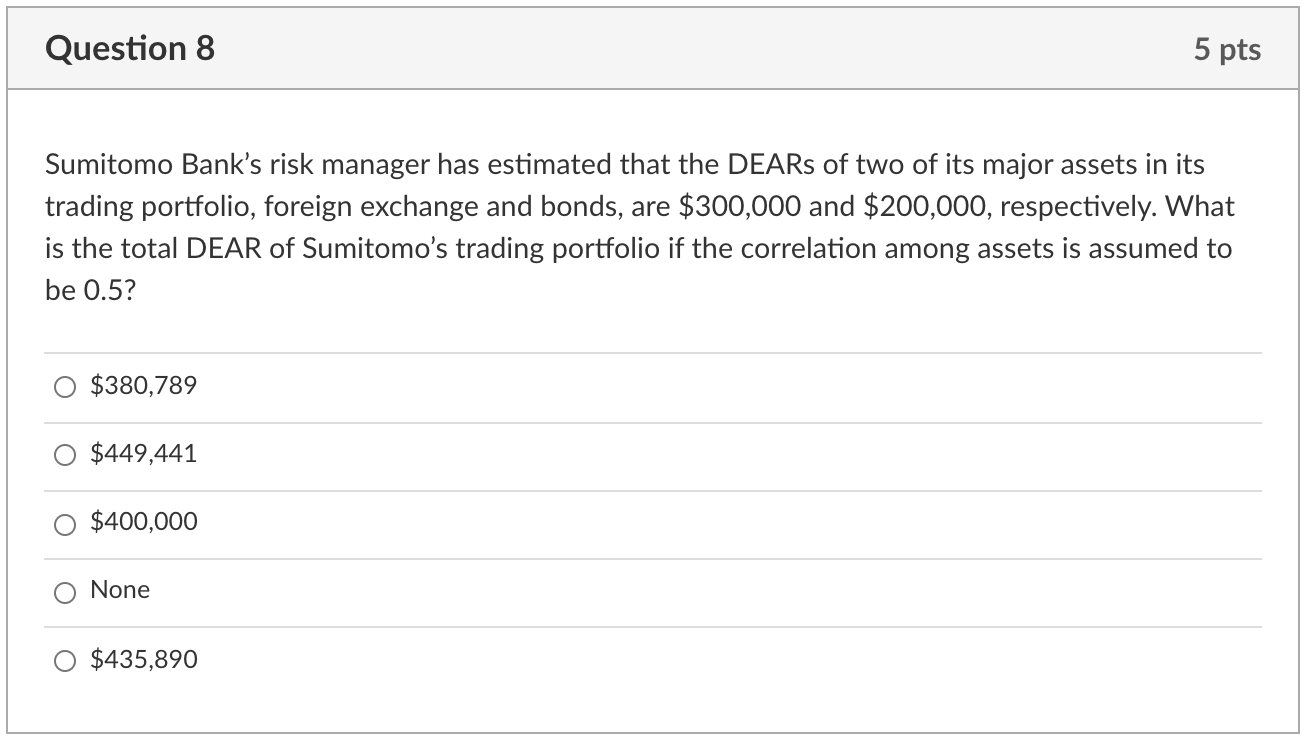

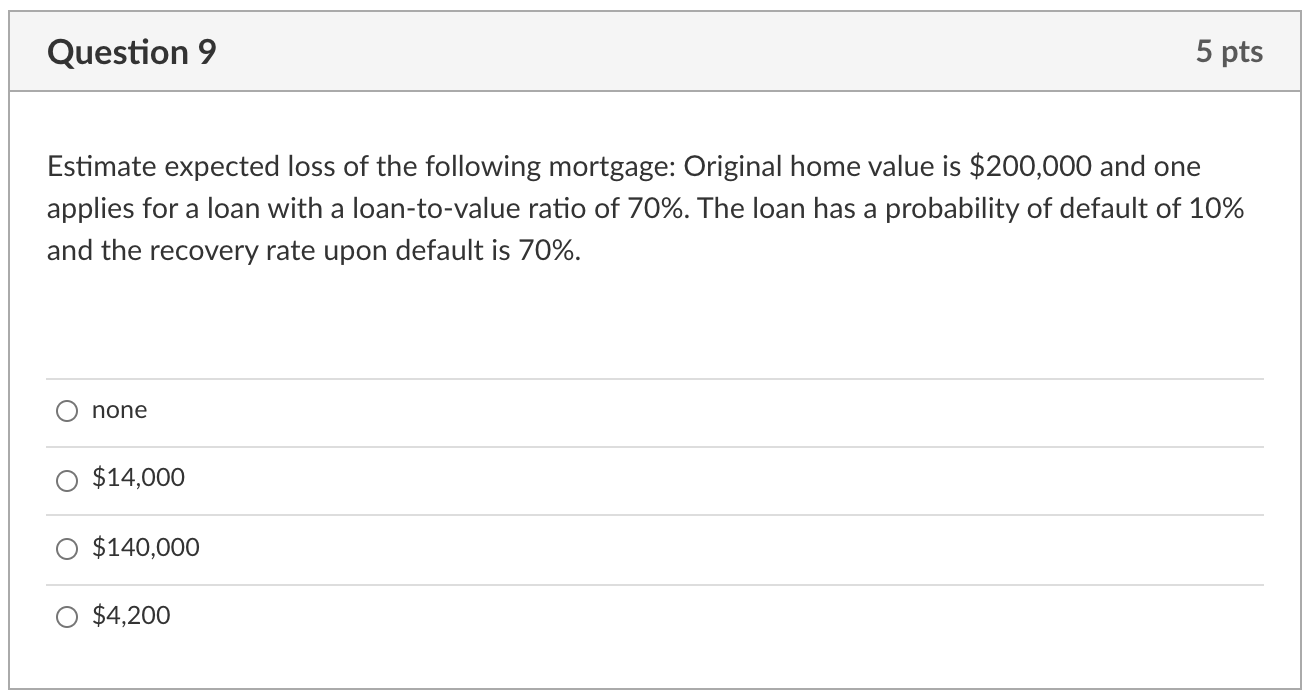

Question 7 5 pts Loss Probability $3,000,000 0.03 1,500,000 0.01 0 0.96 Greater American Insurance Group underwrites the property risk from Buckeye Brewery. The policy involves a deductible of $100,000. The premium that Greater American charges is $150,000. What is the loading of the insurance policy? 0 $49,000 O $20,000 O $50,000 None O $103,000 Question 8 5 pts Sumitomo Bank's risk manager has estimated that the DEARs of two of its major assets in its trading portfolio, foreign exchange and bonds, are $300,000 and $200,000, respectively. What is the total DEAR of Sumitomo's trading portfolio if the correlation among assets is assumed to be 0.5? $380,789 $449,441 $400,000 None $435,890 Question 9 5 pts Estimate expected loss of the following mortgage: Original home value is $200,000 and one applies for a loan with a loan-to-value ratio of 70%. The loan has a probability of default of 10% and the recovery rate upon default is 70%. none $14,000 $140,000 $4,200 Question 10 5 pts Mike wants to protect his company from low corn price when the price of corn goes below $5 per bushel. Which of the following instruments will generate value if the price per bushel of corn should exceed $5? Either buying or selling a call option because both will suit his needs Neither buying or selling a call will help Buying a call option on corn price Selling a call option on corn price Question 7 5 pts Loss Probability $3,000,000 0.03 1,500,000 0.01 0 0.96 Greater American Insurance Group underwrites the property risk from Buckeye Brewery. The policy involves a deductible of $100,000. The premium that Greater American charges is $150,000. What is the loading of the insurance policy? 0 $49,000 O $20,000 O $50,000 None O $103,000 Question 8 5 pts Sumitomo Bank's risk manager has estimated that the DEARs of two of its major assets in its trading portfolio, foreign exchange and bonds, are $300,000 and $200,000, respectively. What is the total DEAR of Sumitomo's trading portfolio if the correlation among assets is assumed to be 0.5? $380,789 $449,441 $400,000 None $435,890 Question 9 5 pts Estimate expected loss of the following mortgage: Original home value is $200,000 and one applies for a loan with a loan-to-value ratio of 70%. The loan has a probability of default of 10% and the recovery rate upon default is 70%. none $14,000 $140,000 $4,200 Question 10 5 pts Mike wants to protect his company from low corn price when the price of corn goes below $5 per bushel. Which of the following instruments will generate value if the price per bushel of corn should exceed $5? Either buying or selling a call option because both will suit his needs Neither buying or selling a call will help Buying a call option on corn price Selling a call option on corn price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts